But it’s not Halloween?

What is it? Witching hour is the final hour of trading on the 3rd Friday of each month as options and futures on stocks and stock indexes expire.

Sometimes you can see heavy volumes as traders close out options and futures contracts before expiries. So, watch out.

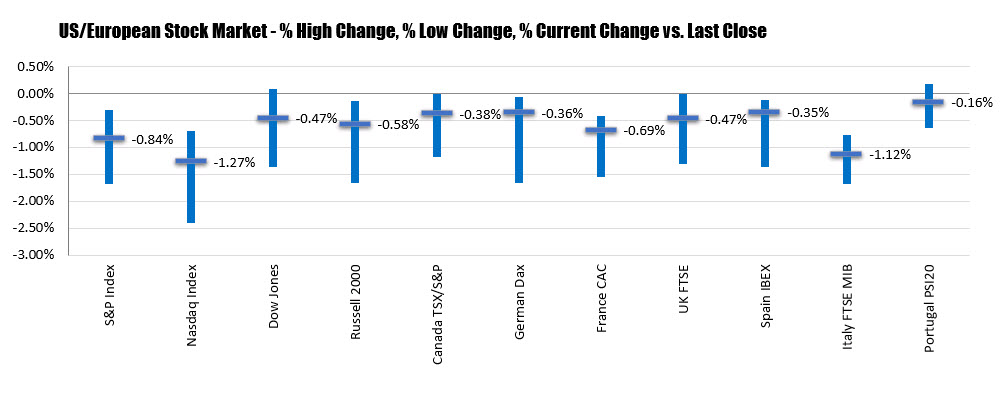

Witching schedule:

- FTSE100 Sep 20 Futures and Options Expiry: 10:15BST/05:15ET

- Euro Stoxx Sep 20 Futures and Options Expiry:11:00BST/0600ET

- DAX Sep 20 Futures and Options Expiry: 12:00BST/0700ET

- E-mini S&P Sep 20 Futures and Options Expiry: 14:30BST/09:30ET

- DJIA Sep 20 Futures and Options Expiry: 14:30/09:30ET

First time to be aware of is 10:15 UK time (BST) on the FTSE 100 futures.