US ABC reported this prior to US markets closing, posting as an ICYMI:

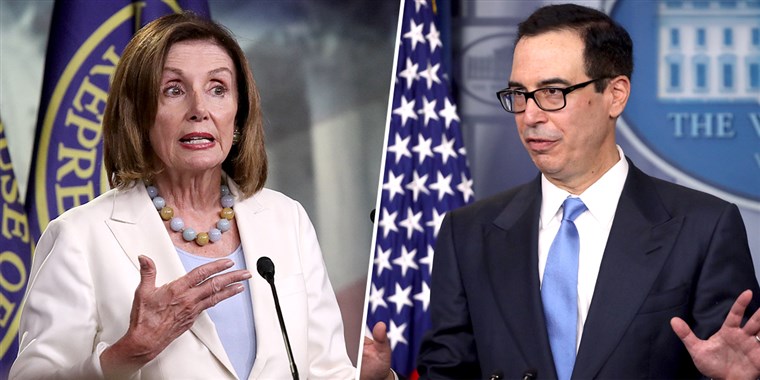

House Speaker Nancy Pelosi and the Trump administration have informally agreed to keep a stopgap government-wide funding bill – needed to avert a shutdown at the end of this month

- The accord is aimed at keeping any possibility of a government shutdown off the table despite ongoing battles over COVID-19 relief legislation

- sidestepping the potential for other shutdown drama in the run-up to the November election

- anonymous Democratic and GOP aides “who have been briefed on a Tuesday conversation between Pelosi and Mnuchin