NZD was also strong

Although the EUR longs remain high at 179K, the net speculative position decreased by 19K.

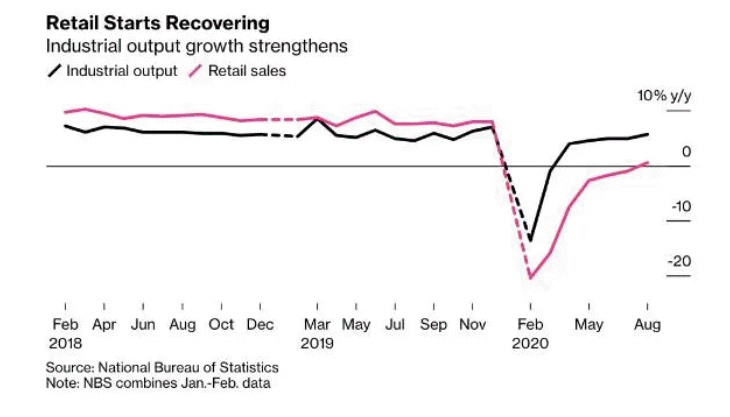

China’s “recovery”, in other words, is largely an exacerbation of the problems that have long been recognised by Beijing. It is a supply-side recovery in an economy that urgently needs more domestic demand but that has found it politically very hard to manage the wealth transfers that it requires.

This recovery isn’t sustainable without a substantial transformation of the economy, and unless Beijing moves quickly to redistribute domestic income, it will require either slower growth abroad or an eventual reversal of domestic growth once Chinese debt can no longer rise fast enough to hide the domestic demand problem

The major US indices are closing the red. The S&P and NASDAQ are down for the 2nd straight day and for the 3rd week in a row. All 11 sectors of the S&P closed lower. The S&P was the weakest of the majors.

For the week, each of the major indices close lower:

The major European indices are ending the session lower. The declines the downside are being led by Spain’s Ibex which fell around 2%. Madrid is enacting mobility restrictions on fears of Covid resurfacing. The German DAX tried to move back positive for the year but fell short with today’s declines.

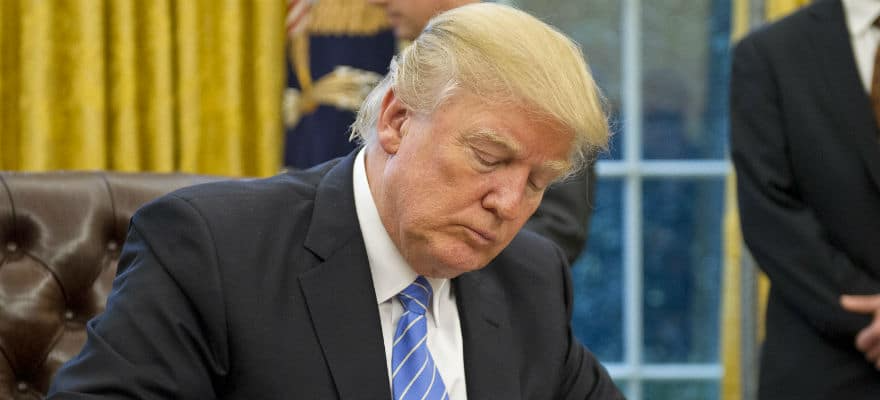

As tensions between the U.S. and China rise, President Donald Trump has signed an executive order that will effectively ban Chinese social networking app TikTok from the U.S. market, unless it is bought by a U.S. buyer.

President Trump stressed that there will be no extension to the TikTok deadline set for September 15th, despite the fact that Treasury Secretary Steven Munchin told CNBC on Monday that the deadline for the TikTok deal was September 20th, not the 15th, as previously announced.

Well, some say it’s largely due to national security concerns, data security and privacy – despite the fact that TikTok doesn’t breach any national security or privacy laws.

The Trump administration will survey the “technical partnership” bargain struck among Oracle and ByteDance, the Chinese group that owns TikTok, before deciding on whether to endorse the arrangement or not.

Meanwhile, President Trump has focused on the need for an instalment to be made to the US Treasury as a component of any arrangement, a remarkable interest that the White House has yet to clarify.

Officials acquainted with the arrangement said the understanding excluded any instalments to the US Treasury.

A senior US official said there were no current conversations about an instalment except that the arrangement would result in economic benefits. In addition, an individual associated with the discussions added that the two organizations would invest vigorously in the U.S. and create a huge number of jobs.

Oracle is noticeably not referring to the agreement as either a sale or acquisition. Maybe it’s a joint venture? Or a vendor agreement?

Oracle Corp. has a history of cooperating with the US government. This makes its partnership with TikTok a key move during the wave of Chinese restrictions going through the White House and Congress.

Oracle has apparently won the competition to take over TikTok’s U.S. operations. TikTok’s Chinese owner ByteDance has rejected Microsoft’s antagonist bid.

A deal between ByteDance and Oracle is appearing to be more of a corporate restructuring rather than the direct sale Microsoft had suggested.

According to “the Wall Street Journal” Oracle has been adopted as a “trusted tech partner”. This is unlike an outright sale, which implies that Oracle will be assisting to manage TikTok’s operations with its individual cloud technologies.

Yet, the arrangement will require the endorsement of both U.S. and Chinese authorities. U.S. authorities will need to be certain that TikTok’s client information will not find its way back to Beijing, while China will need to accept the regulations on AI imposed on it by the U.S. authorities.

The acquisition will help Oracle get important demographic data and information. This information can help Oracle get its foot in the door of new businesses. For instance, the organization could enter the online media space with the assistance of TikTok, thereby opening ways to more information.

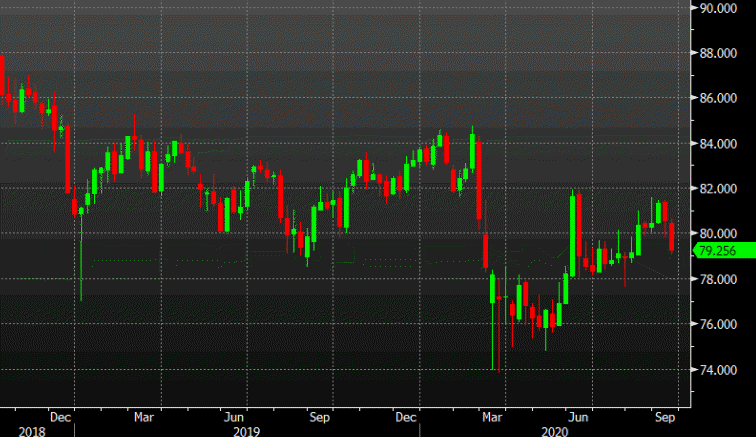

The Chinese yuan rose to its highest point since the news came out in May. Oracle’s shares traded as much as 17% higher in early trading before the markets opened in New York on Monday, after closing at $57 on Friday.

The Committee on Foreign Investment in the United States “CFIUS” will audit the offer this week “and afterwards we will make a proposal to the President and survey it with him.”

Whether it is bullying or preserving national interests, will the Chinese company give in to President Trump?

Only time will tell…

Trade Safe.