Thought For A Day

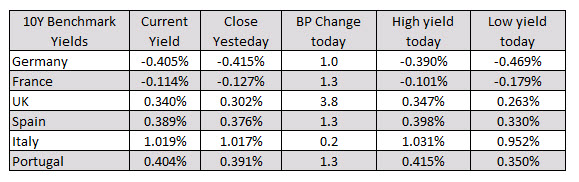

In the European debt market, the benchmark 10 year yields reversed earlier declines and are currently trading up 0.2 basis points to up 3.8 basis points:

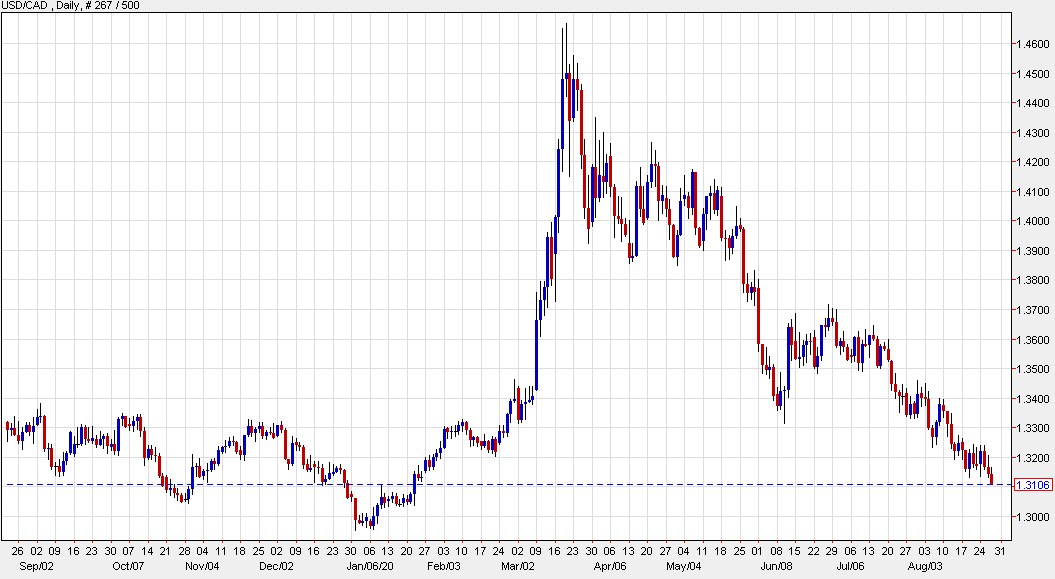

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).

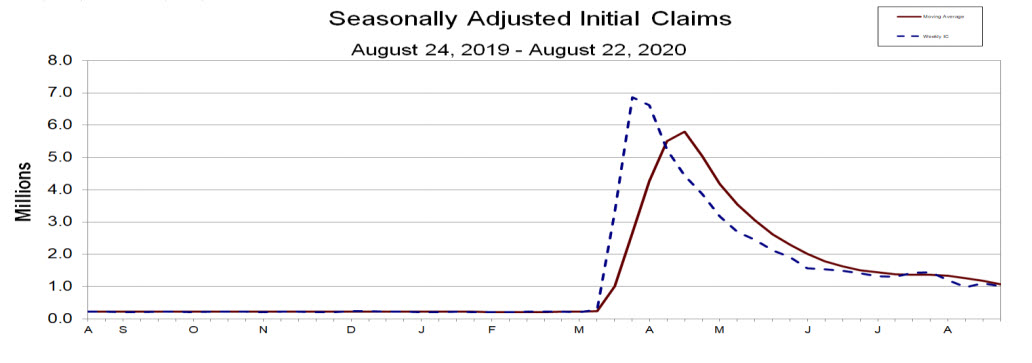

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).