Archives of “September 10, 2020” day

rssPositive global earnings momentum – Crisis, what crisis?

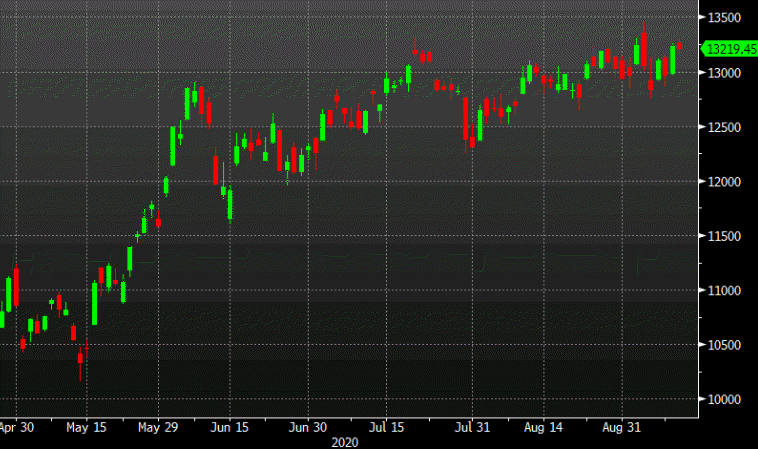

European equity close: Moderate declines follow the ECB

Closing changes for the main European bourses:

- UK FTSE 100 – flat

- German DAX -0.1%

- French CAC -0.3%

- Italy MIBH +0.1%

- Spain IBEX -0.7%

- Stoxx 50 -0.3%

German stocks have held up well in the recent tech-led turmoil.

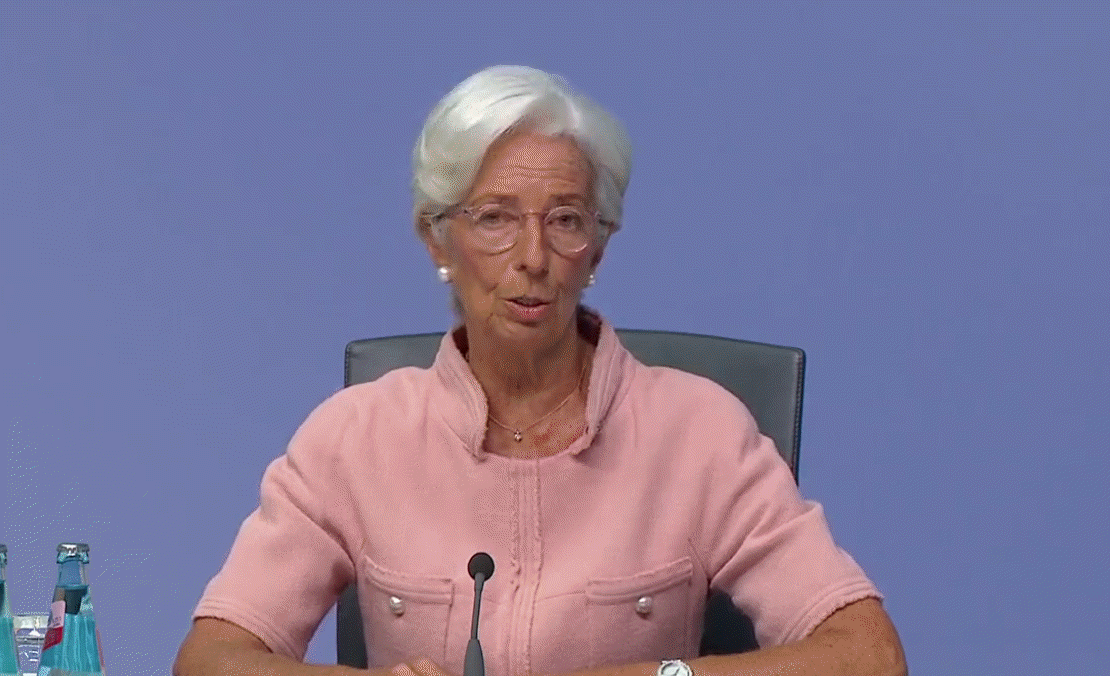

Lagarde: There is no need to overreact to euro gains

Comments from Lagarde in the ECB opening statement:

- Says ECB will monitor FX rate

- Strength of recovery remains surrounded by uncertainty

- Rebound broadly in line with previous expectations

- Domestic demand recorded significant recovery

- Uncertainty weighing on consumer spending and business investment

- Inflation dampened by energy prices

- Ample monetary stimulus remains necessary

- Incoming data suggest notable recovery in consumption

- ECB will carefully assess the euro’s effect on inflation

- New infections are a headwind to the short term outlook

- Repeats that an ample degree of easing needed

- Fiscal measures should be targeted and temporary

The euro jumped to 1.1891 from 1.1850 on the headline from Lagarde.

