Archives of “September 4, 2020” day

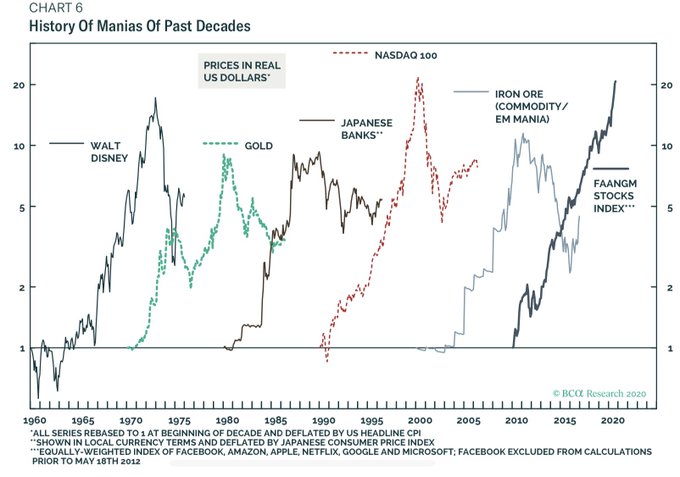

rssA history of market manias!

Central banks’ net purchases of #gold fell below 9 tons in July, the lowest since 2018, World Gold Council data show – Bloomberg

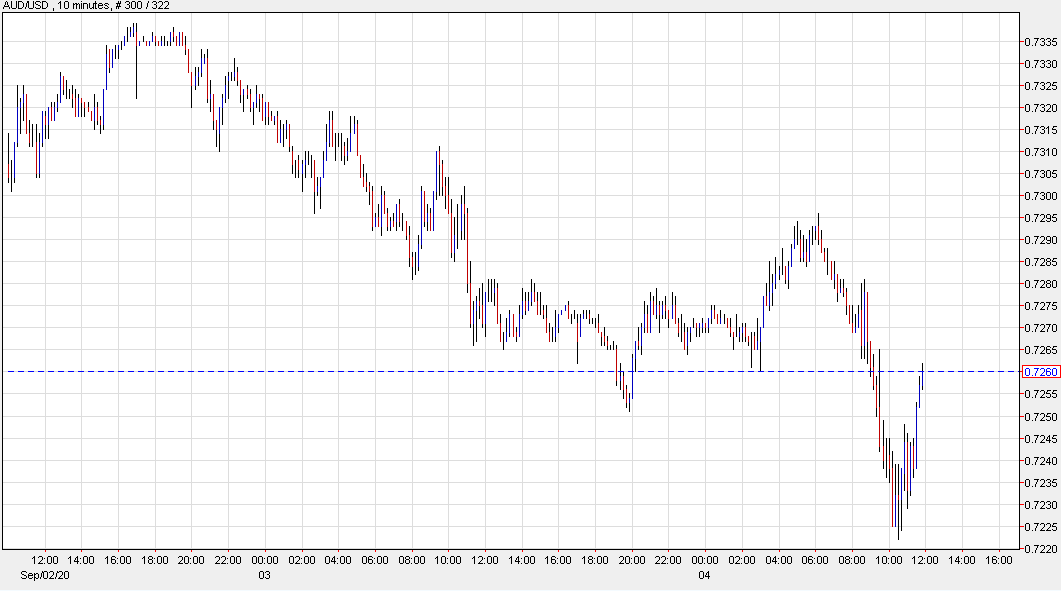

Dollar sellers dip a toe into the water

Euro and Australian dollar tick higher

Some signs of risk taking are appearing in the FX market as EUR/USD and AUD/USD bounce from the lows.

The S&P 500 is trying to make a bottom at the same time. This could just be the same kind of midday bounce we saw yesterday before a bigger rout into the close but it may have room to run.

AUD/USD

European shares can’t escape the US selling. Close lower on the day/week.

