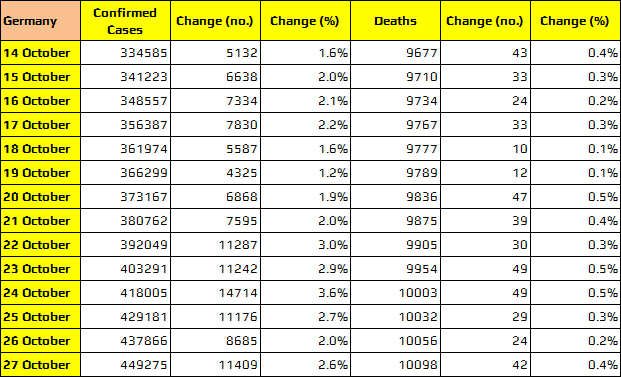

The trend resumes after the ‘Monday effect’ seen yesterday

This marks a fifth day out of six that new cases surpass the 10,000 mark, with another 42 deaths reported bringing the total on that front to 10,098 persons.

As of yesterday, there are ~106,200 active cases across Germany with 272/412 districts being classified as ‘high risk’ – an increase of 21 districts from the day before.

RKI notes that the number of patients requiring intensive care has more than doubled in the past two weeks, rising from 590 (12/10) to 1,362 (26/10).

However, intensive care beds across the country are about 71% occupied, with 8,403 beds (28%) still available, roughly the same as how things were at the start of October.

That said, relative to the situation in mid-July when the virus situation was calmer, there were about 11,000 intensive care beds (34%) available, so you get the picture.

Even if the virus is not directly affecting medical capacity, it is eating into the time and energy of healthcare workers and that may explain the increase in hospitalisations and intensive care treatments for other diseases.

As things go down this road, just be mindful that we could see tighter restrictions be introduced and that may weigh on near-term sentiment for risk and the euro.