Archives of “October 2020” month

rssEuropean equities open slightly lower to start the day

Softer tones in Europe to get the session underway

- Eurostoxx -0.2%

- Germany DAX -0.4%

- France CAC 40 flat

- UK FTSE -0.1%

- Spain IBEX -0.2%

The softer tone reflects some catch-up play to the decline by US stocks yesterday, which closed ~1.6% lower amid fading stimulus hopes.

BOJ expected to cuts its outlooks for the economy, inflation next week

Bank of Japan expected to cut this fiscal year’s economic, price forecasts in its quarterly projections due next week

The BOJ monetary policy meeting is on October 28 and 29. The quarterly Outlook report is due at the conclusion of this meeting.

Reuters with the report of the expected downgrades citing unnamed sources.

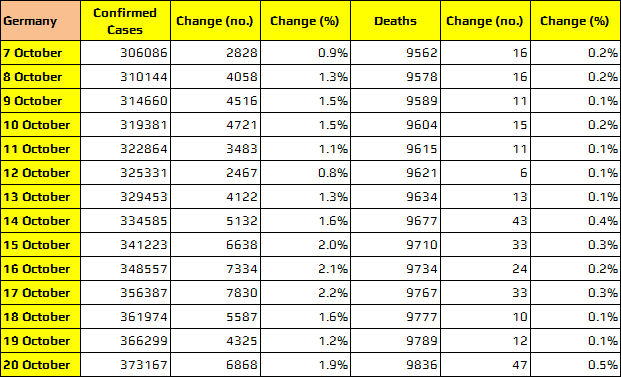

Germany reports 6,868 new daily coronavirus cases in latest update today

The daily death count hits the highest since late May though

The 6,868 new cases is still on the high side and more than what we have seen during the first wave of the pandemic in Germany. As of yesterday, active cases hit over ~61,700. For some context, that figure was reduced to less than ~5,000 in mid-July.

RKI also reports another 48 deaths in the latest update, which is the highest single daily count since late May, bringing the total tally on that front to 9,836 persons.

Yesterday also saw the number of ‘high risk’ areas in Germany move above 100 to 108 districts – an increase of 15 – with 411/412 districts in the country reporting cases.

Once again, as the virus situation continues to worsen, just be mindful of tighter restrictions being introduced and that should weigh further on the economic recovery.

Moderna CEO Expects Covid-19 Vaccine Interim Results in November

Wall Street Journal with the report

Chief Executive Stéphane Bancel

- said the federal government could authorize emergency use of the company’s experimental Covid-19 vaccine in December, if the company gets positive interim results in November from a large clinical trial.

The Journal adds:

- Mr. Bancel’s comments suggest Moderna’s timetable isn’t far off from Pfizer’s, which said last week it expects to seek U.S. authorization of emergency use of its vaccine by late November.

Link for more (may be gated)

Demand for Hong Kong dollars hasn’t been this strong since before the global financial crisis

US election debate on Thursday – microphones will be able to be muted

The US debate commission has adopted new rules to mute microphones

- will give Trump and Biden 2 minutes of uninterrupted time per segment

- after the 2 uninterrupted minutes the microphone will be unmuted and its back to a free-for-all

The first debate between the pair was a debacle. Trump interrupted non-stop as part of his tactics.

Trump’s unhinged performance was lambasted right around the world. The word is he has been seeking counselling for how to behave in the upcoming debate to try to soften his image amongst voters. Trump should not be judged too harshly on his performance in the first debate, he was ill with COVID-19 at the time.

NASDAQ index lower for the 5th straight day. The Dow and S&P down for the 4th day in 5 days

NASDAQ index on track for the longest winning streak since August 2019

The NASDAQ index closed lower for the 5th consecutive day

- Stocks close near session lows

- All 11 sectors in the S&P closed lower

- S&P and Dow close down for the 4th out of 5 days

- the NASDAQ index has its longest losing streak since August 2019

the final numbers are showing:

- S&P index fell for -56.89 points or -1.63% to 3426.92

- NASDAQ index fell -192.67 points or -1.65% to 11478.88

- Dow fell -410.89 points or -1.44% to 28195.42

Thought For A Day

Major European indices end with mixed results to start the trading week

German DAX lower.

The major European indices are ending the day with mixed results to start the trading week. The German DAX and UK FTSE are lower on the day. The other indices are marginally higher.

A snapshot of the provisional closes are showing:

- German DAX , -0.4%

- France’s CAC, +0.1%

- UK FTSE 100, -0.4%

- Spain’s Ibex, +0.15%

- Italy’s FTSE MIB, -0.1%

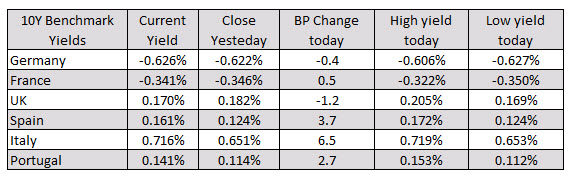

In the European debt market, the benchmark 10 year yields are ending with mixed results. UK and German yields are down marginally while the other major countries are showing gains. Investors are shunning Italian 10 year debt with a rise of 6.5 basis points on the day.