Major indices erase early week gains and close lower for the week

The European shares could not escape the tumble in the US indices. Nevertheless although they are lower, the declines for most of the indices are a little more contained. The provisional closes are showing:

- German DAX, -2.0%

- France CAC, -1.2%

- UK’s FTSE 100, -1.1%

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB, -1.0%

For the week, the FTSE 100 led the way to the downside. All the under indices also fell.

- German DAX, -1.8%

- France’s CAC, -1.05%

- UK’s FTSE 100, -3.5%

- Spain’s Ibex, -2.1%

- Italy’s FTSE MIB, -2.35%

Don’t fight the FED they said.

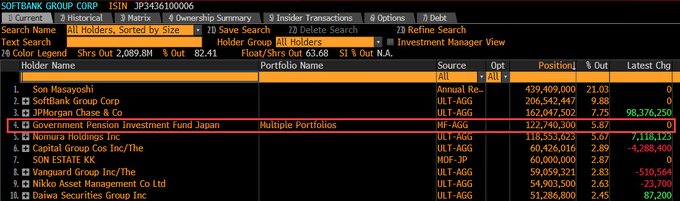

SoftBank is the ‘Nasdaq whale’ that’s been buying stock options

SoftBank unmasked

The finger has been increasingly pointed at option buyers as the driver of the speculative euphoria in tech stocks in the past month but the genesis of the trade was likely Japanese conglomerate SoftBank.

The FT reports:

SoftBank is the “Nasdaq whale” that has bought billions of dollars’ worth of US equity derivatives in a move that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday, according to people familiar with the matter.

The company has made big tech bets before — including a bad one on WeWork — but never via derivatives.

“These are some of the biggest trades I’ve seen in 20 years of doing this,” said one derivatives-focused US hedge fund manager. “The flow is huge.”

IMF Projected Government Fiscal Deficits Relative to GDP

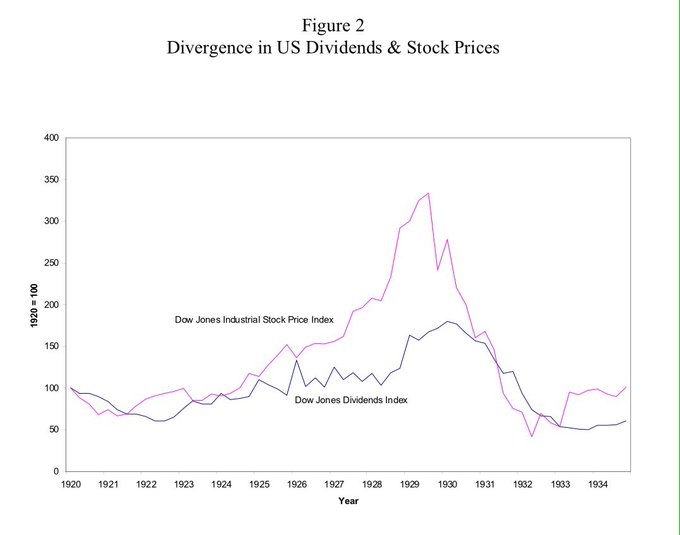

Dow Jones Stock Price and Dividends Index (1920s)

BOJ reportedly mulls “upgrading” economic assessment amid signs of a pickup

Bloomberg reports, citing people familiar with the matter

The BOJ is said to likely consider upgrading its economic assessment amid signs of a rebound in the Japanese economy after the decline in Q2.

But the sources say that any changes would acknowledge that the slump has bottomed, rather than indicate optimism surrounding the outlook of the economy.

Adding that BOJ policymakers still see that the economic situation remains severe and highly uncertain amid the fallout from the coronavirus pandemic.

As for policy action, the sources say that BOJ policymakers see little need to take further measures at this point following their actions in March.

Well, as far as the headline goes, I think calling this an “upgrade” to the assessment is a bit of a stretch. If anything, it looks like they may just signal that the worst is over but the overall economic situation remains rather dire for the time being.

The BOJ will deliver their next assessment of the economy in their policy meeting this month on 17 September.