Full text of the ECB September monetary policy statement

The full text of the latest ECB monetary policy statement – 10 September 2020

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

(1) The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

(2) The Governing Council will continue its purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,350 billion. These purchases contribute to easing the overall monetary policy stance, thereby helping to offset the downward impact of the pandemic on the projected path of inflation. The purchases will continue to be conducted in a flexible manner over time, across asset classes and among jurisdictions. This allows the Governing Council to effectively stave off risks to the smooth transmission of monetary policy. The Governing Council will conduct net asset purchases under the PEPP until at least the end of June 2021 and, in any case, until it judges that the coronavirus crisis phase is over. The Governing Council will reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2022. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

(3) Net purchases under the asset purchase programme (APP) will continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates. The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

(4) The Governing Council will also continue to provide ample liquidity through its refinancing operations. In particular, the latest operation in the third series of targeted longer-term refinancing operations (TLTRO III) has registered a very high take-up of funds, supporting bank lending to firms and households.

The Governing Council continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today.

ECB leaves key policy rates unchanged as expected

CB announces their latest monetary policy decision – 10 September 2020

- Prior decision (16 July)

- Deposit facility rate -0.50%

- Main refinancing rate 0.00%

- Marginal lending facility 0.25%

- To continue purchases under PEPP program with a total of €1.35 trillion

- Purchases will continue to be conducted in a flexible manner over time

- Reaffirms to conduct purchases under PEPP until at least the end of June 2021

- To continue to provide ample liquidity through refinancing operations

- Stands ready to adjust all instruments, as appropriate, to ensure inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry

- Full statement

Pretty much a non-event with the statement language pretty much a mirror of that in July. The euro is rightfully little changed on the announcement as all eyes turn towards Lagarde’s press conference later at 1230 GMT for more clues on the central bank’s latest economic forecasts, inflation outlook, and potential thoughts about the euro currency.

Germany DIW institute raises 2020 GDP forecast

Sees 2020 German GDP at -6.0% vs -9.4% previously in June forecast

- 2021 German GDP forecast of +4.1% vs +3.0% in June

- 2022 German GDP forecast of +3.0%

Essentially, it reads as “the slump in the German economy isn’t as bad as anticipated and that the recovery phase is also gathering modest pace”. But amid fears of a secondary wave of infections in the region and international demand conditions still rather subdued, we’ll see if things will keep with this trajectory towards the latter stages of the year.

Irish PM Martin: I’m not optimistic about striking a Brexit deal at this stage

Further comments by Irish prime minister, Micheál Martin

- Have made clear to Johnson our opposition of UK move

- Johnson said UK will meet its obligations

- We have to prepare for a hard Brexit now

The war of words continue but even before the UK internal market bill, it is not to say that negotiations were going swimmingly well. In any case, both sides will be meeting later today to try and sort this issue out so let’s see.

On a separate note, the ongoing negotiations this week is said to be leading nowhere as well and that may end up being a headwind for pound gains ahead of the weekend.

Nikkei 225 closes higher by 0.88% at 23,235.47

Asian equities climb as Wall Street snaps tech losing streak

A more positive day for stocks in Asia, with the Hang Seng up 0.2% and the Shanghai Composite seen up by 0.5% as well. This comes on the back of a better performance by Wall Street yesterday, with the Nasdaq closing up by 2.7%.

That said, the losing streak may be ended for now but it is still too early to say if this is where everything returns back to sunshine and rainbows. US futures are keeping mildly higher, moving off earlier lows at least but are still more tepid in general.

In the major currencies space, all eyes are on the euro today as we look towards the ECB policy meeting decision and Lagarde’s press conference to follow up on that.

OPEC+ compliance said to improve to 103% in August, but overall output actually increased

Energy Intelligence reports on the matter

According to their assessment, OPEC+ compliance picked up from 96% in July to 103% in August but the figure may be a bit misleading because the targeted output cuts were actually scaled back by 1.9 mil bpd in August as per the April agreement.

As such, OPEC+ overall output actually rose by 1.3 mil bpd in August. The full report can be found here.

Amid the recent slump in oil prices, it prompts further questions of whether OPEC+ will be making additional output cuts as there are still question marks surrounding demand conditions and the impact of the virus outbreak towards the global economy.