Archives of “September 2020” month

rssIts a big Tuesday ahead for Federal Reserve speakers –

Speakers from the Federal Open Market Committee (and other Fed officials) are all during Europe and US time, here is the schedule if you want to keep it handy.

- 1225 GMT Michael Held, EVP at the NY Fed speaks on LIBOR

- 1315 Federal Reserve Bank of NY President Williams speaks from a prepared text at a UST Market conference. Not expecting a Q&A follow up to this.

- 1330 GMT President of the Federal Reserve Bank of Philadelphia Harker speaks on … machine learning! Which may not yield much on his outlook for the economy nor policy, but there is a Q&A to follow which might be more fruitful.

- 1540 GMT Federal Reserve Vice Chair Clarida moderates a panel discussion, the topic is ‘Future considerations for Treasury market resilience’.

- 1700 GMT Williams again, this is a ‘fireside chat’ event, so basically a Q&A. Williams is rarely shy on expressing his views on the economy and policy.

- 1700 GMT and also 1900 GMT Federal Reserve Vice Chair for Supervision Quarles will be speaking. First on regulation, the second on financial stability. Both will feature Q&A.

The boss man is getting the day off by the looks of it …

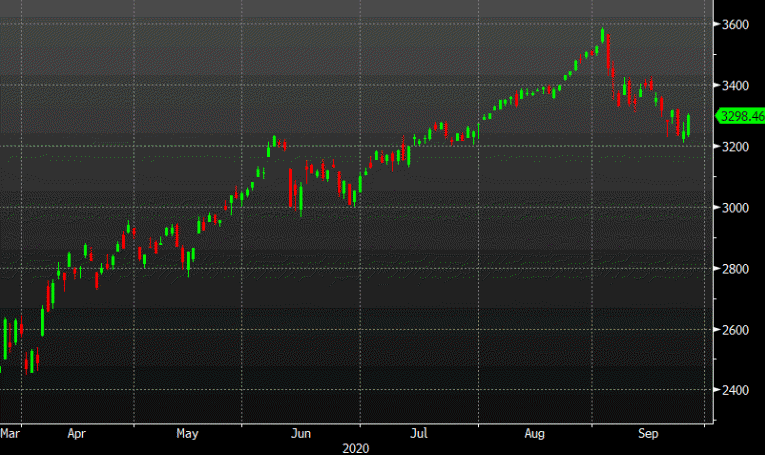

US stocks close higher led by the NASDAQ index

Nasdaq leads the way

The major indices closed higher across the board with the NASDAQ ending up leading the way. The S&P and NASDAQ have now posted 3 days of higher closes. All 11 sectors of the S&P closed higher. The energy and financials led the rally today. The Dow post the best day cents September 9

The final numbers are showing:

- S&P index up 53.14 points or 1.61% at 3351.60

- NASDAQ index up 203.96 points or 1.87% at 11117.52

- Dow industrial average rose 410.10 points or 1.51% at 27584.06.

The NASDAQ closed close to its highs of 11120.79. The Dow industrial average however close around 138 points from its intraday high.

Big winners today included:

- GoodRx, +9.31%

- Boeing, +6.52%

- Deutsche Bank, +5.5%

- Delta Air Lines, +5.2%

- United Airlines +5.06%

- American Airlines, +3.91%

- Whirlpool, +3.87%

- Qualcomm, +3.49%

- Tesla, +3.4%

- Uber, +3.19%

- Citigroup, +3.17%

Some losers today included:

- Beyond Meat, -2.46%

- Rite Aid, -2.2%

- Zoom, -1.74%

- Slack, -0.62%

- Merck and Company, -0.16%

- Walmart, -0.07%

- Verizon, -0.03%

Thought For A Day

Latest Monmouth national poll has Biden at 50% and Trump at 45%

The spread narrows from the previous poll

The most recent Monmouth national poll of likely voters is showing:

- Biden 50%, down -1% from the previous poll

- Trump at 45% from the previous poll.

- Biden had a gain of 7% earlier in the month (51% vs 44%).

- The poll of registered voters has Biden up 50% to 44%.

European indices closed sharply higher on the day

German DAX rises over by 3.2%

The European indices are close for the day and the provisional closes are showing sharply higher levels for each of the major indices:

- German DAX, +3.2%

- France’s CAC, +2.5%

- UK’s FTSE 100, +1.8%

- Spain’s Ibex, +2.4%

- Italy’s FTSE MIB, +2.4%

In other markets as London/European traders look to exit:

- spot gold is trading up $10.40 or 0.56% $1872.08

- spot silver is up $0.44 or 1.97% at $23.35

- WTI crude oil futures are trading up $0.11 or 0.27% at $40 and 36%

in the US stock market, major indices continue to move to the upside with the Dow industrial average leading the way:

- S&P index up 51.38 points or 1.56% at 3349.82

- NASDAQ index up 150 points or 1.38% at 11064

- Dow industrial average up 3 475 points or 1.75% at 27648.60

Never give up!

US stock futures point to big gains at the open

Stocks are strong everywhere

S&P 500 futures are 47 points above fair value after a 52-point rally on Friday. The gain at the open will clear last week’s intraday highs.

Chinese foreign ministry repeats opposition to US ‘bullying’ over TikTok

The saga continues

The latest development in this space is that a judge in Washington has granted a preliminary injunction to temporarily block Trump’s order banning Apple and Google from offering TikTok downloads on their respective app stores.

However, the Global Times reports that the ruling doesn’t make any difference and that China will do all it can to prevent TikTok from falling into the hands of the US.

In the bigger picture, this relates to the battle between both countries which could end up in a worst-case scenario of a large-scale decoupling over the next decade.