No intention to meet McConnell in the middle

- Pelosi has no intention to be McConnell the middle

- Tells caucus she won’t accept GOP aid offer

The series of lower highs and lower lows in the FTSE 100 isn’t inspiring.

“The reports of my death have been greatly exaggerated”.

This quote was attributed by some to Mark Twain when there were reports that he was ill/dead. Mark Twain was in fact alive and well. It seems Saudi Aramco feel a similar way now about the reports of the end of the oil market.

BP and Shell move to renewables

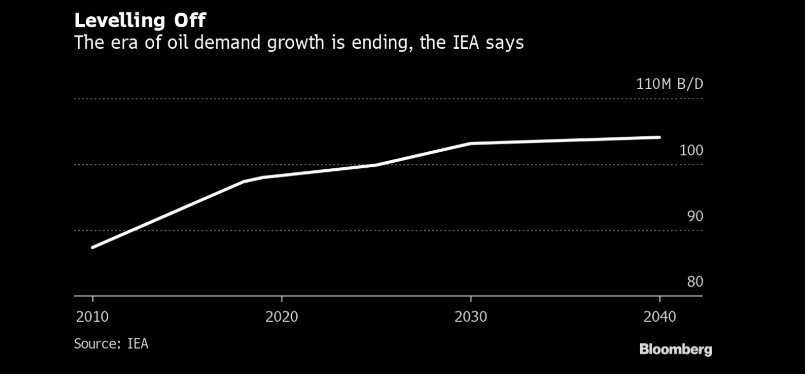

However, is the future green? That’s the move that BP and Shell have taken. They are planning to cut oil production so they can invest in renewable and green energies as they get ready for a low carbon world. However, Aramco question the timing. Speaking to Reuters Aramco said, ‘We expect oil demand growth to continue in the long term, driven by rising populations and economic growth. Fuels and petrochemicals will support demand growth … speculation about an imminent peak in oil demand is simply not consistent with the realities of oil consumption’. The future is green, just not totally green right away.

So, Aramco want to boost their production capacity, so that when demand returns they are well placed to benefit. They want to raise their capacity to $13 million barrels per day from the present 12 million barrels per day. Saudi have around 20% of the world’s known oil reserves and it only costs them around $4 per barrel to produce. Aramco’s plan is to undercut rivals and ensure they are well placed to provide low cost oil for years to come. If US oil stay around the $40-60 range for the next couple of years this will knock out some US shale producers.

Just painting some colour to the oil market picture in the longer-term. The narrative that the IEA sees playing out i.e. global oil demand topping out in the next decade largely hinges on the switch to more efficient energy such as electric vehicles.