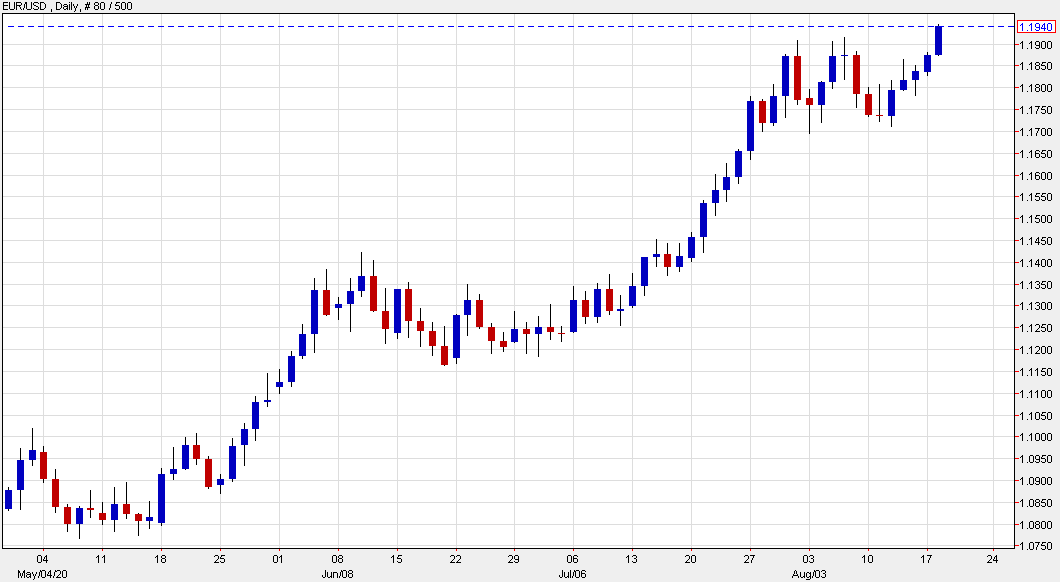

Major indices down across the board

The European shares are closing lower on the day after trading higher earlier. The provisional closes are showing:

- German DAX, -0.5%. The high reached +1.0%

- France’s CAC, -0.8%. The high reached 0.59%

- UK’s FTSE 100, -1.0%. The high reached 0.57%

- Spain’s Ibex, -0.8%. The high reached 1.06%

- Italy’s FTSE MIB, -0.6%. The high reached 1.05%