Archives of “August 7, 2020” day

rssPelosi says offered to reduce aid package by $1 trillion and was rejected by White House

Pencil that in

That’s an important detail because it means that $2.4 trillion is now the upper limit of what’s possibly coming. Every dollar lower is negative for the economy and risk trades and a potential positive for the dollar.

Previously, the indications were that Pelosi was holding firm around $3.4 trillion.

The meeting that was going to be at the top of the hour has been pushed back to 1:30 pm ET.

Along the same lines, according to The Hill, Chuck Schumer said Mnuchin and Meadows balked at Democratic proposal to set relief package at $2 trillion.

“You should have seen the vehemence: No!”“You should have seen their faces: ‘Absolutely not!'”

Precious metals aren’t the only metals falling today

Copper spills lower

The reversals in gold and silver are getting all the attention today but have a look at the copper chart. The industrial metal is down 4.2% in its worst day since March 18.

The break on the chart is a significant one and there isn’t much in the way of support below.

Is this a signal about what’s to come elsewhere? The reality is that if you go looking for things to worry about, you will find them. Still, so many things have run a bit too far and Congress is deadlocked.

Labor Force Flows:

US poised to sanction Hong Kong leader Carrie Lam

Bloomberg report, citing three people familiar

The US is poised to hit Carrie Lam and her allies along with other Chinese officials in a round of personal sanctions, according to a report from Bloomberg.

In terms of market reaction, it’s an negative escalation in overall US-China relations but this action itself isn’t meaningful. The market doesn’t care about sanctions against individuals.

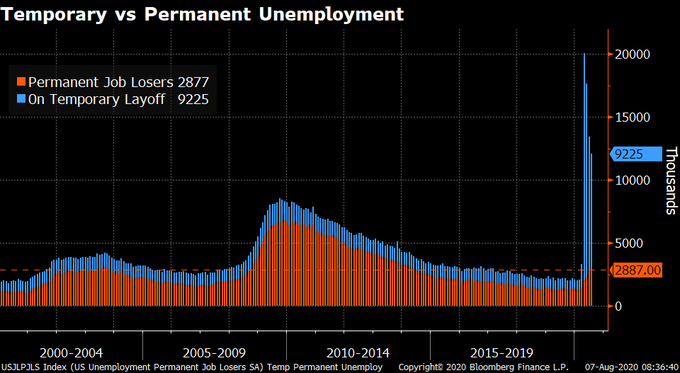

US July non-farm payrolls +1763K vs +1480K expected

US July 2020 non-farm payrolls data

- Prior was +4800K (revised to 4791K)

- Two month net revision +17K

- Change in private payrolls +1462K vs +1200K expected

- Change in manufacturing payrolls +26K vs +255K expected

- Unemployment rate 10.2% vs 10.6% expected

- Adjusted for misclassification 11.1%

- Prior unemployment rate 11.1%

- Participation rate 61.4% vs 61.8% expected

- Prior participation rate 61.5%

- Underemployment rate 16.5% vs 18.0% prior

- Average hourly earnings +0.2% m/m vs -0.5% expected

- Average hourly earnings +4.8%% y/y vs +4.2% expected

- Average weekly hours 34.5 vs 34.4 expected

- Employment in the household survey +1.4m

- Part time jobs +803K

- Full time jobs little changed

- Full report

I noted before the report that a seasonal adjustment quirk was likely to add nearly 1m jobs to payrolls. It only added 245K jobs. From the BLS:

Government employment rose by 301,000 in July but is 1.1 million below its February level. Typically, public-sector education employment declines in July (before seasonal adjustment). However, employment declines occurred earlier than usual this year due to the pandemic, resulting in unusually large July increases in local government education (+215,000) and state government education (+30,000) after seasonal adjustment.

However it was even stronger than that and the majority of it was in private payrolls. The unemployment rate was also better but you can discount most of that because of a dip in participation rather than the rise expected.

Looking at the US and Canadian jobs data together, one thing that caught my attention is the growing gap in labor force participation. The Canadian participation rate now 1.2 pp below Feb levels while US 1.9 pp lower. I would have expected it the other way around with more of Canada shut in July. That will be something to watch in the months ahead.

