AUD/JPY is the best trade this month

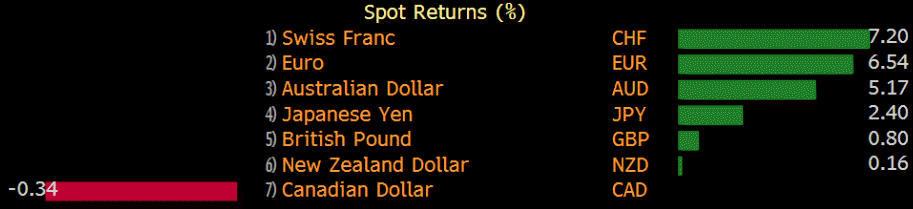

“The yen still can’t fall far and is doing its job: ready to rally if global equities correct, doing little while they go up…A sterling short squeeze has dragged EUR/GBP below 0.90 but we doubt it can hold here for long, even if the outlook is still for the real trade-weighted index to bump along the bottom,” SocGen adds.

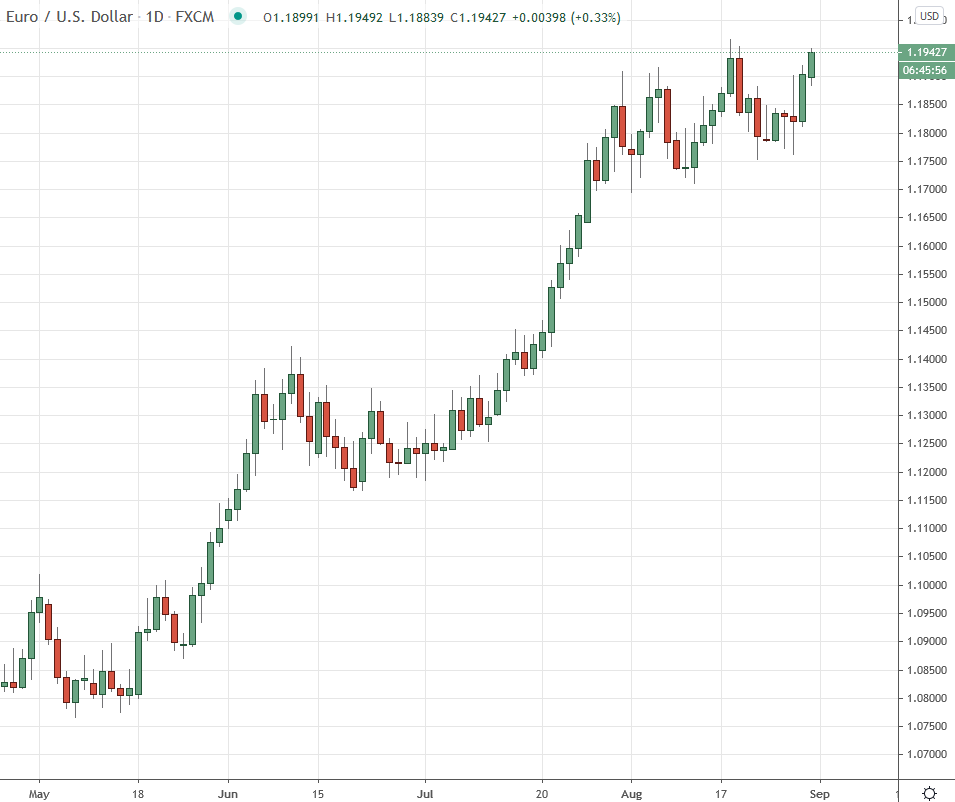

With much of Europe and the United States reeling from Covid-19, one beneficiary has been the euro, having risen to yearly highs vs the dollar this month.

After bottoming out in mid-March, the currency pair has seen its fortunes reverse, striking fresh yearly highs as investors flock behind the euro.

There are a few different factors in play however, all resulting in a net positive for the EUR/USD looking ahead.

Key points to watch

The recent gridlock in the United States’ Congress has eroded confidence in the US dollar. This has led to an all-out siege against the greenback, with the euro and gold scoring advances.

Partisan bickering between Republicans and Democrats shows no sign of abating anytime soon, with a fresh stimulus bill as elusive as ever. With key economic safety nets in danger of lapsing, the US economy is appearing more fragile than ever, which bodes poorly for the US dollar in H2 2020.

Conversely, Europe’s recent stimulus package has proved to be a dose of stability investors were looking for. Consequently, the EUR/USD has touched fresh highs and remains bullish.

Covid-19 continues to play a role in both Europe and the US, though the scale of the pandemic could not be more different between the two continents. Whereas the US has seen the death toll soar past 160k with upwards of 60k new cases per day, Europe has seen witnessed a fraction of this.

Internal strife and doubts over Donald Trump’s handling of the pandemic will continue to hamper any US dollar rally in the near-term. With an election scheduled in under 3 months, there is the potential for a wide range of factors, so this is one area to watch.

