Archives of “October 30, 2020” day

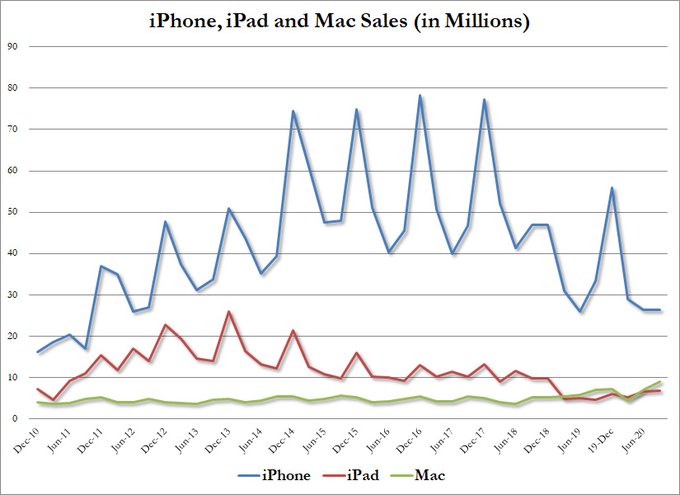

rssThe iPhone peaked in 2017

Japan data, September industrial production +4% m/m (beats estimates of +3%)

September industrial production +4% m/m

- expected +3.0%, prior +1.0%

- up for the 4th consecutive month

For they y/y, -9.0%

- expected -9.8%, prior -13.8

As part of the release the ministry provides surveyed outlooks for IP:

- October seen at +4.5% m/m

- November at +1.2% m/m

S&P 500 Performance According to the US President

Valuation of the American market.

Oil – Kuwait denies OPEC+ division on output cuts

Kuwait’s oil minister says the country will support any OPEC+ decision on future output policy

- Denies reports that Kuwait and other countries are debating whether they should roll over existing oil cuts into 2021

I’d suggest these comments on no debate are inaccurate. there is always debate within OPEC and partners on policy ahead.

Amazon, Facebook, Twitter, Alphabet all come in better than expectations

Amazon:

- revenues $96.15 billion vs.$92.70 billion estimate

- EPS $12.37 vs. $7.41 estimate

- the caveat is AWS numbers came in about expectations and apparently there was favorable taxes

- Amazon shares are trading down at $3163 after closing at $3211

Facebook

- EPS $2.71 vs. $1.91 estimate

- revenues $21.47 billion vs. 19.28 billion estimate

- Facebook shares are trading down at $275 after closing at $280.83

- revenues 936 million vs. 777 million estimate

- earnings-per-share $0.19 adjusted vs. $0.06 estimate

- Twitter is trading down at $46.33 after closing at $52.43

Alphabet

- revenues 46.17 billion vs. 42.90 billion estimate

- earnings-per-share $16.40 vs. $11.29 estimate

- Alphabet shares are trading up at $1638 after closing at $1556.88

Starbucks

- earnings-per-share $0.51 vs. $0.31 estimate

- revenues $6.2 billion worth of $6.06 billion estimate

- Starbucks shares are trading up at $89.40 after closing at$88.30

Mnuchin says Pelosi has all or none approach on stimulus

Now that any prospect for coronavirus US stimulus relief is off into the future the players can take a few snipes at each other.

US Treasury Secretary Mnuchin on Pelosi. Pelosi indicated earlier that there could be a stimulus package implemented after the election and prior to inauguration date, which is a wide range.

US equity close: Good bounce back but some softness into the close. Onto earnings

Closing changes

The US equity market posted a good bounce-back after yesterday’s big rout. It looked like more trouble early today as stocks gave back early gains and turned negative but in the New York morning the turn started and it got some momentum after lunch until some late selling ahead of tech-earnings extravaganza.

- S&P 500 +39 to 3310 +1.2%

- Nasdaq +1.6%

- DHIA +0.5%

Thought For A Day