Archives of “September 2020” month

rssFauci says COVID-19 vaccine could be available earlier if clinical trials overwhelmingly positive

Dr. Anthony Fauci is director of the National Institute of Allergy and Infectious Diseases, interview.

- Referring to two ongoing clinical trials of 30,000 volunteers are expected to conclude by the end of the year

Fauci said an independent board has the authority to end the trials weeks early if interim results are overwhelmingly positive or negative.

- Data and Safety Monitoring Board could say, “‘The data is so good right now that you can say it’s safe and effective,'” Fauci said. In that case, researchers would have “a moral obligation” to end the trial early and make the active vaccine available to everyone in the study, including those who had been given placebos – and accelerate the process to give the vaccine to millions.

Here is the link to the piece for more.

The stock market tends to predict the outcome of elections.

AAPL weight now > Consumer Staples, Nearing Industrials

S&P and NASDAQ close at record highs

Major indices closed near highs for the day

The S&P and NASDAQ index closed at record highs once again. The NASDAQ index led the way with a 1.39% gain. Each of the major indices close near session highs. The S&P closed higher for the 8th time in 9 days. The NASDAQ index rose for the 3rd consecutive day.

The final numbers are showing:

- S&P index up 26.35 points or 0.75% at 3526.66

- NASDAQ index up 164.21 points or 1.39% at 11939.60

- Dow industrial average up 215.61 points or 0.76% at 28645.66

The European shares today ended mostly lower. The German DAX rose by 0.22%, while the UK FTSE 100 fell by -1.7%.

Thought For A Day

How To Trade In Stocks – Livermore

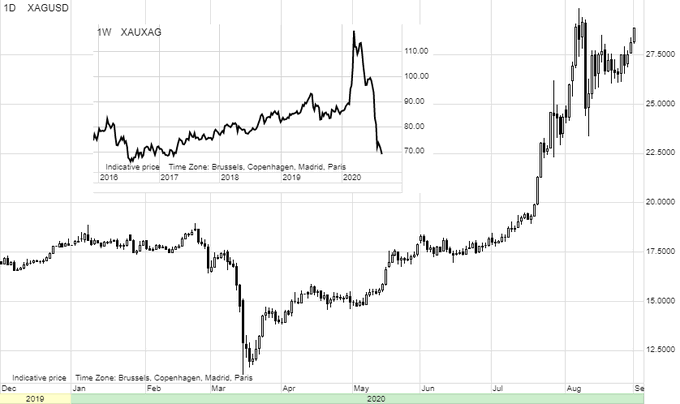

#Silver supported by #copper strength is once again outperforming #gold. The #XAUXAG ratio has dropped to 69, the lowest since March 2017.

1925 – How I Trade and Invest In Stocks… – Wyckoff. Watching, waiting, executing.

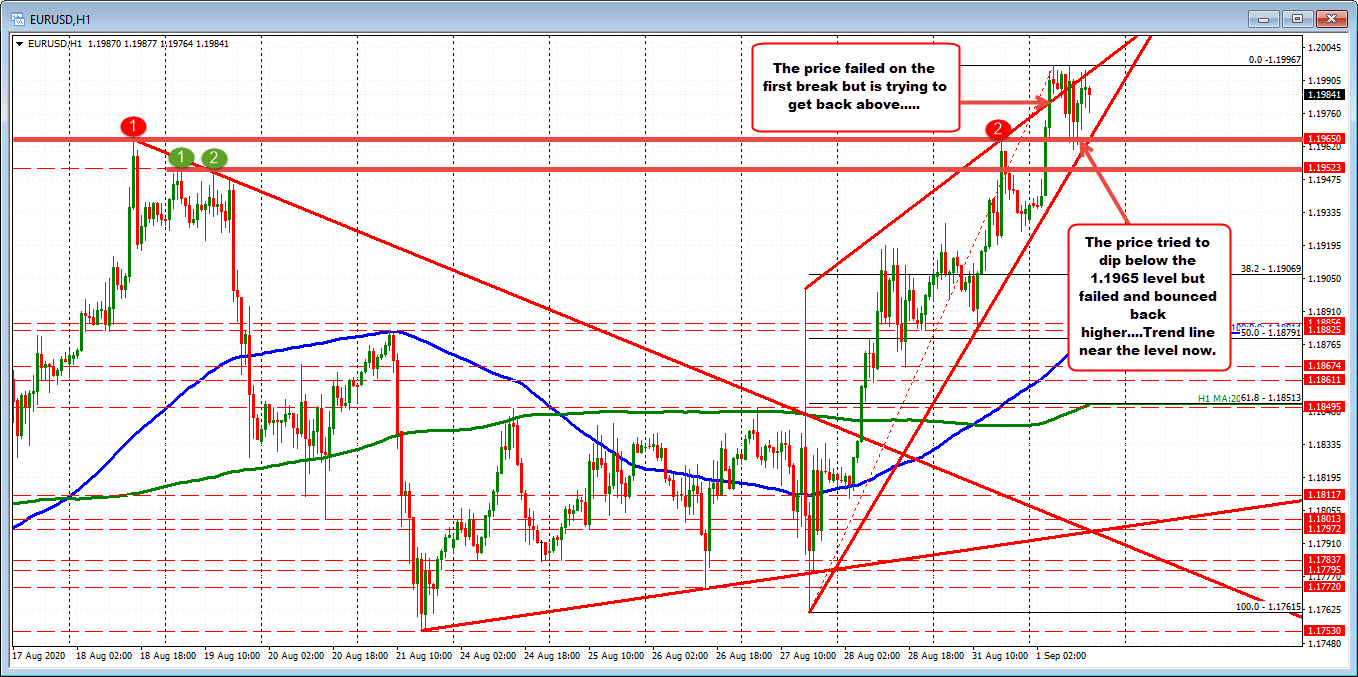

EURUSD trades to highest level since May 2018 and tests 1.2000 in the process

Tests the May 13 week high and 1.2000 today.

The EURUSD traded to a high price today of 1.19967. That moved just ahead of the May 13, 2018 high price of 1.19957 (by a pip – highest level since May 3rd) and just short of the natural resistance at 1.2000. A break of the 1.2000 level (and stay above) would have traders targeting 1.2054 and 1.2092 as the next upside targets.

Drilling down to the hourly chart, the price move higher today occurred in the Asian session and stalled at the similar high (at 1.19967) during the early European session. That move took the price above a topside trend line but the break failed.

Getting above the trend line, and the high for the day along with the 1.200 level are obvious upside targets to get to and through.

On the downside, the swing hi from August 18 at 1.1965 is near a upward sloping trendline. The low corrective move after reaching the high today moved just below that level to 1.19604, but could not sustain selling pressure. Risk for longs looking for more upside would be a break below that level today.