Archives of “October 16, 2020” day

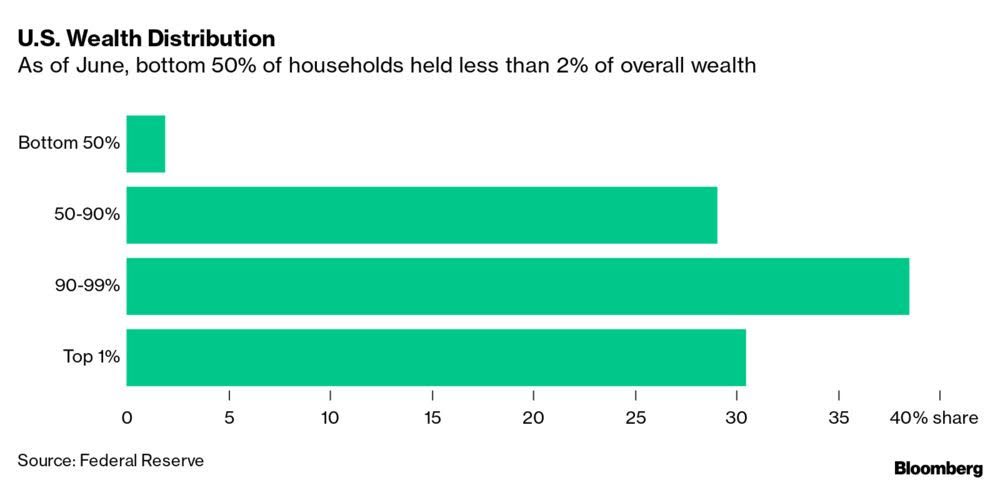

rssThe 50 Richest Americans Are Worth as Much as the Poorest 165 Million

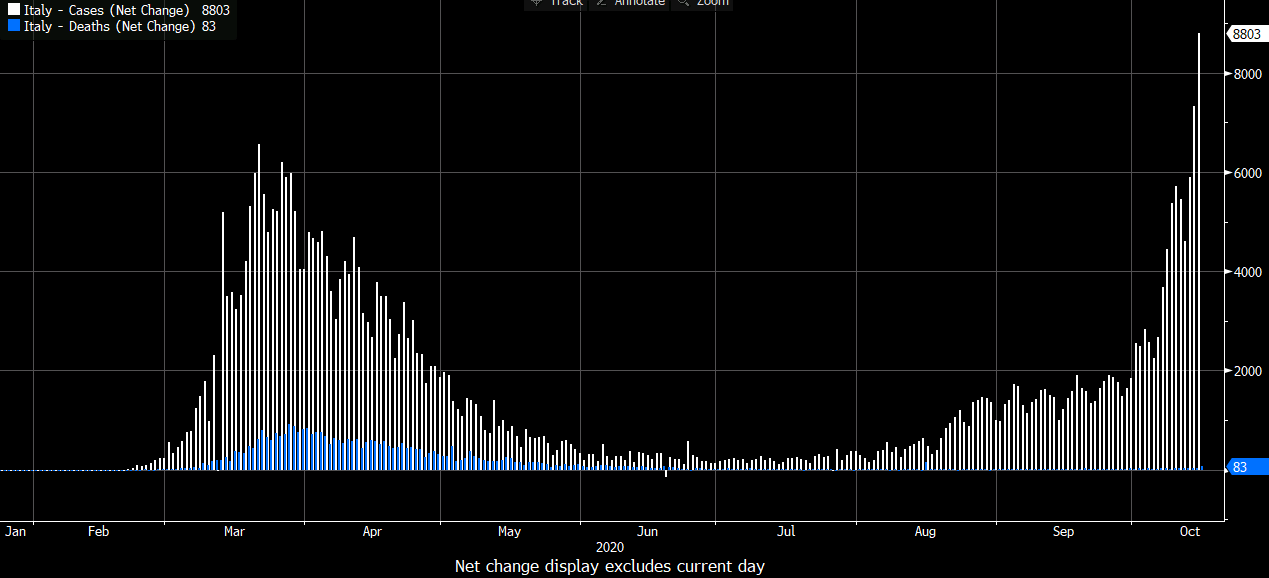

Italy reportedly weighs imposing curfew measure to limit virus spread

Corriere della Sera reports on the matter

The report says that Italian prime minister, Giuseppe Conte, does not want the country to return to a full lockdown or a two-week “reset” i.e. shutdown, instead weighing measures similar to some of that taken in France.

