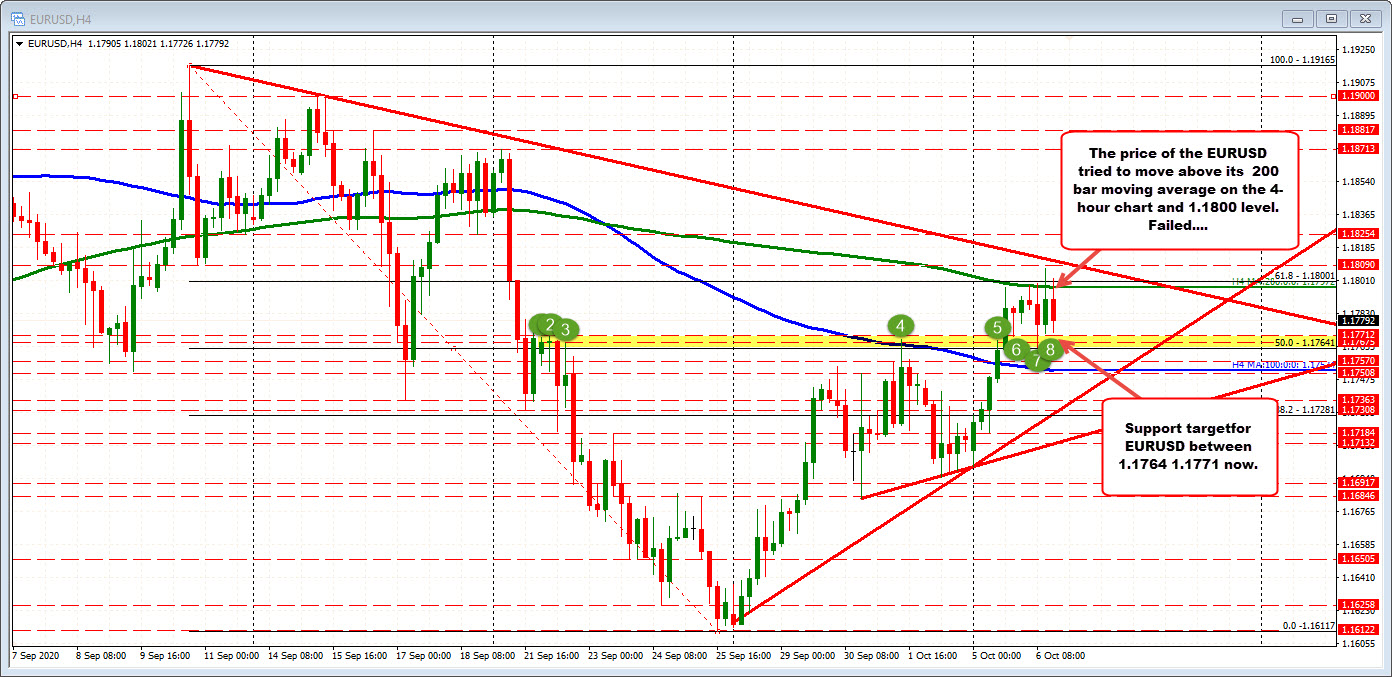

The dollar and yen fumbled in overnight trading as the market reversed the moves from Friday and then some, with all of the uncertainty from Trump’s virus infection being put behind and US stimulus talks appearing to move closer to some compromise.

On the latter, we still may not get something before the election but the continued day-to-day talks are still stirring up some positive sentiment in the market for now.

Major currencies are so far little changed, with the aussie getting a brief spike above 0.7200 as the RBA left its cash rate unchanged but is back down to 0.7185 currently.

There isn’t much in terms of data releases today but we will be hearing from the likes of Lagarde and Powell so that may keep things interesting before the market will look towards Capitol Hill once again for any signs of further stimulus progress.

0600 GMT – Germany August factory orders data

Prior release can be found here. This is now a bit of a lagging indicator as we have seen from the manufacturing PMI that factory activity has rebounded quite strongly in Q3, so that should also be reflected in the industrial orders data today.

0730 GMT – Germany September construction PMI

Prior release can be found here. A general indication of German construction activity, which has been keeping more steady in the rebound phase but much like there will be more question marks surrounding that once the catch-up phase loses steam and the focus turns towards new work – which may not be as robust as in the past.

(more…)

Scalpers

Scalpers

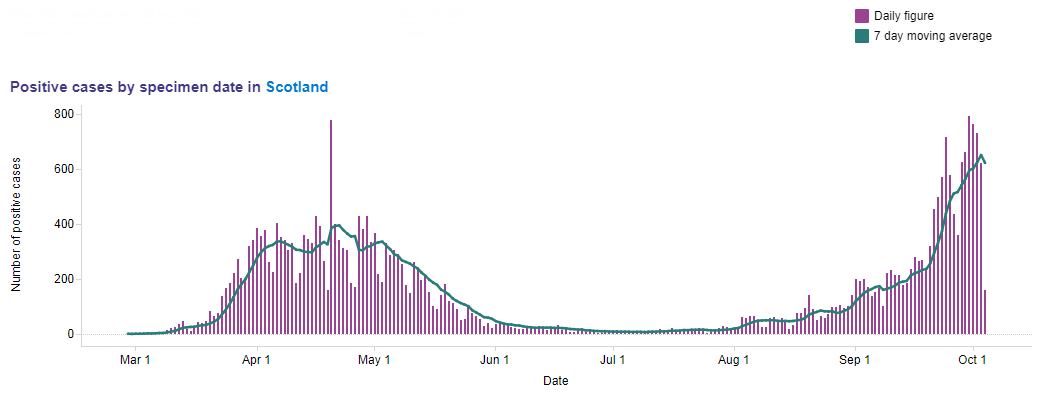

*chart updated until 4 October midday

*chart updated until 4 October midday