Archives of “September 2020” month

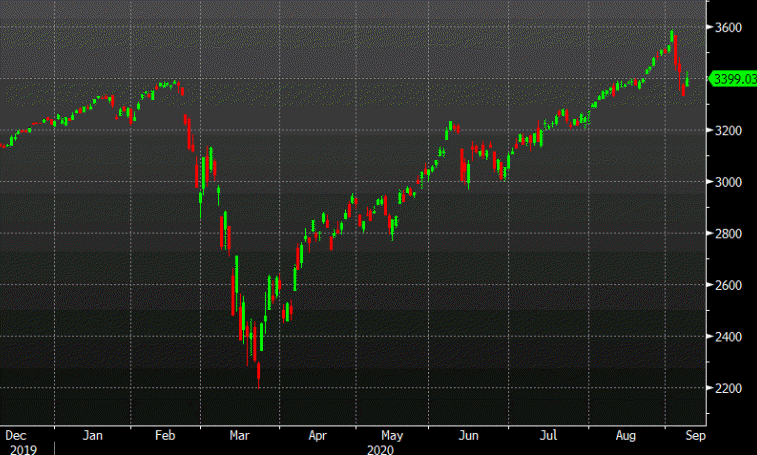

rssLate slump tarnishes big bounce in US equity markets

Good chunk of the gains evaporate late

It was a very good day for equity markets with the S&P 500 up 2% and the Nasdaq up 2.7% but a late swoon kept it from being a great day.

The S&P 500 rose as high as 3424 and peaked with just 30 minutes left in trading but it took a sharp fall from there to close at 3399. That turned a 2.8% gain into a 2.0% climb.

Closing changes:

- SPX +67 to 3399

- DJIA +439 to 27,940

- Nasdaq +293 to 11,141

Thought For A Day

US EIA sees larger demand drop in latest monthly forecast

Oil shrugs it off

The EIA now sees US oil demand falling 2.12 million barrels per day this year compared to last month’s forecast of 2.0 mbpd.

Oil is at the highs of the day, up 4% but the genesis of the drop to $36 this week from $40 is worry about demand.

Full text of the Bank of Canada rate decision on Sept 9, 2020

Full text:

Bank of Canada maintains commitment to current level of policy rate, continues program of quantitative easing

The Bank of Canada today maintained its target for the overnight rate at the effective lower bound of ¼ percent. The Bank Rate is correspondingly ½ percent and the deposit rate is ¼ percent. The Bank is also continuing its quantitative easing (QE) program, with large-scale asset purchases of at least $5 billion per week of Government of Canada bonds.

Both the global and Canadian economies are evolving broadly in line with the scenario in the July Monetary Policy Report (MPR), with activity bouncing back as countries lift containment measures. The Bank continues to expect this strong reopening phase to be followed by a protracted and uneven recuperation phase, which will be heavily reliant on policy support. The pace of the recovery remains highly dependent on the path of the COVID-19 pandemic and the evolution of social distancing measures required to contain its spread.

The rebound in the United States has been stronger than expected, while economic performance among emerging markets has been more mixed. Global financial conditions have remained accommodative. Although prices for some commodities have firmed, oil prices remain weak.

In Canada, real GDP fell by 11.5 percent (39 percent annualized) in the second quarter, resulting in a decline of just over 13 percent in the first half of the year, largely in line with the Bank’s July MPR central scenario. All components of aggregate demand weakened, as expected.

As the economy reopens, the bounce-back in activity in the third quarter looks to be faster than anticipated in July. Economic activity has been supported by government programs to replace incomes and subsidize wages. Core funding markets are functioning well, and this has led to a decline in the use of the Bank’s short-term liquidity programs. Monetary policy is working to support household spending and business investment by making borrowing more affordable.

Household spending rebounded sharply over the summer, with stronger-than-expected goods consumption and housing activity largely reflecting pent-up demand. There has also been a large but uneven rebound in employment. Exports are recovering in response to strengthening foreign demand, but are still well below pre-pandemic levels. Business confidence and investment remain subdued. While recent data during the reopening phase is encouraging, the Bank continues to expect the recuperation phase to be slow and choppy as the economy copes with ongoing uncertainty and structural challenges.

CPI inflation is close to zero, with downward pressure from energy prices and travel services, and is expected to remain well below target in the near term. Measures of core inflation are between 1.3 percent and 1.9 percent, reflecting the large degree of economic slack, with the core measure most influenced by services prices showing the weakest growth.

