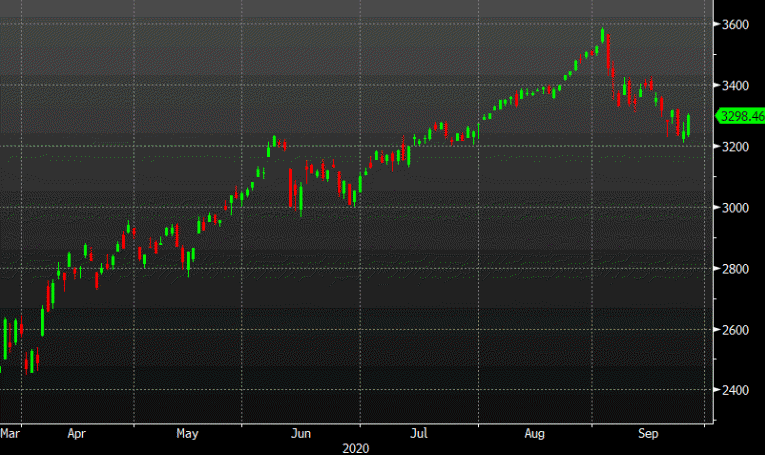

DXY at 94.35

I came across a piece on Bloomberg’s Market Live blog making a case for the Dollar Index to hit 90, before 100. Here is the rationale:

1. The recent Dollar strength has been fuelled by US election uncertainties.

2. The rising COVID-19 cases in Europe have been a key part of the EURUSD weakness. Technically the EURUSD is being pushed back down into a large downtrend from 2008.

3. Despite crowded eur longs and USD shorts being a bit cleaner there still remains election risks.

4. The sum conclusion is that once the election tensions fade then the EURUSD will be driven by the fact that the Fed’s stimulus is greater than the ECB’s. Therefore, DXY to move to 90 before 100.

Points 1 and 2 are really two sides of the same coin. EURUSD weakness = DXY strength and vice versa due to their tight negative correlation. US elections are close and tense. The ‘sell everything’ feel has definitely been here with heavy global stock selling.