Archives of “August 2020” month

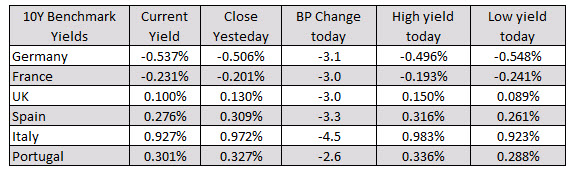

rssAverage 10-year bond yield across select economies

EUR/USD: A Buy On Dips; USD/JPY: Next Move Lower; GBP/USD: 1.32 Next Critical Levels

“For G10, GBP takes center stage in light of a less-dovish-than-expected BoE meeting this morning.The next critical level for GBPUSD is 1.32. USDJPY continues to hold 106, reaffirming our bias that the next move is lower. EURUSD continues to hold below 1.19 but remains a buy on dips in the months ahead,“

To read more enter password and Unlock more engaging content

China’s Global Times says the US is becoming the biggest uncertainty in future global economic growth

An opinion piece in the state-owned tabloid

Some of the remarks in the piece:

- The US has rolled out a series of policies to monetize financial deficit … which has aggravated financial risks in the country, and cast a shadow over further investments.

- US’ failure to handle the coronavirus may even prolong the pandemic

- skyrocketing unemployment has resulted in sliding consumption which in turn is causing a decline in exports from its trade partners

- huge debt and expanding stock market bubbles have damaged the confidence of global investors

GT is a barometer of official thinking in China re the US, relations between the two contries are on a downward path.

Global Times editor Hi Xijin:

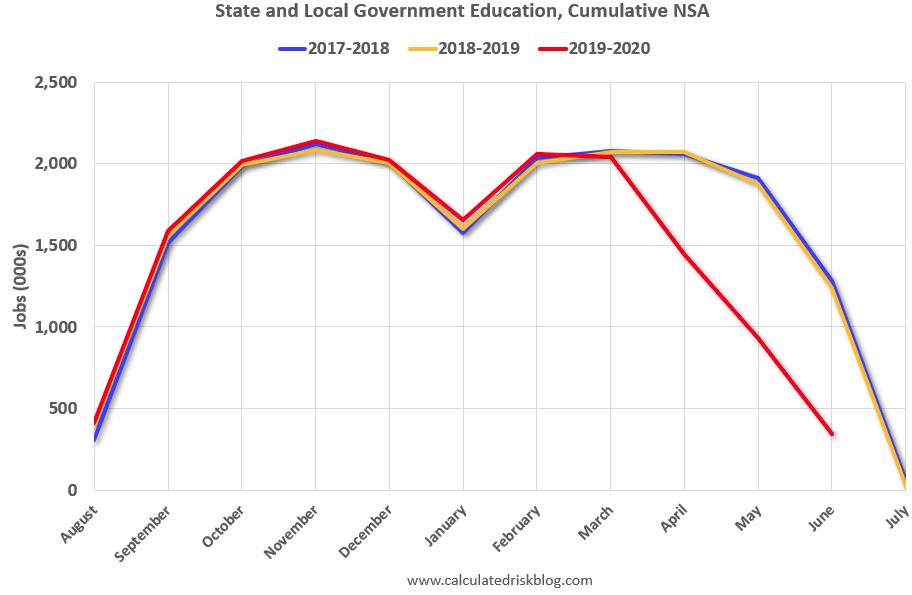

Non-farm payrolls preview: Half the expected jobs gain in July are because of a quirk in seasonal adjustments

Teaching jobs are a big quirk

The consensus for Friday’s non-farm payrolls report is for 1.5 million jobs gains in the month but that doesn’t tell the real story.

The ADP report this week got some attention because it showed private hiring at just 167,000 jobs. Normally, you would expect that to take a big bite out of expectations, but it hasn’t.

Why? A big reason is seasonal adjustments in the data.

Normally, one of the easiest and clearest seasonal adjustments is teachers. They’re laid off at the same time every year and hired at the same time every year. So you discount the lay offs in June/July and the hires in Aug/Sept. It all washes out.

This year though, teachers were laid off early — in April, May and June.

In the BLS model, most of those layoffs are supposed to happen in July. So what happens is they add nearly 1 million jobs to the total before they even start counting. The thing is, those layoffs haven’t happened this year.

The effect was highlighted by Calculated Risk.

Because of that effect, job losses were overestimated in April/May and now will be added back in July. They estimate the effect at +850K jobs.

Still, that number could be fluid and the assumptions and adjustments the BLS makes will be critical in how it turns out. The risk is that it shows a skewed picture.

Given that, the better spot to watch may be the unemployment rate, which is taken from the household survey. This has its own problems because many people laid off because of COVID-19 have been misclassified — a problem the BLS has been struggling to correct. The consensus there is an improvement to 11.2% from 12.3%. Private payrolls (consensus +1398K) could also offer a clearer look at the economy excluding teacher effects.

As for trading it, watch out for people pointing to the seasonal adjustment effect after the fact. But note that it should already be priced in.

US stocks finish strong ahead of non-farm payrolls

Closing changes for the main market indexes

- S&P 500 +21 points (0.65%) to 3349

- DJIA +0.7%

- Nasdaq +1.0%

The MSCI wold index erased the year-to-date decline today.

Thought For A Day

US dollar dips after Trump talks about payroll tax cut order

Trump says executive order coming on a payroll tax cut and eviction protections

Trump can delay the collection or payroll taxes and he can ban evictions for a time, but eventually those payments will come due. The idea may be that the end of the deferral will put pressure on Congress to waive it but it could also result it a bit of a payment cliff.

This was rumored and hinted at for more than a week so I’m not sure this is what’s moving the dollar at the moment but it’s something to watch. The larger theme of relentlessly rising US deficits is one that’s going to last years, not months.

European shares end the day lower. UK’s FTSE falls -1.1%.

Down day for the major indices

The European shares are ending the day lower. The UK FTSE has fallen -1.1%. The Bank of England was very cautious about the prospects for the economy, but said that negative rates are not being considered (at least at the moment).The provisional closes are showing:

- German DAX, -0.4%

- France’s CAC, -0.9%

- UK’s FTSE 100, -1.2%

- Spain’s Ibex, -1.1

- Italy’s FTSE MIB, -1.3%

In other markets as the European/London traders look to exit:

In other markets as the European/London traders look to exit:- Spot gold is up $15.70 or 0.76% at $2053.44

- Spot silver is up $1 or $0.04 or 3.86% $28

- WTI crude oil futures are down $0.17 in a up and down trading session. The high price reached $42.65. The low price extended to $41.61.

- S&P index is currently down -5 points or -0.15% at 3322.57

- NASDAQ index is down -2.7 points or -0.02% at 10996

- Dow industrial average is down 6.6 points or -0.03% at 27195

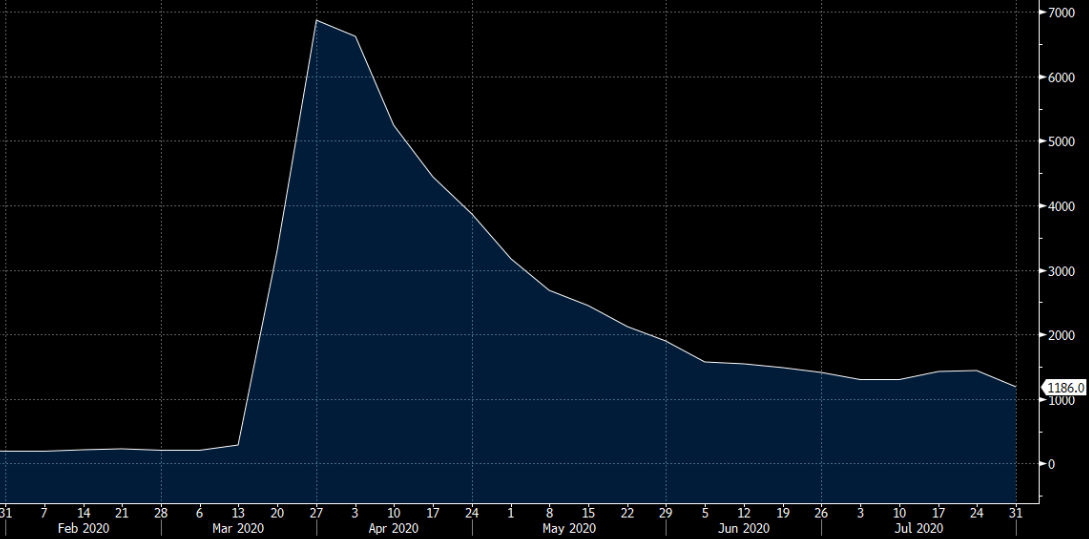

US weekly initial jobless claims 1186K vs 1400K expected

Weekly jobless claims data

- Lowest since the pandemic started

- Prior was 1434K (revised to 1435K)

- Continuous claims 16107K vs 16900K

- PUA claims 655K vs 909K prior (lowest since the week the program was introduced)

Better numbers on initial jobless claims but it’s still daunting how they’ve remained so high.