Archives of “August 8, 2020” day

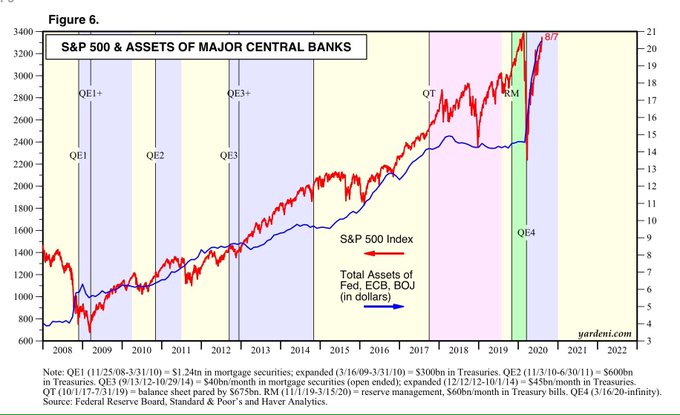

rssThere is nothing more certain than the benefits of the S&P 500.

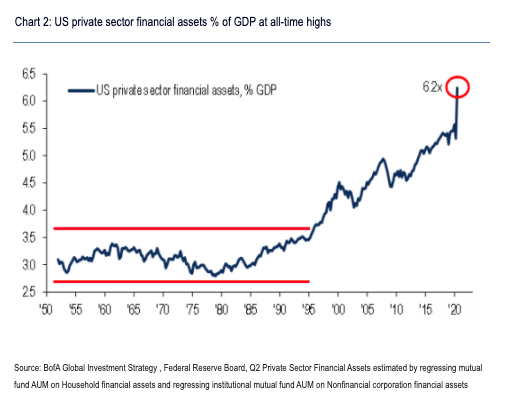

US financial assets equal 6.2 times GDP.

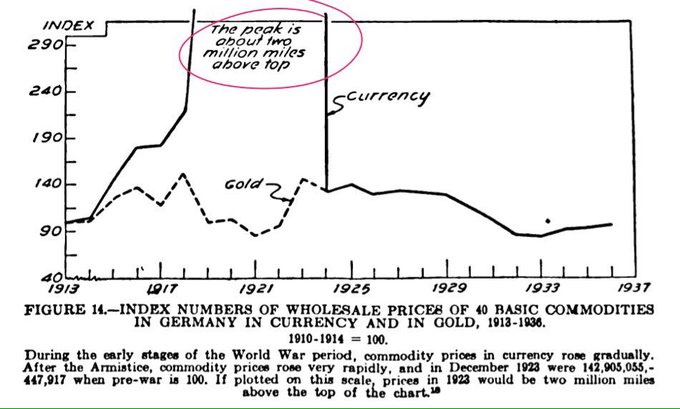

Reminds me of this chart plotting Weimar hyperinflation where the analyst calculates wholesale prices would run 2 million miles above top.

literally off the chart..

