Latest data released by Markit – 23 September 2020

- Prior 50.5

- Manufacturing PMI 53.7 vs 51.9 expected

- Prior 51.7

- Composite PMI 50.1 vs 51.9 expected

- Prior 51.9

Business activity in the euro area pretty much grinds to a halt in September, with the services sector being the main drag as seen earlier from the French and German readings – owing to the resurgence in virus cases across the region.

The bright spot is that the manufacturing sector remains unperturbed by the situation as a pickup in foreign demand is helping to bolster new orders and output.

When put together, the pace of the recovery has certainly stalled somewhat towards the end of Q3 and this certainly doesn’t bode too well for the outlook going into Q4.

“The eurozone’s economic recovery stalled in September, as rising COVID-19 infections led to a renewed downturn of service sector activity across the region.

“A two-speed economy is evident, with factories reporting that production growth was buoyed by rising demand, notably from export markets and the reopening of retail in many countries, but the larger service sector has sunk back into decline as face-to-face consumer businesses in particular have been hit by intensifying virus concerns.

“Job losses also picked up in the service sector as more companies became worried about costs and overheads. Fortunately, factories saw slower staff shedding as pressure on capacity begins to emerge, suggesting the overall rate of job cutting has peaked.

“Encouragement comes from a further improvement in companies’ expectations for the year ahead, but this optimism often rests on infection rates falling, which remains far from guaranteed for the coming months. The main concern at present is therefore whether the weakness of the September data will intensify into the fourth quarter, and result in a slide back into recession after a frustratingly brief rebound in the third quarter.”

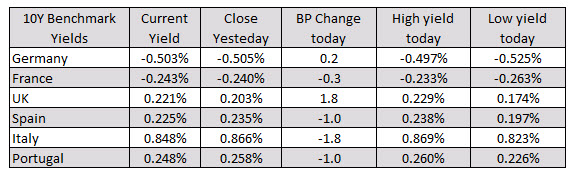

In other markets as London/European traders head for the exits:

In other markets as London/European traders head for the exits: