S&P index falls short once again

The NASDAQ index closed at a record level at 11129.72. I was above the previous record at 11108.07.

The S&P index closed short of its record high at 3386.15.

The Dow industrial average has been down for 2 last 3 trading days

The final numbers are showing:

- S&P index up 9.14 points or 0.27% at 3381.99. It’s high price reached 3387.59. It’s low price extended to 3379.22

- NASDAQ index closed at 11129.72. That is up 110.42 points or 1.0%. It’s high price extended to 11144.52. It’s low price fell to 1108.30

- The Dow industrial average salt more selling today. It close down -86.11 points or -0.31% at 27844.95

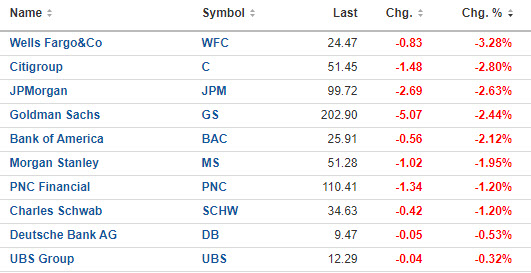

Financials were under pressure today. After the close on Friday it was officially disclosed that legendary investor Warren Buffett had rid himself of a lot of his is financial stock exposure in the 2nd quarter.

Buffett also showed an investment in Barrick Gold which helped to push up the price of spot gold. Spot gold was up near $40 on the day or 2.06%, while Barrick Gold rose by and oversized 11.63%. It must be good to be Buffett.