Archives of “August 10, 2020” day

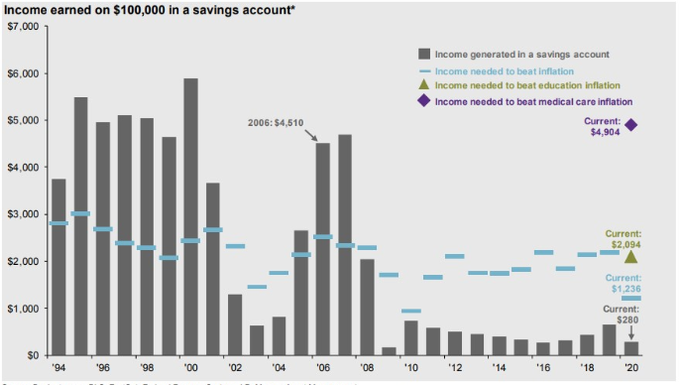

rssInterest earned on US savings accounts.

European shares end the session higher

German DAX near unchanged in up and down session

The major European stock indices are ending the session flat or higher. The German DAX was the weakest as it closes near flat for the day. Spain’s Ibex is the strongest with a gain of near 1.4%.

The provisional closes are showing:

- German DAX, unchanged

- France’s CAC, +0.3%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, +1.4%

- Italy’s FTSE MIB, +0.5%

In the European debt market, the benchmark 10 year yields are ending the session lower.

This is what gold fever looks like

Hungry for gold news?

Last week I made one comment that submitted to one media outlet on gold prices. The take up was telling.

The below was the amount of publications it occurred in and the approximate circulation.

Remember the below came from just one comment.

This is what a mania market looks like.

Gold is buy on the dips and buy on the breakouts. If you could only trade one market this year – this would be it.

- Yahoo News –Gold just hit $2,000 an ounce – but that could be a scary sign for the economy(246,000,000 monthly unique views)

- NBC News –Gold just hit $2,000 an ounce – but that’s not necessarily a good sign (105,000,000 monthly unique views)

- The Guardian –After Covid-19, just how high will prices go in the 2020 gold rush? (313,000,000 monthly unique views)

- MSN News –Gold just hit $2,000 an ounce – but that could be a scary sign for the economy(776,000,000 monthly unique views)

- Professional Paraplanner-Gold hits £2k but is it time to buy?(6230 monthly unique views)

- GoldStocks.com –How Much Higher Are Gold Prices Going?(5620 monthly unique views)

- The Guardian –UK and US services firms cut jobs; gold at record high – as it happened (313,000,000 monthly unique views)

- Evening Standard-Market report: Gold glitters above $2000, FTSE recovers(22,600,000 monthly unique views)

- Evening Standard (print)-Gold rush hits new high as price tops $2000 an ounce (Circulation: 700,191)

- City AM-Gold surges to new record on pandemic fears but ‘can go higher’(1,200,000 monthly unique views)

- Your Money-Gold rises above $2,000 an ounce for the first time(2,060,000 monthly unique views)

- MSN-Market report: Gold glitters above $2000, FTSE recovers(776,000,000 monthly unique views)

- ETF Express-Gold shatters USD2,000 record price(3900 monthly unique views)

- Finance Monthly-Gold Reaches $2,000 Per Ounce For The First Time(54,000 monthly unique views)

- UK Investor Magazine-Gold price hits $2,000 but might still be worth investing in (26,000 monthly unique views)

- Mirror (print)- article scan here (Circulation: 442,000)

- Daily Record (print)- article scan here (Circulation: 102,000)

- Guardian (print)- article scan here (Circulation: 129,000)

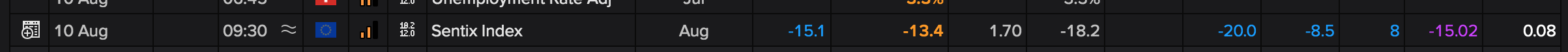

Eurozone August Sentix investor confidence -13.4 vs -15.1 expected

Sentix 10 August 2020

- prior 18.2

Slightly better than expected, but a minor data point. Still growing confidence (or at least not as bad as expected) is better than the alternative. EURUSD unfazed and flat.