As the economy moves from reopening to recuperation, it will continue to require extraordinary monetary policy support. The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. To reinforce this commitment and keep interest rates low across the yield curve, the Bank is continuing its large-scale asset purchase program at the current pace. This QE program will continue until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.

Bank of Canada leaves QE program at $5B per week, as expected

Highlights of the Bank of Canada rate decision

- No change in 0.25% overnight rate, as expected

- Both the global and Canadian economies are evolving broadly in line with the scenario outlined in July

- The rebound in the United States has been stronger than expected, while economic performance among emerging markets has been more mixed

- BOC continues to expect the recuperation phase to be slow and choppy as the economy copes with ongoing uncertainty and structural challenges.

- CPI expected to remain well below target in the near term

- Repeats that BOC “will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”

There is almost nothing notable here. There were no chances in policy and the language on forward guidance is entirely unchanged.

There were some CAD bids waiting in the wings until after the decision as it plays catch-up with the other commodity currencies. I expect more of that in the minutes ahead.

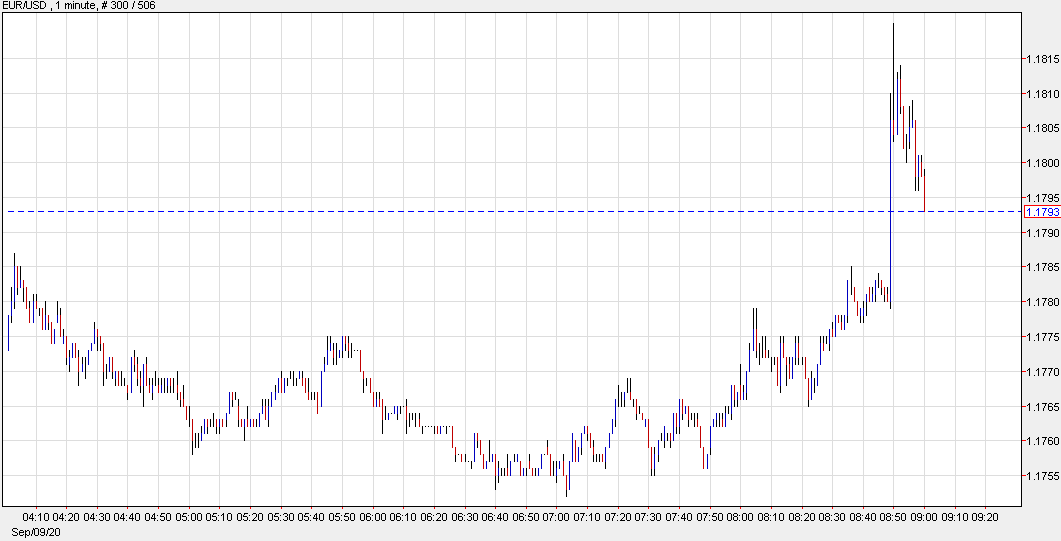

ECB forecasts said to show more confidence in the economic outlook

Leak from the ECB forecasts from Bloomberg boosts the euro

Some ECB policy makers have become more confident in their forecasts, according to a Bloomberg report citing people familiar.

The latest projections — due tomorrow — will show only slight changes to June with GDP revised higher this year on higher private consumption.

With that, there is a falling chance of further stimulus this year; but that will depend on December forecasts.

The euro rallied to 1.1820 from 1.1780 on the headlines but there isn’t much here. A slight increase in forecasts is no surprise given strong retail sales data.

Risk sees some calmer tones after the storm – for now at least

The rout takes a bit of a breather ahead of North American trading today

Tech shares were the ones hit the hardest yesterday, with the Nasdaq falling by over 4% but following a brief scare in early European trading today, the mood has been much calmer and we are seeing some pullback in the equities space.

Nasdaq futures are up by ~1.7% while S&P 500 futures are up by ~0.7% as we look towards North American trading, hinting at some pause to the plunge.

That said, risk sentiment remains in a fragile state with the Nasdaq looking at key technical levels to try and work out how the bias is shifting amid the rout.

The market is still very much trying to sort out whether this is a healthy correction in stocks after the rally to all-time highs or if this is a bit of a reality check that could see the selloff turn even uglier over the next few sessions.

That remains the key question and while it is going to be tough to pick a side, the technical levels highlighted in the post above will do well to try and help us figure things out.