Spain’s Ibex leads the way

The major European indices are ending the session higher for the 3rd time in 4 days this week. The provisional closes are showing:

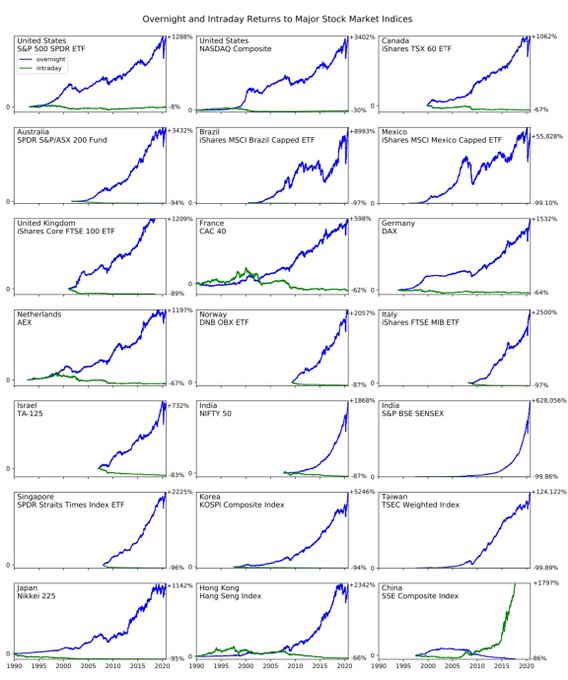

- German DAX, +1.0%

- France’s CAC, +0.8%

- UK’s FTSE 100, +0.7%

- Spain’s Ibex, +1.3%

- Italy’s FTSE MIB, +0.9%

- Spot gold is trading up $1.19 or 0.06% at $1888.50.

- Spot silver is trading up $0.08 or 0.33% at $23.89.

- WTI crude oil futures are trading up $0.70 and back above the $40 level at $40.65

- S&P index is still up 10.3 points or 0.3% of 3429.59 but well off the high price of 3444.45

- NASDAQ index is up 24 points or 0.22% at 11389.07. That is off the high of 11448.23

- Dow industrial average is trading down -18 points or -0.06% at 28285.30. It’s high price reached 28459.13