Archives of “August 15, 2020” day

rssWarren Buffett makes a big bet on gold

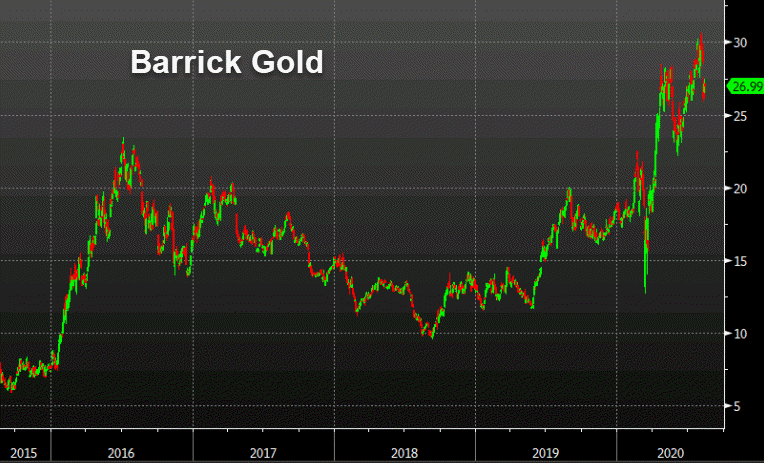

Buffett bought a stake in miner Barrick Gold

Warren Buffett has famously disparaged gold but evidently he’s had a change of heart.

According to a Q2 13F filed today, The Oracle of Omaha added 20.9 million shares of Barrick Gold, which is the world’s second largest gold miner. He paid $563.5 million for the stake, which equates to $26.95 per share and his Berkshire Hathaway owns 1.2% of the company. It was the only new company he bought in the second quarter.

The shares closed at $26.99 on Friday but jumped about $1.00 in after hours trading.

This could indicate a massive change of heart from the world’s most famous investor, or one of his deputies.

His most-famous musing on gold was from back in 1998:

“(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

As recently as 2018 he repeated his misgivings about gold.

“The magical metal was no match for the American mettle,” he wrote in his annual letter while comparing the returns of both since he first invested in stocks in 1944.

Now this doesn’t necessarily mean he has a new view on gold. Barrick’s cash flows with gold steady at these levels are compelling (and other miners are even more compelling). Still, expect much more interest in the space now that Warren Buffett has given it his blessing.

Other highlights from his Q2 13F:

- Exited Occidental Petroleum, but added to Suncor Energy

- Cut JPMorgan stake by 62%

- Cut Mastercard stake by 7%

- Aside from SU, only added to STOR and KR

- Reduced WFC, SIRI, PNC, MTB, BK

- Exited DAL, LUV, UAL, AAL, QSR, GS, OXY

In terms of the ones he reduced. In general Buffett doesn’t sell shares unless he plans to sell out. However at times he has to sell to stay below ownership limits.

Overall, his investment mix doesn’t exactly show confidence in the economic or stock market recovery.

Berkshire Hathaway reduced J.P. Morgan stake in 2nd quarter

13F filings from Berkshire Hathaway

The latest 2nd quarter 13F filings from Berkshire Hathaway show:

- reduced J.P. Morgan stake by 62%.

- Exited Goldman Sachs position

- Southwest air

- United Airlines

- Delta Air Lines

- American Airlines

- Restaurant Brands International

- Occidental Petroleum

Other swings in positions show increased stakes in:

- Store Capital Corp.

- Kroger

- Suncor energy

Reduces positions in:

- Wells Fargo

- J.P. Morgan

- SiriusXM

- PNC Bank

- M&T Bank

- Bank of New York Mellon

- MasterCard

they added new positions in:

