Archives of “August 20, 2020” day

rssWhat could possibly go wrong?

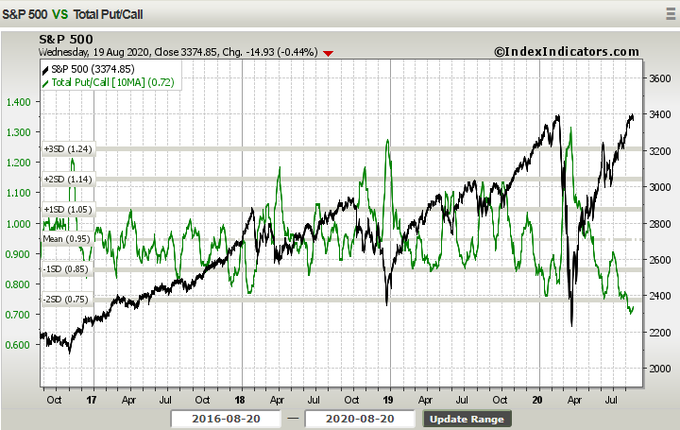

Don’t fight the Fed

European shares end the session sharply lower

German DAX -1.1%. UK’s FTSE down -1.6%

The major European indices are ending the session with declines as high as -1.6%. The provisional closes are showing:

- German DAX, -1.1%

- France’s CAC, -1.3%

- UK’s FTSE 100, -1.6%

- Spain’s Ibex, -1.35%

- Italy’s FTSE MIB, -1.5%

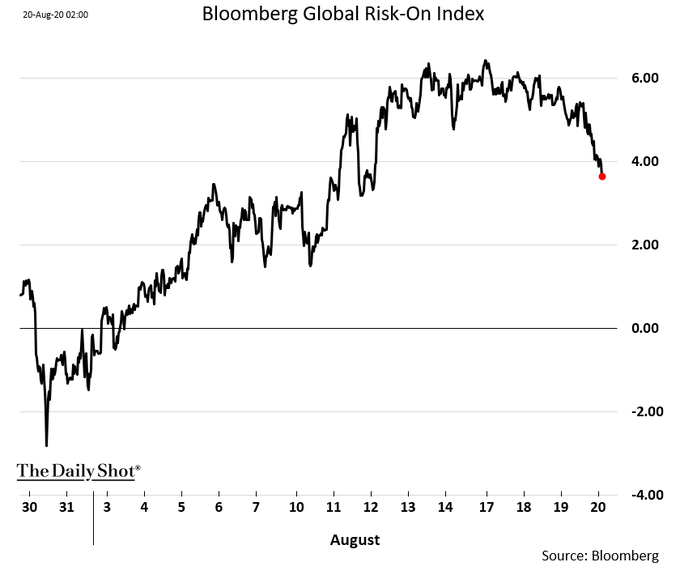

Chart: Bloomberg’s global risk-on index –

ECB, BOE, BOJ, SNB announce further change to Fed swap lines

The major central banks, in consultation with the Fed, jointly decide to reduce further the frequency of 7-day operations

The frequency of 7-day dollar operations will be reduced from three times per week to once per week, while the 84-day operations will still continue to be offered weekly. The changes will kick into effect from 1 September. This follows the change from June here.

The major central banks do reaffirm though that they stand ready to re-adjust the provision of dollar liquidity as they see fit based on market conditions.

Just be reminded that these swap lines have largely helped with calming the market down and alleviating funding stress and a liquidity crunch back in late March and early April.

But with market conditions a lot calmer at the moment, they are slowly being weaned off so just be mindful that the “insurance” in the market is slowly taken out.

That said, you can be rest assured that they will be quickly reinstated should we see a repeat of the March meltdown across multiple asset classes in the market.

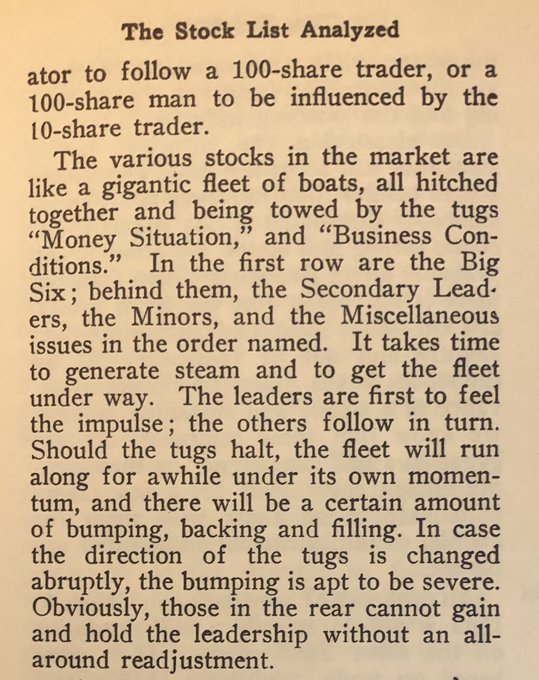

1910 Studies In Tape Reading – Wyckoff

The yuan has overtaken the yen as the third most used currency in trade finance.

Nikkei 225 closes lower by 1.00% at 22,880.62

Asian equities slip after the retreat from Wall Street

The more downbeat FOMC meeting minutes also adds to further reasons for the decline, with the Hang Seng down by 2.0% and the Shanghai Composite down by 1.0%.

Elsewhere, US futures are down by ~0.6% and that is keeping the risk mood more on the defensive ahead of European morning trade. Treasury yields are a little lower on the day, with 10-year yields down by 2.4 bps to 0.655%.

Meanwhile, major currencies are trading little changed for the most part as tighter ranges continue to play out after the dollar reversal in trading yesterday.

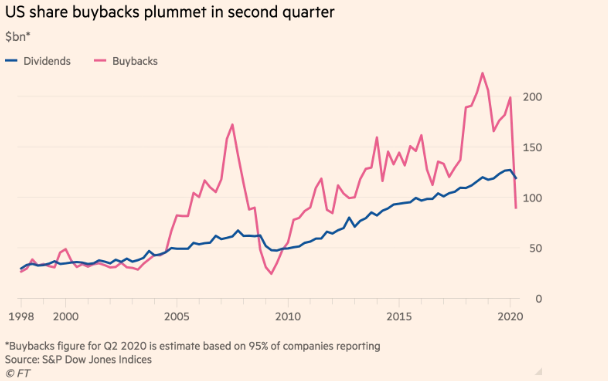

The virus crisis cut US share buybacks by almost half in Q2

But that hasn’t stopped the market from rallying

S&P Dow Jones Indices are showing that provisional figures on total spent on buybacks by companies in the S&P 500 was about $89.7 billion in Q2 2020 – down 46% from the same period last year.

The estimate marks the lowest quarterly total for buybacks by companies in the index since 2012 and the drop would have been much steeper without the aid of tech firms.

Unsurprisingly, the big banks were the notable ones absent from the list with Goldman Sachs, JP Morgan, Morgan Stanley and BofA all having said that they would stop buybacks in March as they contemplate larger provisions.

Meanwhile, the likes of Apple, T-Mobile, Alphabet and Microsoft contributed strongly to buybacks seen in the past quarter.

More on this from the FT here (may be gated).

An interesting point in all of this is what it tells us about the market rally over the past few months. This market has been resilient despite the lack of share buybacks for the most part. Q3 is also likely to be a muted period in terms of buyback activity.

Is the market really seeing light at the end of the tunnel amid the whole virus crisis? Or is cheap money really that powerful? What happens when buybacks start to come back into the picture and inflate valuations once again? Just some things to consider.