The pros and cons

Coronavirus in the White House has hurt risk trades today but they’ve mostly recovered. Ultimately, the odds of Trump dying are low and other than that, it’s tough for a read on how it will affect the election.

I’m coming around to the idea that a blue wave is coming but this could cause a shake-up. Maybe Trump gets some sympathy or maybe it hurts him in some other way.

There’s always the chance he takes a turn for the worse on the weekend or makes a rapid recovery. Does that shift the Presidential race?

The bottom line is that on that front, there are so many unknowns. In general, the more uncertainty you add, the more it begs for safety so on net, it’s negative.

The other big uncertainty is US fiscal stimulus. There are more calls today and neither side wants to appears as if it’s walking away so that might all be a mirage. Still, there’s a chance of a deal on the weekend and that overshadows any virus news. There’s also the chance that it fails completely, but I’d say the odds right now are about 20% of a deal so it swings both ways.

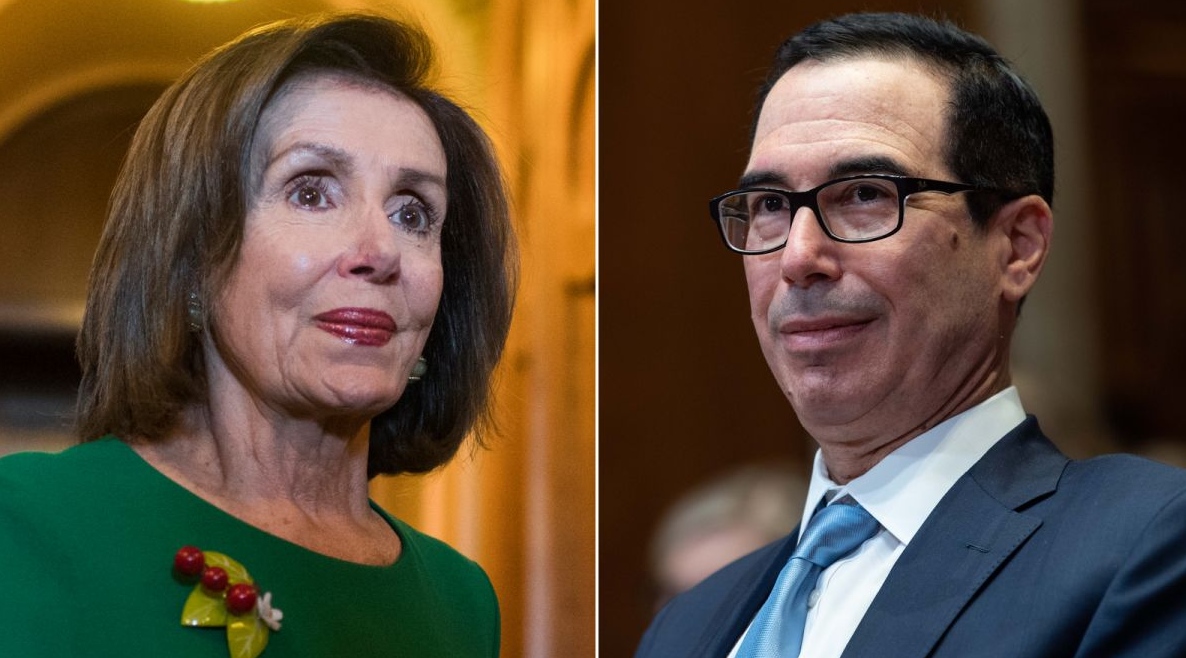

This is what Pelosi said today that boosted stocks from the lows:

“This kind of changes the dynamic because here they see the reality of what we have been saying all along — this is a vicious virus,” Pelosi said on MSNBC.

“I’m optimistic, I’m always optimistic,” she said, “We always have to find a path, that is our responsibility to do so, and I believe that we will.”

Is that a throwaway line to emphasize a point? A sign she’s willing to move? Or a sign she thinks Republicans should move?

Ultimately, I don’t think there’s going to be a rush on either side heading into the weekend but there’s still time for more headlines.

In a sign that a deal could be emerging, Mnuchin told at least one Republican senator in a phone call on Thursday night that the agreement with Pelosi would include a substantial amount of money for state and local governments, a provision numerous conservative Republican senators have strongly resisted, according to one person granted anonymity to share details of the private conversation. The call was interpreted as designed to prepare conservatives for the White House to give more on state and local aid than they had previously expected.