Crude Oil -8,315 Light Distillates +445 Middle Distillates +3,981 Heavy & Residues -614 Total Distillates +3,812 Total (Crude + Distillates) -4,502 #OOTT

Archives of “September 2020” month

rssEuropean shares end with mixed results

German DAX up marginally. France’s CAC flat.

The European major stock indices are close for the day. The results are mixed. The provisional closes are showing:

- German DAX +0.1%

- France’s CAC, flat

- UK’s FTSE 100 -0.4%

- Spain’s Ibex, +0.80%

- Italy’s FTSE MIB -0.3%

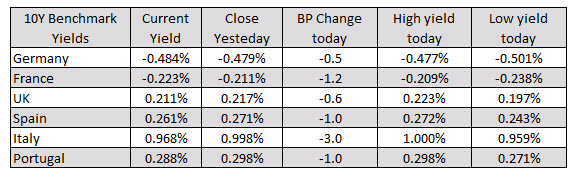

In the European debt market, the benchmark 10 year yields are lower with German DAX yields down -0.5 basis points while Italian yields are down 3.0 basis points.

In the forex, the EUR the has taken over as the weakest of the majors from the USD. The GBP remains the strongest.

Oil climbs back above $40

Impressive rebound

The oil news flow this week has been relentlessly bearish. The EIA and OPEC reports both highlighted disappointing demand and a tip back into oversupply. There was also the BP outlook that was widely mischaracterized as predicting a peak in demand.

None of that matters today as risk trades pick up on hopes of low rates forever, more US government stimulus and a vaccine in April.

The November oil contract is up $1.54 to $40.09.