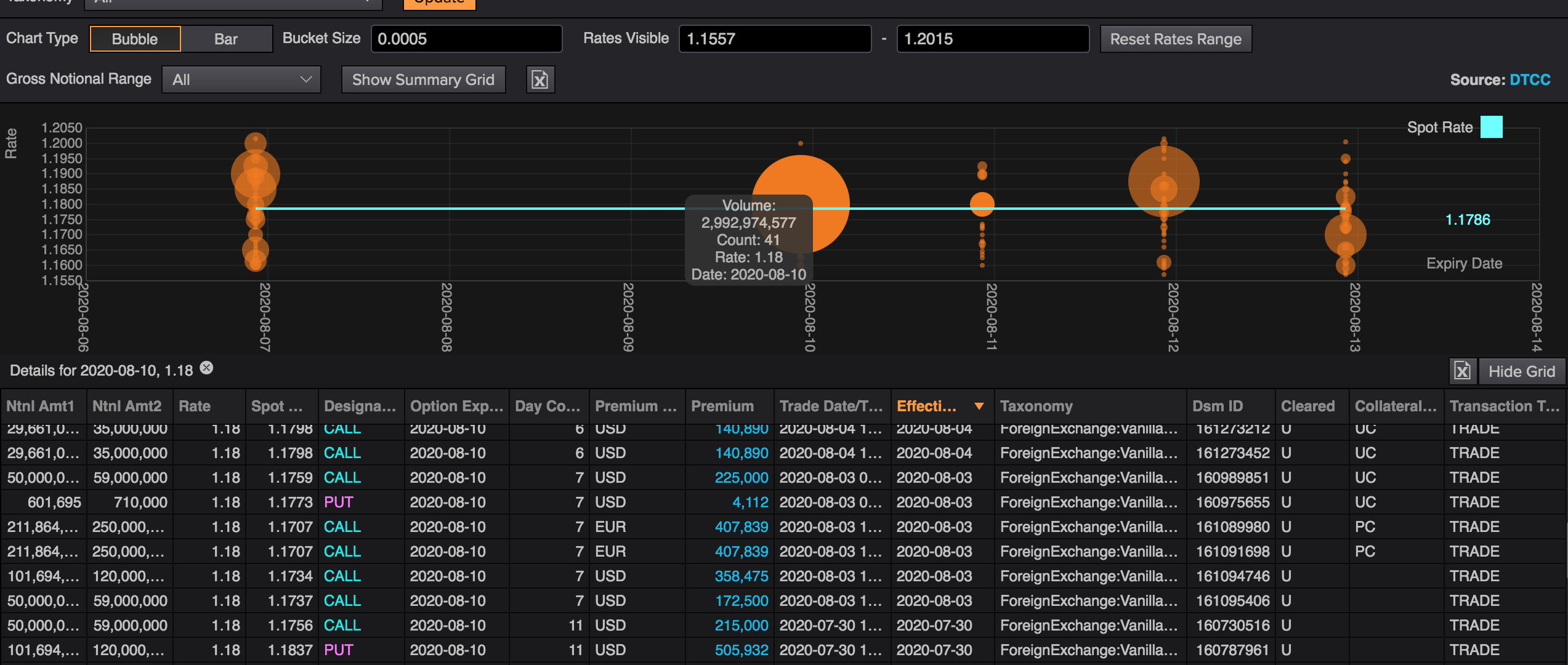

It’s a yawn kind of day with the only bit of action the EURUSD pulling away from 1.18000.

Large options at 1.1800 on the EURUSD (call option bias)

Call option tilt

The nearly 3 billion worth of options at the 1.1800 has a call option bias, so watch the level carefully as bulls may try and push away from that level today. Snapshot of the option offering below – there are more on the table but the skew is about 85% call to 15% puts, so the screenshot captures a rough and ready visual representation of the split.

Price is currently just below the 1.1800 level, so watch the price action around here before the NY cut at 2pm GMT

Weekend news – US imposes sanctions on Hong Kong chief executive Carrie Lam

The sanctions have been placed by the US Treasury. On HK head Lam and 10 other top officials in Hong Kong and mainland China.

- Sanction target those undermining Hong Kong’s autonomy, said Treasury Secretary Mnuchin

- Treasury accused Lam of “implementing Beijing’s policies of suppression of freedom and democratic processes”

On Friday Trump took action against TikTok and WeChat, US treasury adding to the actions on China over the weekend.

Thought For A Day