What is the difference between stocks and CFDs?

Ever wondered about the two main methods of trading stocks and their key differences?

Traditional stock trading

Stock trading or share dealing has been around for centuries and is still the most common way for traders, banks and financial corporations to buy and sell stocks and shares. As far back 1602 the earliest joint-stock company was formed while the first actual stock exchange started trading in 1773 in London. Today, the total market capitalisation of all stocks worldwide is estimated at more than $70 trillion!

What is it?

Share dealing means a trader will buy shares in a company and wait for an increase in the share value, in the hope of making a profit (knowing that the risk of making losses exists too). This relative long-term strategy results in the trader holding stock and so has partial ownership in that company.

Why is it so popular?

- Stocks markets are well followed and they are easier to understand, buy and sell.

- Enables traders to take advantage of a growing economy.

- Returns typically far outweigh those of holding money in lower-return assets like cash.

- Traders can spread their risk across different asset classes and sectors of the economy.

- Investors benefit from dividend income, even if the stock has lost value.

It’s easy to see why stock trading has stood the test of the time and is a suitable investment product for many. Visit FXTM to trade and invest in hundreds of major company stocks including Apple and Facebook, Coca-Cola and Nike.

All trademarks displayed are the trademarks of their respective owners, and constitute neither an endorsement nor a recommendation of those organizations. In addition, such use of trademarks or links to the web sites of third-party organizations is not intended to imply, directly or indirectly, that those organizations endorse or have any affiliation with FXTM.

CFD Stock Trading

The explosion of Europe’s €1 trillion CFD market in recent years has attracted retail investors into trading equities, as well as many other markets like currencies, commodities and cryptocurrencies.

What is it?

CFD stands for ‘Contract for Difference’. It means the trader enters into a contract with their broker, agreeing to exchange the difference in the price of the asset between the point at which they open and close the contract. The trader will not own the underlying asset.

Why is it so popular?

- Open and trade positions with a high degree of leverage – you gain exposure to a stock without putting up the full cost.*

- Profits can be magnified with the use of leverage compared to the initial outlay. This also can result in the loss of your invested capital.

- Trade on price moves in either direction – you make money if you are long and stocks rise (which is the only way to profit in traditional share dealing) and also if you’re short and prices fall. Conversely, you lose money if you are short and prices rise.

There is no settlement period – your profit and loss are calculated immediately after you close your position, meaning that funds into your account can be allocated to other trading.

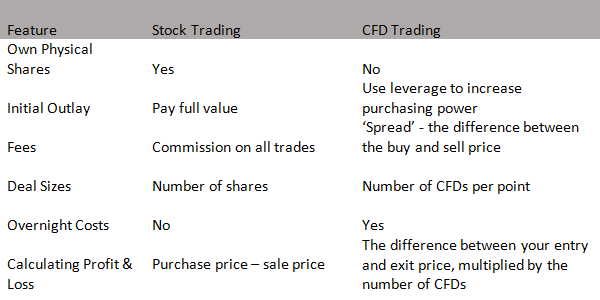

Summary: Features of Stock Trading and CFD Trading

Trading stocks allows you to own a part of a company’s future. Depending on your risk tolerance and timeframe, the benefits are many and varied if you choose to invest in shares or trade CFDs.

That’s why so many people invest and trade the stock markets today.