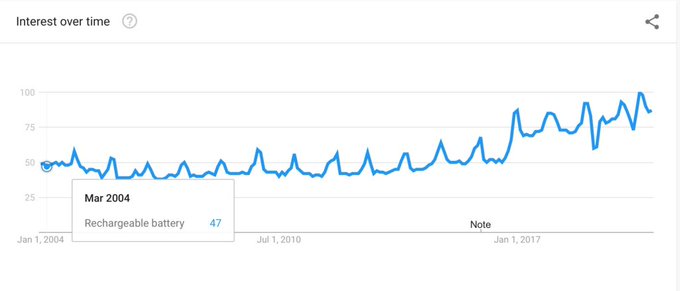

Google trends for rechargeable battery topic

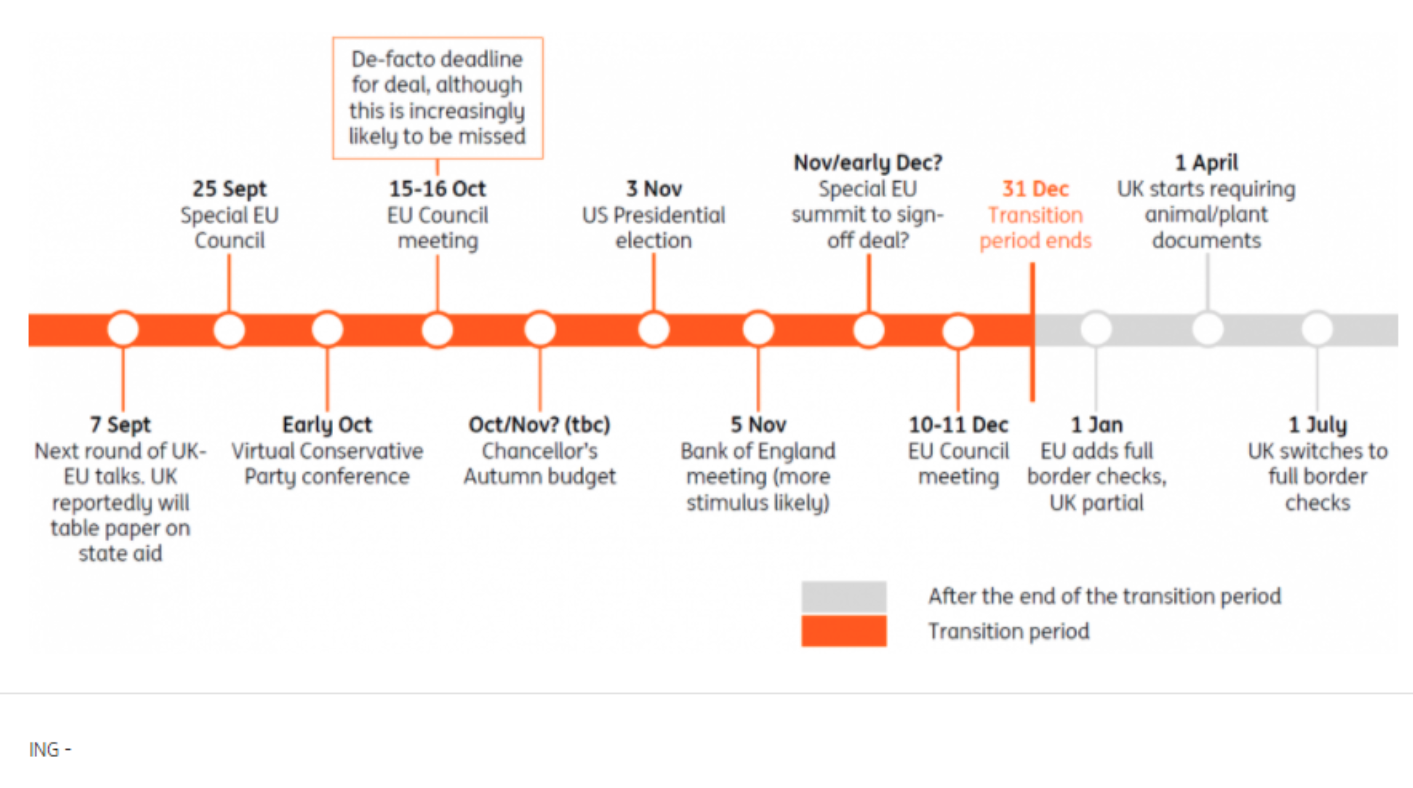

Key Brexit dates ahead

Here is handy little crib sheet from ING on the key Brexit dates ahead

Next date in focus is the special EU Council meeting on September 25. Bearish pressure mounts for the GBP.

Next date in focus is the special EU Council meeting on September 25. Bearish pressure mounts for the GBP.Don’t over leverage

Leverage can be a killer

The use of leverage is almost certainly the most important aspect of risk management. In turn proper risk management is the top priority for all traders. Or at least it ought to be.

This is the case whether you are trading for a fund, your family or even a personal account. Furthermore, whether people realise it or not, managing risk is going to be one of the single most important factors in your success or otherwise as a forex trader.

You can’t trade if you have no capital left. Many traders have over leveraged, lost all their capital and then never traded again. In contrast, the proper use of leverage will prevent you from destroying your account and preserve your capital as a trader.

Sometimes people say it is just about greed or fear. However, often times it is simply ignorance as to how leverage works.

OECD GDP projections

Organisation for Economic Co-operation and Development

OECD was founded in 1961 to stimulate world trade and economic progress. Their latest GDP projections for this year and the next. China alone to keep in positive territory amongst the big players.

- World GDP -4.5%, 2021 +5%

- US GDP -3.8%, 2012+4.0%

- Chinese GDP +1.8%, 2021 +8%

- Euro area GDP -7.9%, 2021 +5.1%

- Japan GDP -5.8%, 2021 +1.5%

- UK GDP-10.1%, +7.6%

OPEC+ compliance with oil cuts at 101%

citing two sources

Compliance, which is usually an issue, running at good levels. All hands to the pump for the COVID-19 crisis eh!. Or at least not to the pump 😉

EU Commission head: not the time to withdraw fiscal support

EU head, via Reuters

- We must take the opportunity to make structural reforms

- We must complete the capital markets union and banking union

- Will put forward legal proposals to set up framework for minimum wages

- Everyone must have access to minimum wages either through collective agreements or statutory minimum wages

Von der Leyen speaking at the State of the European Union address

A quarter of US Gulf of Mexico output offline as hurricane advances

Via Reuters

- 500K bpd of offshore crude oil production and 28% of natural gas output shut in the Gulf of Mexico on Tuesday according to the US interior Gov’t

US crude futures rising on the shutdowns as Hurricane Sally approaches.