Archives of “August 27, 2020” day

rssEuropean shares end the day lower.

Erase gains from yesterday’s trading

Yesterday, European shares moved to the upside with gains between 0.1% (UK FTSE 100) and 1% (German DAX).

Today the major indices are ending the day lower across the board. The provisional closes are showing:

- German DAX, -0.7%

- France’s CAC, -0.7%

- UK’s FTSE 100, -0.6%

- Spain’s Ibex, -0.6%

- Italy’s FTSE MIB, -1.0%

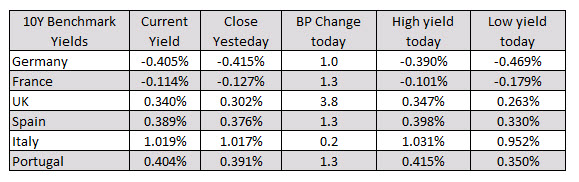

In the European debt market, the benchmark 10 year yields reversed earlier declines and are currently trading up 0.2 basis points to up 3.8 basis points:

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).Market depth of the future of the S&P 500 since 2009.

Annualized intraday performance of the VIX future since 2014.

10% of North Americans own 87% of the shares.

US dollar sinks as Powell introduces average inflation targeting

Dollar sinks, gold jumps

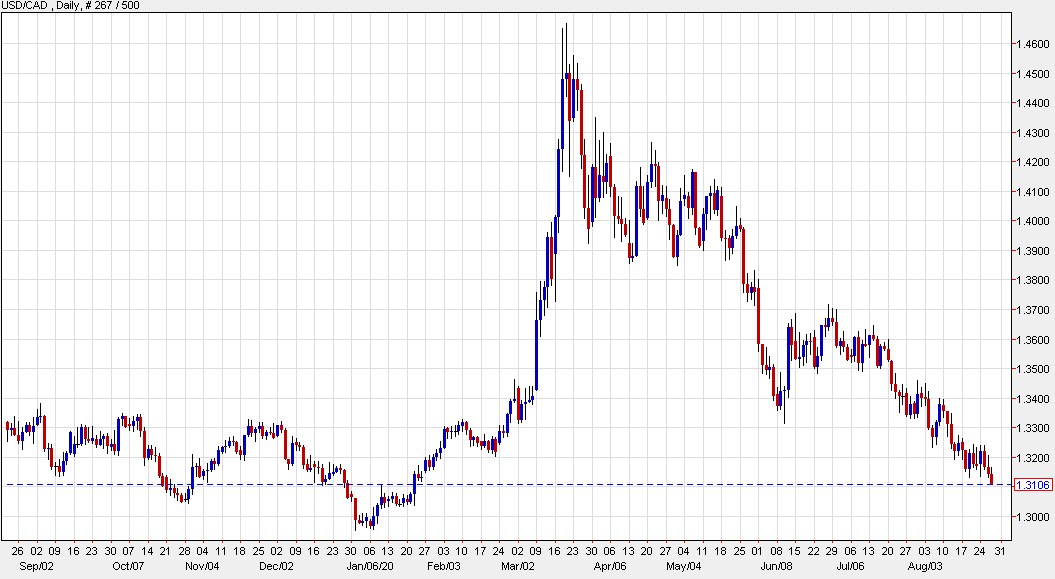

The US dollar came into this week sitting just above post-pandemic support. The shift to a more-dovish regime of average inflation targeting is causing the dollar to break down on a number of fronts.

One is USD/CAD, which has broken through a triple bottom.

The Australian dollar is another currency that’s breaking out.

Watch live: Powell speaks at Jackson Hole

The headlines will cross before the speech

Find out what Powell has to say live here:

US initial jobless claims 1006K vs 1000K estimate

US initial jobless claims and continuing claims

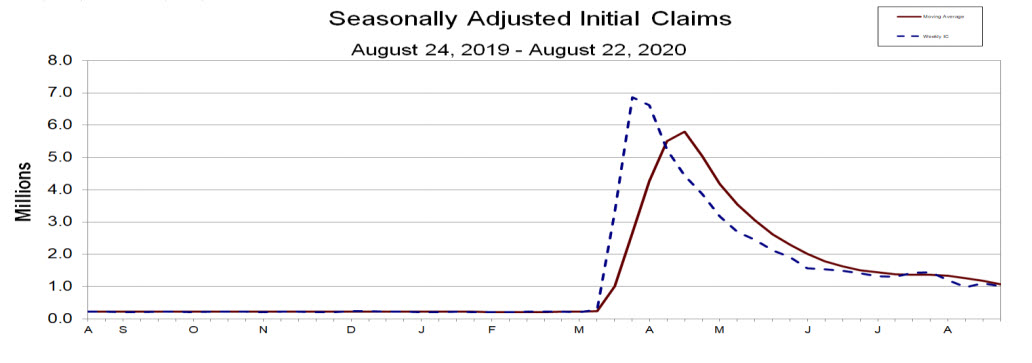

- initial jobless claims 1006K vs 1000K estimate

- jobless claims four-week average 1068K vs 1175.25K last week

- continuing jobless claims 14535K vs 14400K estimate

- continuing claims four-week average 15215K vs 15819.75 last week

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).Continuing claims also was slightly higher than expectations. Nevertheless it was still lower vs. the last week’s revised 14758K number.

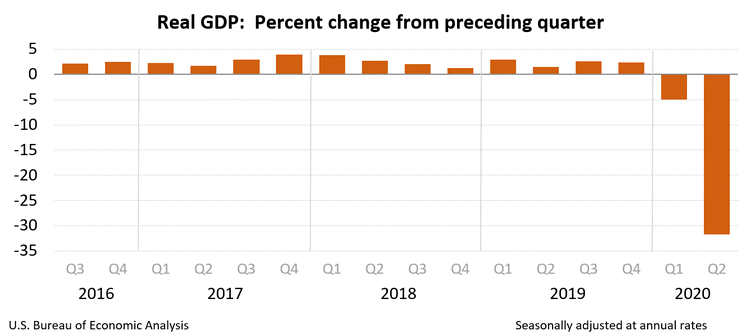

US Q2 GDP second reading -31.7% vs -32.5% expected

The second reading on Q2 gross domestic product

- The first estimate was -32.9%

- Q1 was -2.5%

- Final sales -28.5% vs -29.3% prelim

- Business investment -26.0% vs -27.0% prelim

- Consumer spending -34.1% vs -34.6% prelim

- Exports -63.2% vs -64.1% prelim

- Imports -54.0% vs -53.4% prelim

- Inventory change -$286.4B vs -$315.5B prelim

- GDP deflator -2.3% vs -2.0% expected

- Full release

Despite the headline, there’s more good news here than bad. The revision higher in inventories means that inventory rebuilding will be less of a tailwind in Q3 and Q4 than anticipated. The drop in inflation also added to real GDP.

“In the second estimate, real GDP decreased 31.7 percent in the second quarter, an upward revision of 1.2 percentage points from the previous estimate issued last month. The revision primarily reflected upward revisions to private inventory investment and PCE,” the BEA said in the release.

China says that US sanctions are a gross interference of its internal affairs

Comments by the Chinese foreign ministry

- US sanctions are unjustified

- Says US defense secretary, Mark Esper, is talking nonsense

- Affirms that China abides by international laws, UN conventions

This relates to the latest escalation between the two countries involving the South China Sea as seen yesterday here. But as long as tensions continue to just play out slowly and not lead to a breakdown in the Phase One trade deal, this is petty stuff for markets.