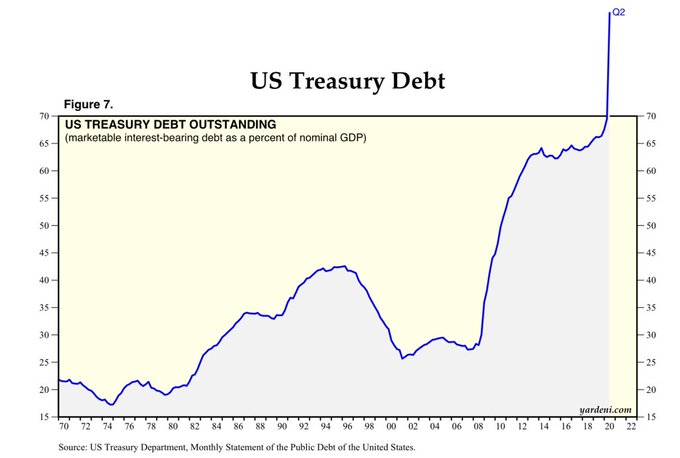

A little manufactured valuation

US 10-year bond yield minus trimmed mean PCE

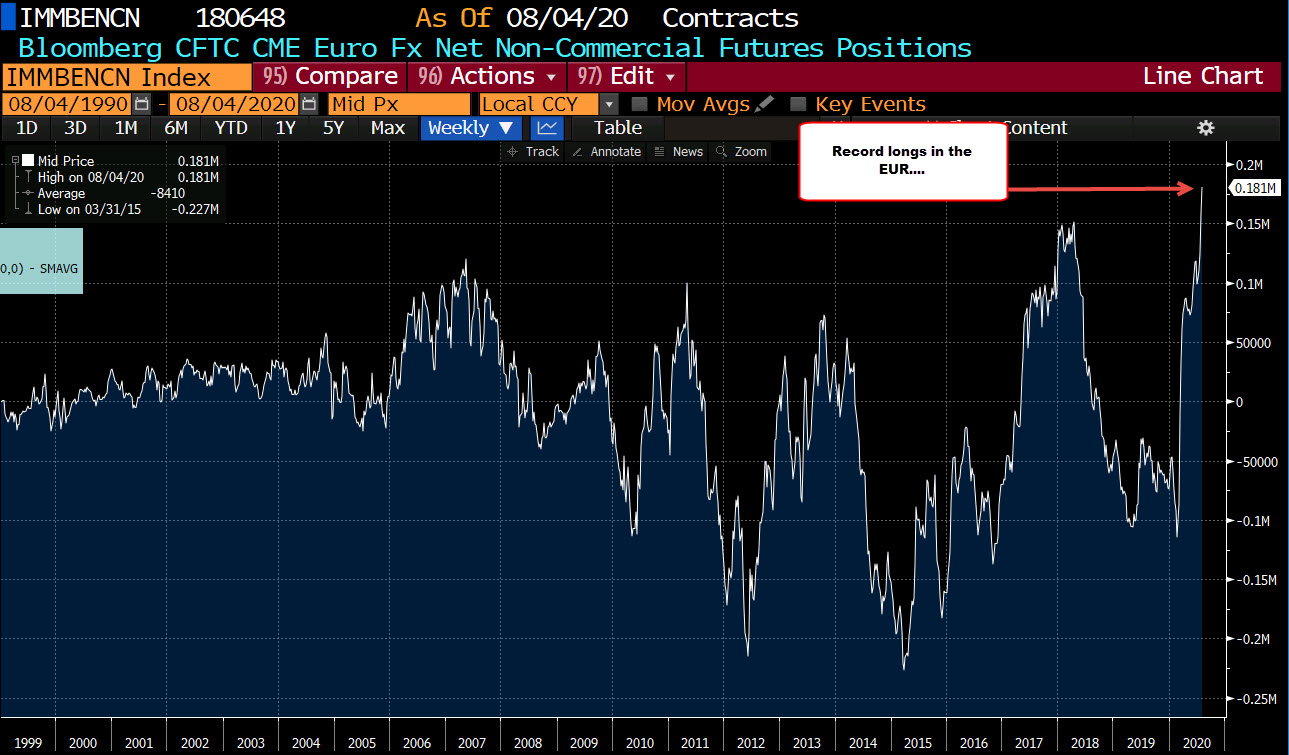

CFTC commitments of traders: EUR longs climb to a new record

Weekly FX speculative positioning data from the CFTC.

- EUR long 180K vs 157K long last week. Longs increased by 23K

- GBP short 15K vs 25K short last week. Shorts trimmed by 10K

- JPY long 31K vs 29K long last week. Longs increased by 2K

- CHF long 12K vs 8K long last week. Longs increase by 4K

- AUD short 1K vs 5K short last week. Shorts trimmed by 4K

- NZD short 1K vs 1K short last week. No big change

- CAD short 23k vs 13K short last week. Shorts increased by 10K

Highlights

- EUR longs increase by another 23K after surging by 32K last week. New record longs for the EUR. The EURUSD traded to the highest level since May 2018 on Wednesday but has backed off over the last 2 days

- Either shorts were trimmed or longs increased in 6 of the 7 currencies (dollar selling). The only currency where shorts were increase was the Canadian dollar. Shorts increased by 10K in the loonie

- The total net short position (long USD) was 36K. The total net long position (short USD) was 223K long. Last week the net short positions totaled 44k. The total net long position was 194K

S&P and Dow close higher for the 6th consecutive day

NASDAQ 7-day win streak broken today

The S&P squeaked out a higher close. The Dow industrial average also closed higher. The gains for the day extended the up streak to 6 consecutive days. The NASDAQ index streak of 7 consecutive higher closes was broken as it fell close to 1% on the day.

A look at the final numbers shows:

- S&P index rose 2.12 points or 0.06% to 3351.532

- NASDAQ index closed down 97.09 points or -0.87% to 11010.98

- Dow industrial average closed up 47.74 points or 0.17% to 27434.72

The Dow had his best week since June 5.. The S&P index at its best week since July 2.

For the week the major indices close higher with the Dow leading the way with a 3.81% increase.

The change for the 1st week of August is showing:

- S&P index, +2.45%

- NASDAQ index, +2.47%

- Dow industrial average +3.8%

Year-to-date, the Dow is within 3.87% of unchanged for the year.

- S&P index is up +3.73%

- NASDAQ index is up and oversized +22.72%

- Dow industrial average is down -3.87%

Winners today included:

- First Solar, +13.08%

- FedEx, +6.57%

- Marriott international, +3.77%

- Wells Fargo, +3.47%

- American Express, +3.46%

- Travelers, +3.17%

- Charles Schwab, +2.72%

- PNC financial, +2.58%

- General Dynamics, +2.57%

- Bank of America +2.47%

- Citigroup, +2.42%

- Raytheon technologies, +2.29%

- J.P. Morgan, +2.2%

- Berkshire Hathaway, +2.11%. Berkshire Hathaway will announce their earnings tomorrow

Big decliners today included:

- Tencent, -7.36%

- Lyft, -6.65%

- Uber, -5.21%

- AliBaba, -5.08%

- Slack, -3.76%

- Zoom, -3.55%

- Chewy, -3.23%

- Adobe, -3.19%

- Netflix, -2.77%

- PayPal, -2.63%

- Qualcomm, -2.53%

- Tesla, -2.44%

- Apple, -2.28%

European shares closed mixed led by the German DAX which rose by 0.66%. Spain’s Ibex fell by -0.11%.

Thought For A Day