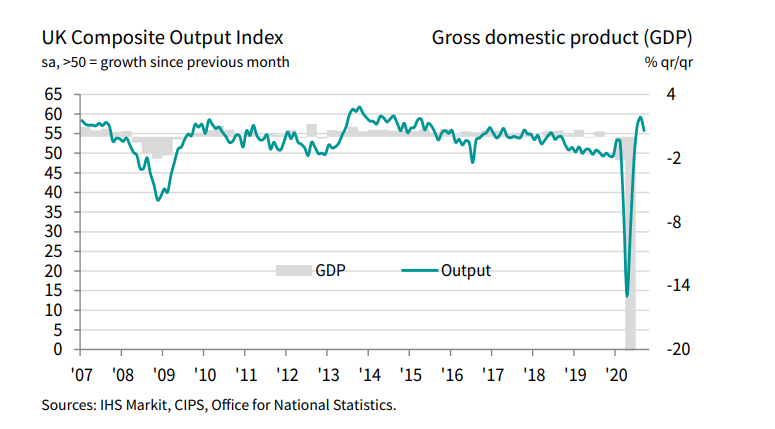

Latest data released by Markit/CIPS – 23 September 2020

- Prior 58.8

- Manufacturing PMI 54.3 vs 54.0 expected

- Prior 55.2

- Composite PMI 55.7 vs 56.1 expected

- Prior 59.1

The recovery in the UK economy begins to lose steam, with household demand seen weakening towards the end of Q3. Business activity continues to grow at a modest pace but the data here mainly reflects the past as the focus stays more on the virus situation now.

The market is looking more towards what restrictions will be introduced by the government to curb the spread of the virus and that is what matters more for the pound at this stage.

Inevitably, if the virus situation worsens, that will also be reflected in business activity data as seen above as well. Markit notes that:

“The UK economy lost some of its bounce in September, as the initial rebound from Covid-19 lockdowns showed signs of fading.

“It was not surprising to see that the slowdown was especially acute in services, where the restaurant sector in particular saw demand fall sharply as the Eat Out to Help Out scheme was withdrawn. Demand for other consumer-facing services also stalled as companies struggled amid new measures introduced to fight rising infection rates and consumers often remained reluctant to spend.

“Encouragingly, robust growth in manufacturing, business services and financial services has offset weakness in consumer-facing sectors, meaning the overall rate of expansion remained comfortably above the survey’s long-run average, which adds to expectations that the third quarter will see a solid rebound in GDP from the collapse seen in the second quarter.

“However, jobs continued to be cut at a fierce rate in September as firms sought to bring costs down amid weak demand, meaning unemployment is likely to soon start rising sharply from the current rate of 4.1%. The indication from the survey that growth momentum is quickly lost when policy support is withdrawn underscores our concern over the path of the labour market once the furlough scheme ends next month, and raises fears that growth could fade further as we head into the winter months, especially as lockdown measures are tightened further.”

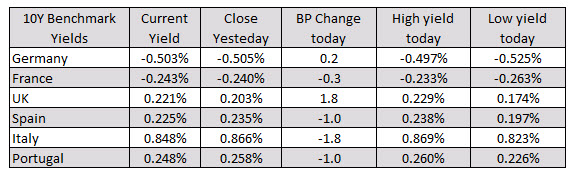

In other markets as London/European traders head for the exits:

In other markets as London/European traders head for the exits: