S&P gets a boost

The outlook on Italy was raised to stable from negative with the rating affirmed at BBB by S&P.

No doubt it’s due to Italy’s strong long-and-short term commitments to fiscal restraint.

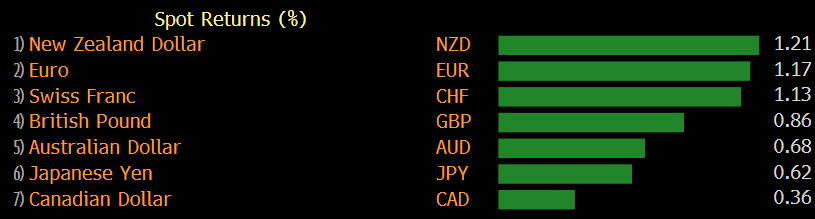

The GBP shorts were wise to get out of the way ahead of Wednesday’s news on restarting negotiations. The nearly-flat positioning now reflects the total lack of commitment in the trade lately.