- Gold

- Barrick Gold

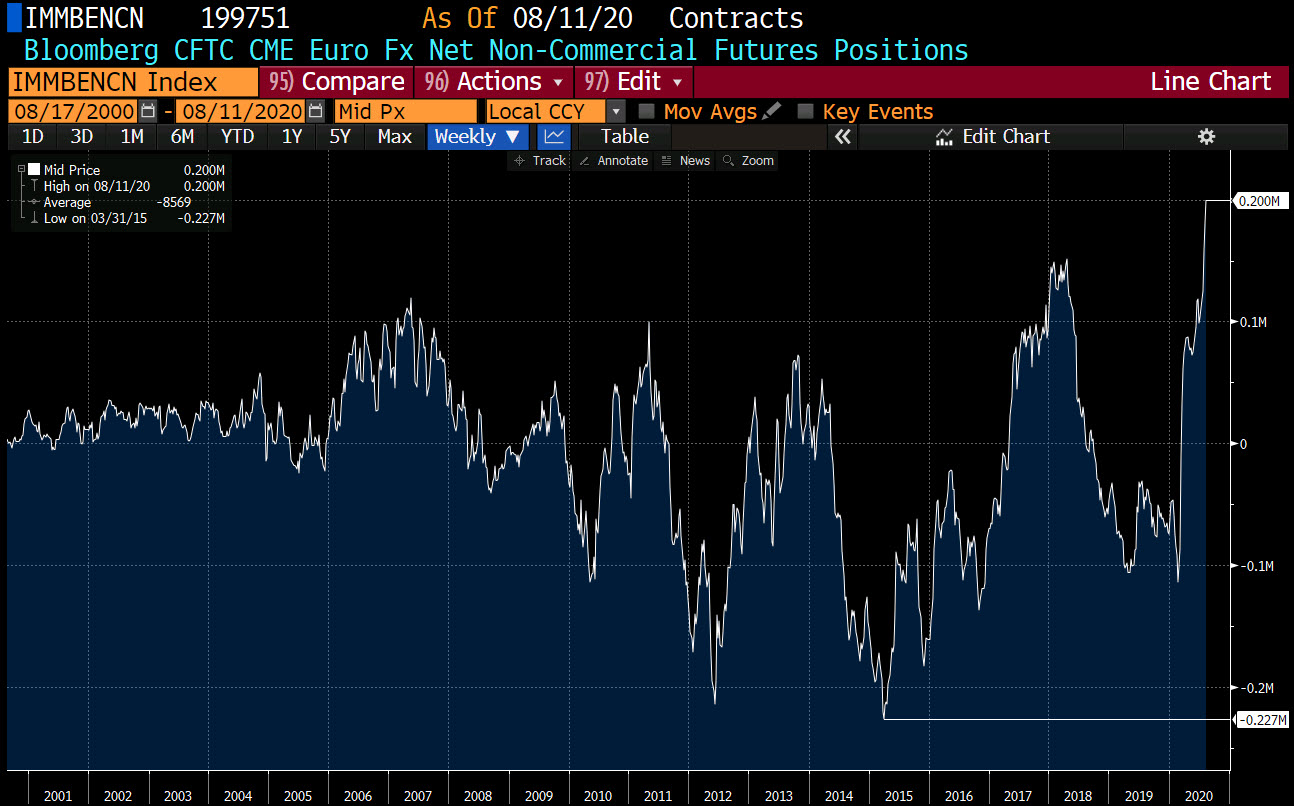

CFTC commitment of traders: EUR longs increase to 200K (all time largest long position).

Weekly FX speculative positioning data from the CFTC

- EUR long 200K vs 180K long last week. Longs increased by 20K

- GBP short 3K vs 15K short last week. Shorts trimmed by 12K

- JPY long 27K vs 31K long last week. Longs trimmed by 4K

- CHF long 17K vs 12K long last week. Longs increase by 5K

- AUD short 1K vs 1K short last week. Shorts trimmed by 4K

- NZD 0K vs 1K short last week. Shorts trimmed by 1K

- CAD short 30k vs 23K short last week. Shorts increased by 6K

Highlights:

- EUR longs continue to rise and are at new record long position at 200K. The largest short position all time is at -227K

- GBP position has been whittled down to near unchanged after being short by 36K at the beginning of June 2020

- AUD and NZD speculative positions are near unchanged

- CAD shorts are the more or less, the only short currency position (long USD position).

Saudi public investment fund exits stakes in major companies

Dissolve stakes in Boeing, Facebook and others

The Saudi public investment fund has exited positions in a slew of major companies stocks including:

- Starbucks

- Citigroup

- Bank of America

- Pfizer

- Boeing

- Disney and

- BP

Thought For A Day