A 10pm curfew is said to be among those being considered with a return to virtual teaching for high schools as well. The government is also said to agree on the need for further efforts to expand/encourage working from home to curb the virus spread.

Eurostoxx futures +0.7% in early European trading

A bit of catch-up play in early trades

- German DAX futures +0.6%

- UK FTSE futures +0.8%

- Spanish IBEX futures +0.4%

European indices close the day near the lows yesterday, down by over 2% across the board, missing out on the late recovery in US equities towards the latter stages.

Hence, the gains here are largely due to some catch-up play and belies the more tepid and cautious risk mood to kick start the session.

US futures aren’t doing a whole lot, with S&P 500 and Nasdaq futures keeping at flat levels at the moment. Major currencies are also mostly little change besides some mild strength in the yen, with AUD/USD seen a little weaker under its 100-day moving average.

Nikkei 225 closes lower by 0.41% at 23,410.63

A mixed day for Asian equities

Japanese stocks slumped to close the week, following the softer mood in Wall Street yesterday as US futures also keep more tepid in trading so far today.

But the Hang Seng is up by 1%, recouping early losses as Alibaba shares rebound strongly in anticipation of the Ant Group IPO, while Chinese equities keep more flat.

The overall risk mood remains more tepid and cautious, after having seen the strong wave of risk aversion early on yesterday countered by a late recovery in US stocks.

USD/JPY is keeping lower around 105.20-25 for the time being though but large expiries seen at 105.00 may well keep price action stuck ahead of North American trading.

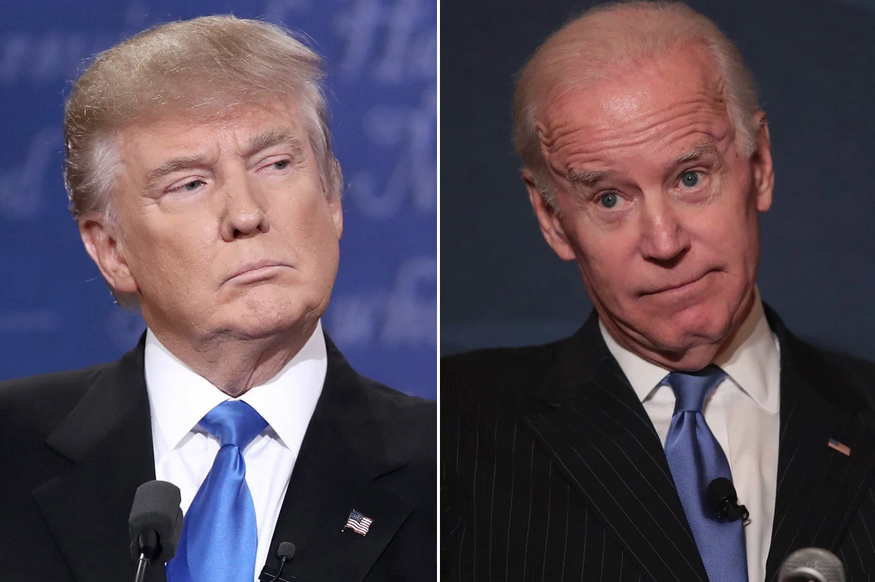

Trump campaign says has a quarter of a billion $ cash on hand

Yesterday we got the Biden campaign with their cash on hand:

- US President challenger Biden campaign has nearly half a billion $ in campaign cash

Trump campaign now.

- $251m cash on hand

- raised $247m in September.

Wow. Huge $$$.

The US election winner will clearly be the purveyors of advertisements!

