German DAX lower.

The major European indices are ending the day with mixed results to start the trading week. The German DAX and UK FTSE are lower on the day. The other indices are marginally higher.

A snapshot of the provisional closes are showing:

- German DAX , -0.4%

- France’s CAC, +0.1%

- UK FTSE 100, -0.4%

- Spain’s Ibex, +0.15%

- Italy’s FTSE MIB, -0.1%

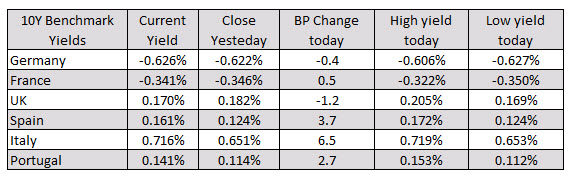

In the European debt market, the benchmark 10 year yields are ending with mixed results. UK and German yields are down marginally while the other major countries are showing gains. Investors are shunning Italian 10 year debt with a rise of 6.5 basis points on the day.