Finally, any dollar bulls will need to dial back expectations in H2 2020 after a recent tranche of economic data. The latest US unemployment data is further casting doubt on a V-shaped recovery, once touted by White House administration officials.

Few, if any experts now full expect a quick rebound in the US economy as Covid-19 continues to linger. A looming battle this fall surrounding school openings could also serve as an additional harbinger, with shuttered institutions doing little to promote economic growth. (more…)

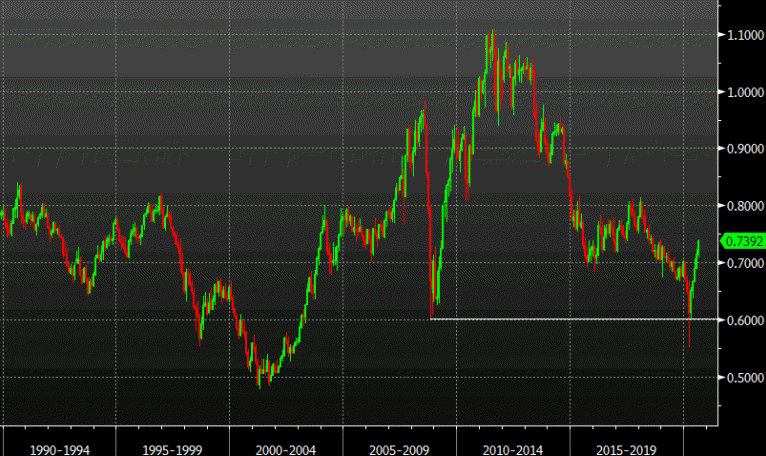

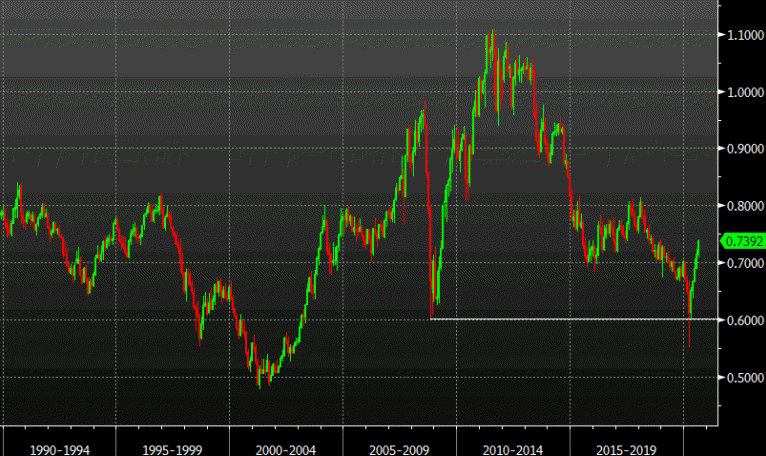

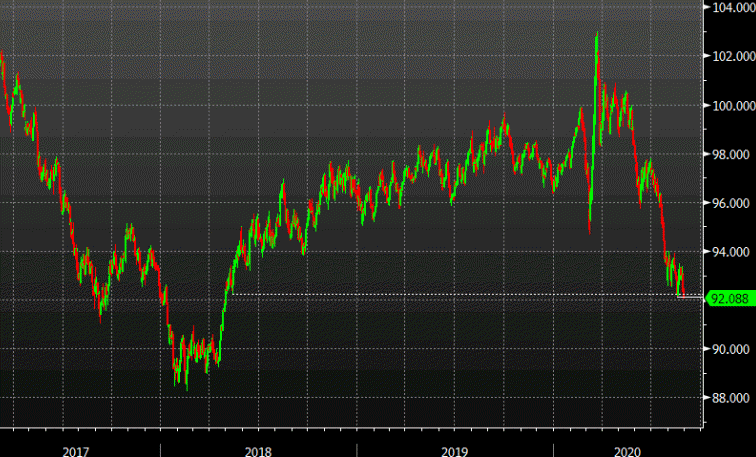

If one could describe the Dollar’s performance over the past few months in one word, the best fit would be vulnerable.

The once king of the FX space has weakened considerably in Q3, depreciating against every single G10, most Asian and emerging market currencies. This is despite its safe-haven status and the global reserve currency title. For those who are wondering why the Greenback remains depressed and unable to shake away the blues despite the general uncertainty, the first clues can be found in the US economy. (more…)

The investment firm says that the dollar is facing an “uphill battle” to find support as the Fed’s accommodative monetary policy depresses yields:

“We believe an unprecedented degree of fiscal support, the Fed’s expected commitment to make up for past inflation target overshoots, and the US’ uneven recovery are likely to impart a depreciation bias to the dollar in all but the most extreme cyclical scenarios.”