Archives of “August 2020” month

rssWeakening US #dollar more than strengthening renminbi

Freeland to be named next Canadian finance minister

CTV report

Deputy PM Chrystia Freeland — best known for renegotiating NAFTA for Canada – will be named finance minister after Morneau’s resignation yesterday, CTV reports.

Another day, another dollar (selloff)

US dollar on the defensive again

The US dollar is sinking again.

The rundown of reasons to sell the dollar is this:

- US election/political risk

- Improving Republican polls increase risk of divided, deadlocked

- The lack of further stimulus could tee-up US economic underperformance

- Relative valuations are better outside the US (i.e. equity p/e ratios)

- Money is flowing out of USD safe-haven trades

- Debt monetization fears

At the moment, the euro and the pound are leading the way with the commodity currencies not far behind. It’s a genuine dollar rout though and at some story the momentum simply takes over.

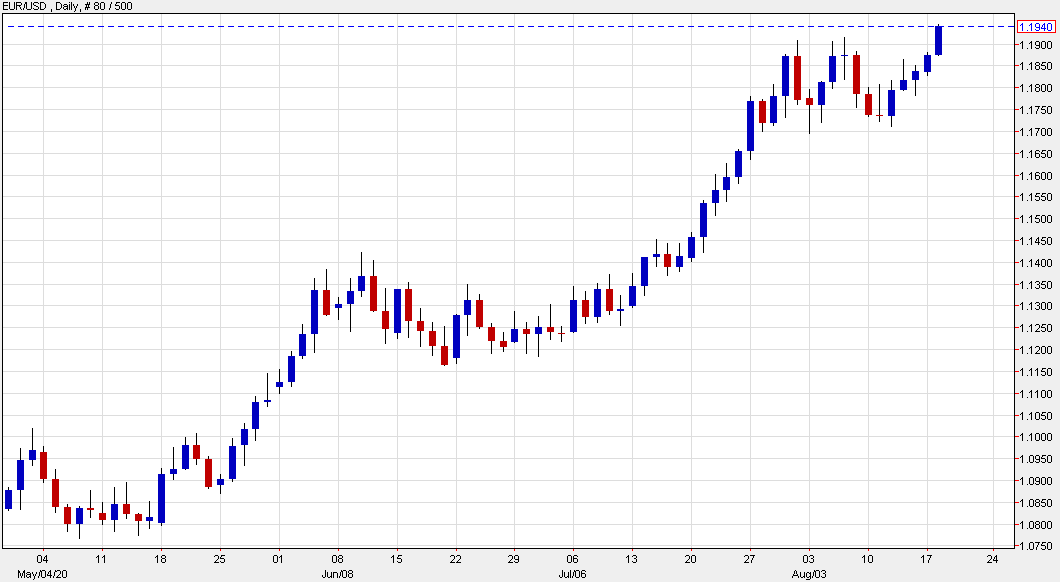

EUR/USD still faces a big level at 1.20 but it certainly looks like it can run. The major risk I continue to see is that equity markets begin to kick-and-scream about the lack of stimulus.

Capitalization of the North American stock market as a percentage of GDP.

China and Russia are using less and less dollars.

European stocks are ‘cheap’.

China repeats that it firmly opposes US’ suppression of Huawei

Comments by the Chinese foreign ministry

This comes after the US moved to cut off Huawei’s supply chain via fresh sanctions that will restrict any foreign semiconductor company from selling chips – developed or produced using US software/technology – to the Chinese company.

The remarks from China today are rather reserved – no specific mention of retaliation but there is anxiety surrounding the situation – but fitting with the tone that both sides are still largely holding off from escalating tensions too much for the time being.

Nikkei 225 closes lower by 0.20% at 23,051.08

A mixed and slow session for Asian equities for the most part

Asian equities are a bit more mixed in trading today, with Japanese exporter stocks also not really finding much comfort in a stronger yen. The Hang Seng is down 0.1% but the Shanghai Composite is up by 0.1% going into the closing stages.

The push higher in the Nasdaq and the S&P 500 is failing to really brighten the mood as we look to get things going in European morning trade.

US futures are near unchanged levels on the day so that isn’t really providing much clues.

In the currencies space though, the dollar is still a notable laggard – alongside the kiwi – as we see EUR/USD near 1.1900 and USD/JPY tracking near session lows of 105.60.

A rather empty calendar day beckons in Europe

Nothing major on the agenda in the session ahead

The dollar is slightly weaker across the board to start the day, carrying over from trading yesterday as the market keeps calmer tones for the most part. USD/JPY is breaking under 106.00 once again while EUR/USD is flirting with the 1.1900 handle.

Gold is also starting to creep higher and looking towards $2,000 while equities are keeping firmer for the most part with the Nasdaq closing at a record level with the S&P 500 closing just shy of its own all-time high. The latter is still a key spot to watch:

Looking ahead, there isn’t any notable releases today in European trading.

The only event to take note of is a speech by ECB vice president Luis de Guindos at 0800 GMT. That will cover “Economic consequences of the crisis and recovery measures in Spain and the Eurozone”. As such, he may touch a bit on the economy and policy.

I wish you all the best of days to come and good luck with your trading! Stay safe out there.