Archives of “September 19, 2020” day

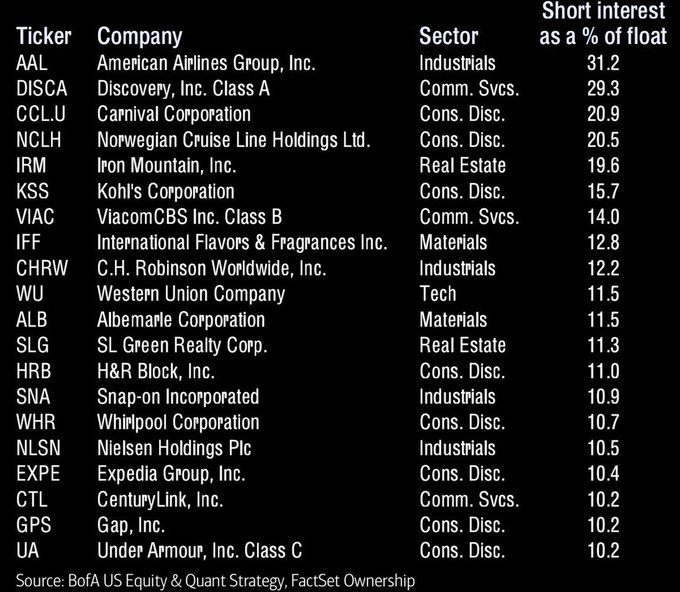

rssThe S&P 500 Shares Best Selling Short.

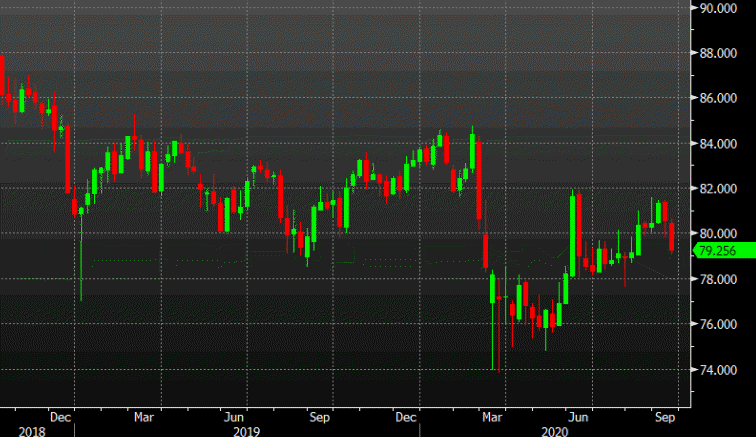

CAD/JPY was the biggest FX mover this week

NZD was also strong

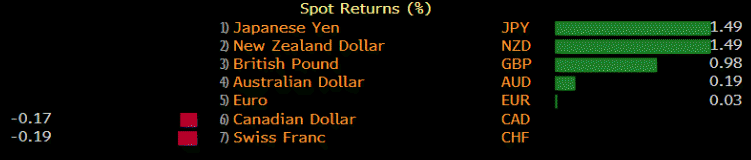

The yen was the top performer this week while the kiwi lagged. On its face, that fits in nicely with the ‘risk off’ theme but the old risk on/off paradigm hasn’t applied for a long time. Neck-and-neck with the yen as the top performer was the New Zealand dollar.

Taking a look at CAD/JPY, there isn’t much in the weekly chart. It was the second week of declines but it’s still comfortably within the range since June.

Do note that the pair failed twice at 82.00 and that points to a downside bias.

CFTC commitments of traders: Traders trim some of the EUR longs

Weekly commitments of traders data for the week ending September 15, 2020

- EUR long 179K vs 198K long last week. Longs decreased by 19K

- GBP long 2K vs 13k long last week. Longs decreased by 11K

- JPY long 23K vs 22K long last week. Longs increased by 1K

- CHF long 12K vs 12K long last week. No change in net speculative position

- AUD long 16K vs 2K short last week. Longs increased by 18K

- NZD long 3K vs 5K long last week. Longs decreased by 2K

- CAD short 17k vs 17K short last week. No change in net speculative position

Although the EUR longs remain high at 179K, the net speculative position decreased by 19K.

The other big change was in the AUD. The net long position moved up 18K to a net positive positin of 16K from short 2K.

The GBP long moved from 13K to 2K.

