The last poll had Biden up by 1%

A New York Times/Siena poll is showing Dem presidential candidate Biden leading Pres. Trump 46% to 42% in the key battleground state of North Carolina. The last poll had Biden leading by 1%.

Remember that it’s not just about setups. You want tailwinds behind you on new buys. Feedback on other new buys, status of TMLs, leaders, breadth, indices, and sentiment. Align this with a solid buying strategy and you increase your odds on the trade greatly.

On the PM earnings calendar:

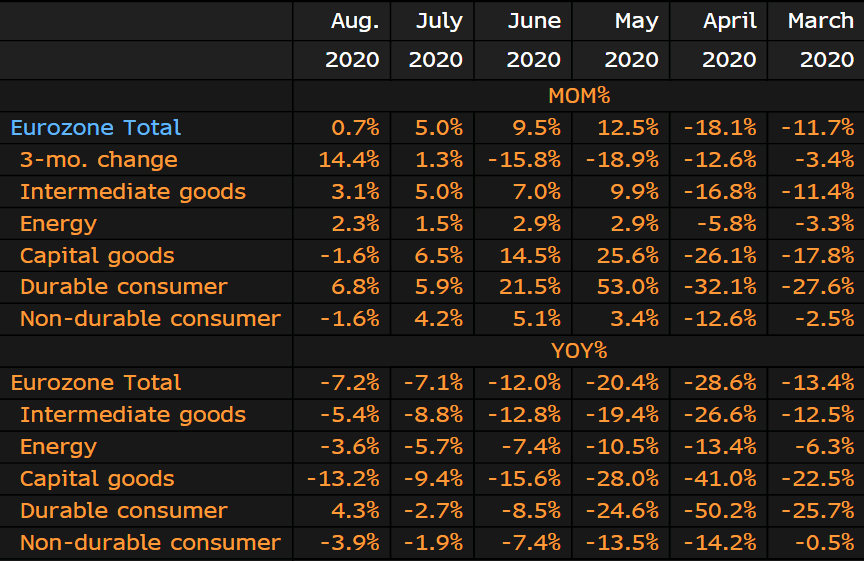

Euro area factory output continues to highlight an improvement in Q3 but the recovery pace is losing some steam with the August bounce, though expected, not all too robust.