WHO on Remdesiver vaccine disappointment – looking at alternatives to trial

More from the WHO:

- says solidarity therapeutics trial produces conclusive evidence on effectiveness of repurposed drugs for covid-19 in record time

- says interim remdesivir, hydroxychloroquine, lopinavir/ritonavir and interferon regimens appeared to have little or no effect on 28-day mortality

- who-interim results in trial indicate remdesivir appeared to have little or no effect on 28day mortality or in-hospital course of covid-19 in patients

- study, which spans over 30 countries, looked at effects of treatments on overall mortality, initiation of ventilation, duration of hospital stay

- newer antiviral drugs, immunomodulators and anti-sars cov-2 monoclonal antibodies are now being considered for evaluation at solidarity trial

Headlines via Reuters

US election – Wall Street Journal/NBC News poll shows rebound for Trump to only 11 points behind Biden

This from the Wall Street Journal overnight, polling registered voters shows Biden leading Trump 53% to 42%

- An 11 point lead which is an improvement for Trump as the previous poll had him trailing by 14.

In the detail of the piece is this:

- The No. 1 election issue among those surveyed was the economy, and voters gave Republicans a 13-point advantage over Democrats as the better economic manager. Yet, the pollsters said voters this election cycle don’t seem to be voting based on that issue alone.

- a recent example of Republicans losing an election while leading with voters on handling the economy was the 2018 midterms, in which Democrats gained enough seats to retake control of the House.

Here is the link for further (may be gated)

—

And, repeating this from earlier:

I am aware that posts like this make some folks upset. They accuse me of all sorts of things, such as bias. Which is projection, but its OK as these folks are upset and hurting. If you would like to point me to any reputable polls showing Trump is ahead I’d be keen to post on those, it would add some interest to the race for the White House.

US election poll gives Biden a double-digit point lead over Trump

This an NPR/PBS poll published Thursday in the US.

- Biden 54%

- Trump 43%

- “among likely voters in the poll”.

Says the piece:

- It’s the highest level of support Biden has achieved since the poll began testing the head-to-head matchup in February

- Biden continues to have an advantage with Black voters, Latinos, whites with a college degree, women, people who live in cities and suburbs, young voters and independents

- Biden is leading in this survey with white voters 51% to 47%. That is extraordinary. Trump won white voters in 2016 by 20 points, and no Democrat has won that high a share of white voters since Jimmy Carter in 1976, when the U.S. was far less racially diverse.

- Biden has pulled ahead in several key states, including Wisconsin, Michigan and Pennsylvania, which were crucial to Trump’s victory in 2016. But Trump is within striking distance.

Here is the link to the piece for more.

—

ps. I am aware that posts like this make some folks upset. They accuse me of all sorts of things, such as bias. Which is projection, but its OK as these folks are upset and hurting.

If you would like to point me to any reputable polls showing Trump is ahead I’d be keen to post on those, it would add some interest to the race for the White House.

Major indices close lower for the 3rd straight day

Major indices recover off session lows

The major indices close lower for the 3rd straight day. However the indices closed well off there lows for the day.

Highlights include

- S&P and NASDAQ on track for weekly gain

- Dow on track for its 1st losing week in 3 weeks

- Healthcare was the worst sector while energy was the strongest

- The Dow was down -332 point at the low

- The S&P index was down -47.78 points at the lows

- The NASDAQ was down -219.63 points

- S&P and NASDAQ close 3% below its all-time high

- Dow closes 4% below its all-time high

- Dow is still negative on the year (-0.16%). The NASDAQ is up 30.55% while the S&P is up 7.82% year-to-date.

The final numbers are showing:

- the S&P index fell -5.33 points or -0.15% at 3483.34. The high price reached 3489.08. The low price extended to 3440.89

- the NASDAQ index fell 54.858 points or -0.47% at 11713.82. The high price reached 11740.68. The low price extended to 11559.10

- the Dow industrial average fell -19.8 points or -0.07% at 28494.26. The high price reached to 28535.85. The low price extended to 28181.54.

In the European markets today, the major indices move lower with the Italy FTSE MIB down -2.77%. The Spain’s Ibex was the least hit at -1.44%. The German DAX fell by 2.49%