Archives of “August 2020” month

rssIt’s fine..

North Korea’s Kim Jong Un presided over a politburo meeting (in other words he is not dead)

Rumours of Kim’s death have been (you know the rest) greatly exaggerated

Yonhap report the leader presided over a politburo meeting to discuss antivirus, typhoon preparation

Yonhap is South Korean media, their report does not cite any source. … here we go, citing NK state media KCNA

“I am not dead, take notes!”

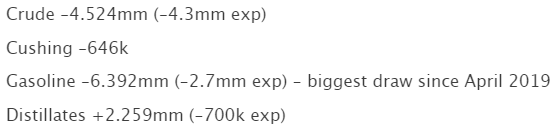

Private oil data shows draw in headline in crude oil inventory

Inventory data from the private survey is out now, official data follows Wed. morning (US time)

Earlier post with expectations is here :

S&P and NASDAQ closed at record highs once again

S&P index and NASDAQ go out near highs as well

The S&P and NASDAQ index are closing at record highs once again. The broader indexes also traded to new all time high prices today. The Dow industrial average close lower her by Apple and Boeing.

The final numbers are showing:

- S&P index rose 12.37 points or 0.36% to 3443.65. That was just off the all-time high price of 3444.21

- Nasdaq index closed up 86.755 points or 0.76% at 11466.47. It’s new all time high price reached 11468.25

- Dow industrial average fell -60.02 points or -0.21%to 28248.44. It’s high reached 28400.74 .

Salesforce after the close is reporting better-than-expected earnings on the top and bottom line. EPS came in at $1.44 vs. $0.66 estimates. Revenues come in at $5.15 billion vs. an estimate for $4.9 billion. There shares are up over 7% in after-hours trading.

Salesforce was 1 of the 3 stocks added to the Dow industrial average (along with Honeywell and Amgen). The 3 stocks replace Exxon Mobil (down -3.38%), Pfizer (-1.11%) and Raytheon (-1.5%).

Intuit it is also posting better-than-expected earnings on the top and bottom lines. There shares are up 4.52% in after-hours trading.

Thought For A Day

US trade representative Navarro: Phase I trade deal alive and well

White House trade representative Peter Navarro speaking

The White House and trade representative Peter Navarro is speaking saying:

- Phase I trade deal with China is “alive and well”

- China buying commodities as it said it would.

Overnight it was reported that US trade representative light highs are Robert Lighthizer and China’s Liu He had a telephone conference. The comment was “Both sides see progress”this despite China buying less than half of what it promised to buy from the US in January as a result of the pandemic. There are reports that China has booked ships to import US will next month. However those arrangements are not guaranteed.

One has to think that the Trump administration would prefer to keep the realities of the phase 1 trade deal more positive ahead of the election. After all, with all the tariffs enacted (that is a tax to consumers) admitting failure would not be good for the general public to know.

Gold stays below the 50% midpoint today. Sellers remain more in control

Down -0.45% on the day.

The price of gold has moved lower in trading today. It currently trades at $1920.30, $-8.45 or -0.45%. The low today has reached $1914.31. The highs extended to $1937.56.

Technically, yesterday the price moved up to test its 100 hour moving average (blue line in the hourly chart above). Sellers came in near the level and push the price back to the downside.

In trading day the corrective high off of the Asian low stalled ahead of its 50% midpoint of the range for August. That level comes in at $1939.41. The high price today reached $1937.56. The falling 100 hour moving average is currently right near that 50% retracement level at $1939.32. Needless to say stay below the 50% retracement and the 100 hour moving average keeps the sellers more in control.

On the downside the next target comes against day lower trend line connecting recent lows from August 17 and August 21. That trend line comes in around the $1903 level. A move below would open the door for a retest of the August 12 low at $1863.15.

Sellers remain more in control in the precious metal. It would take a move back above the $1939 level to tilt the bias back higher.

European shares give up gains and close near session lows

UK FTSE 100 leads the move to the downside

The major European indices give up gains of over 1% and are ending the day around or below unchanged (and at session lows). The UK FTSE is the biggest decliner. The GBP is also the strongest currency on the day.

The provisional closes are showing:

- German DAX, +0.1%. The traders highs +1.2%

- France’s CAC, +0.1%. It traded as high as 1.3%

- UK’s FTSE 100, -1.1%. It traded as high as 1.13%

- Spain’s Ibex, fell -0.03%. It traded as high as 1.49%

- Italy’s FTSE MIB fell -0.3%.. It traded as high as 1.26%

As London traders head for the exit, the GBP remains the strongest of the major currencies. The JPY remains the weakest. The USD has stayed mostly lower on the day but has traded up and down in choppy trading.