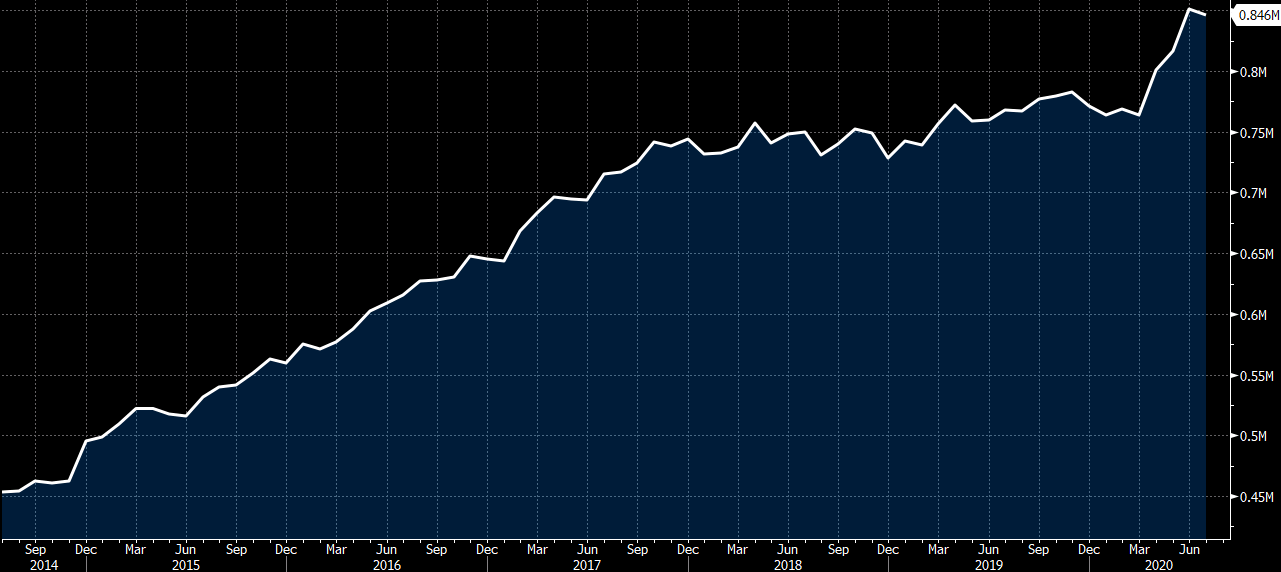

Switzerland July foreign currency reserves CHF 845.8 billion vs CHF 850.1 billion prior

Latest data released by the SNB – 7 August 2020

- Prior CHF 850.1 billion; revised to CHF 851.1 billion

Swiss foreign reserves declined a little last month but are keeping at rather bloated levels still. In terms of SNB intervention, the weekly sight deposits data offers a better sense of the situation and it still reaffirms that Jordan & co. is actively stepping into the market.

Eurostoxx futures -0.1% in early European trading

Mildly softer tones in early trades

- German DAX futures flat

- UK FTSE futures -0.2%

- Spanish IBEX futures -0.1%

Despite European futures keeping closer to flat levels, the overall risk mood is more on the defensive side to start the session as US futures are seeing down ~0.3% now.

That said, they are off earlier lows – similar for Asian equities – and that is seeing some of the dollar and yen strength ease a little. Both currencies are still leading gains but are off the highs seen earlier in the day.

The main focus will be on US non-farm payrolls today for any further clues about labour market conditions and how that will relate to risk sentiment later ahead of the weekend.

Nikkei 225 closes lower by 0.39% at 22,329.94

A softer end to the week for Asian equities

The risk mood in Asia was dampened by Trump’s executive orders against ByteDance and Tencent earlier in the day, prompting a fall in equities as well as US futures. The declines have been pared back a little but the mood is still more defensive for now.

The Hang Seng is down by 1.7% with Tencent stocks down by over 4% (but off the earlier lows where stocks fell 10%) and the Shanghai Composite is down by 0.9%.

In the currencies space, the dollar is still keeping firmer across the board but gains have been pared back a little as well. EUR/USD is now at 1.1845 after having moved to a low of 1.1820 earlier, with AUD/USD at 0.7210 after hitting a low of 0.7195 earlier.