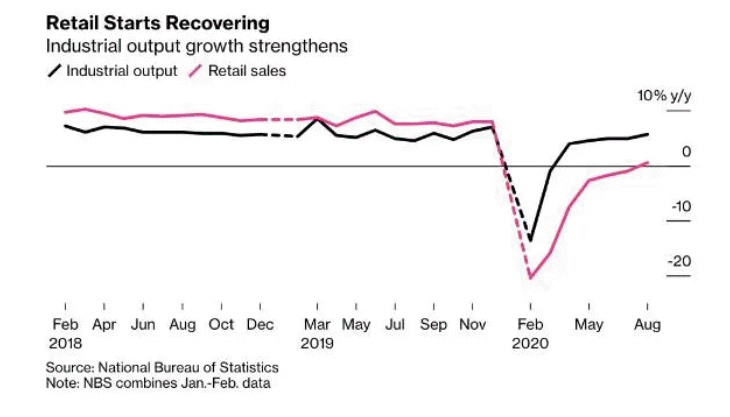

China has recovered but it’s the wrong kind of recovery

Industrial production is driving the rebound

China is an interesting counter-point to many ideas about the global economy right now. It’s essentially a COVID-free country and an entirely open economy.

From a distance, it’s recovered in a big way.

But when you drill down, it’s not quite as strong as it seems. Retail sales are down 8.6% y/y in the first 8 months of the year and were just 0.5% y/y in August.

It’s not the consumer driving the recovery.

Contrast that with:

- Industrial production +5.6%

- Fixed asset investment +4.16%

- Trade surplus +19.3%

That’s not a sustainable recovery and it’s not the consumer-led economy that China’s been trying to build for the past 5 years.

China has gone back to the old playbook to stimulate growth. Perhaps that was the right thing to do but the slow consumer recovery even in a COVID-free country is worrisome.

It also sets up domestic problems for China down the road, as the FT highlights today:

China’s “recovery”, in other words, is largely an exacerbation of the problems that have long been recognised by Beijing. It is a supply-side recovery in an economy that urgently needs more domestic demand but that has found it politically very hard to manage the wealth transfers that it requires.

This recovery isn’t sustainable without a substantial transformation of the economy, and unless Beijing moves quickly to redistribute domestic income, it will require either slower growth abroad or an eventual reversal of domestic growth once Chinese debt can no longer rise fast enough to hide the domestic demand problem

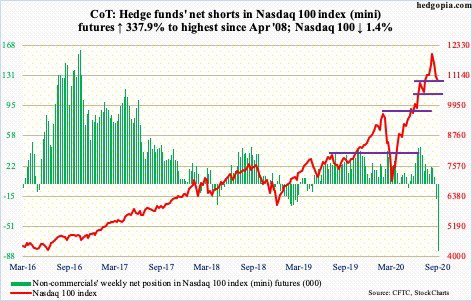

Hedge funds have a tremendous short positions on Nasdaq

Major indices close in the red. S&P and NASDAQ post the 3rd straight losing week

S&P leads the way to the downside today

The major US indices are closing the red. The S&P and NASDAQ are down for the 2nd straight day and for the 3rd week in a row. All 11 sectors of the S&P closed lower. The S&P was the weakest of the majors.

The final numbers are showing:

- Tthe S&P index fell -37.68 points or -1.12% to 3319.33

- The NASDAQ index fell -116.99 points or -1.07% to 10793.28

- The Dow industrial average fell 244.69 points or -0.88% to 27657.29

For the week, each of the major indices close lower:

- S&P index fell -0.65%

- NASDAQ index fell -0.56%

- Dow industrial average fell -0.03%

Year to date, the NASDAQ index continues to lead by a wide margin. The changes are showing

- S&P index, +2.74%

- NASDAQ index +20.29%

- Dow industrial average -3.09%

Some of the bigger winners today included:

- US steel, +11.23%

- Zoom, +6.26%

- Tesla, +4.29%

- Crowdstrike Holdings, +2.23%

- Twitter, +2.01%

- CVS health, +1.99%

- Rite Aid, +1.67%

- J&J, +1.36%

- Target, +0.91%

- Deere and Company, +0.91%

- Slack, +0.91%

- Tencent, +0.48%

Some of the bigger losers today included:

- Beyond Meat, -5.2%

- Boeing, -3.85%

- Intuitive Surgical, -3.8%

- First Solar, -3.7%

- Qualcomm, -3.65%

- United Airlines, -3.58%

- Apple, -3.33%

- Delta Air Lines, -3.27%

- American Airlines, -3.01%

- Boston Scientific, -2.97%

Thought For A Day