Thought For A Day

Details:

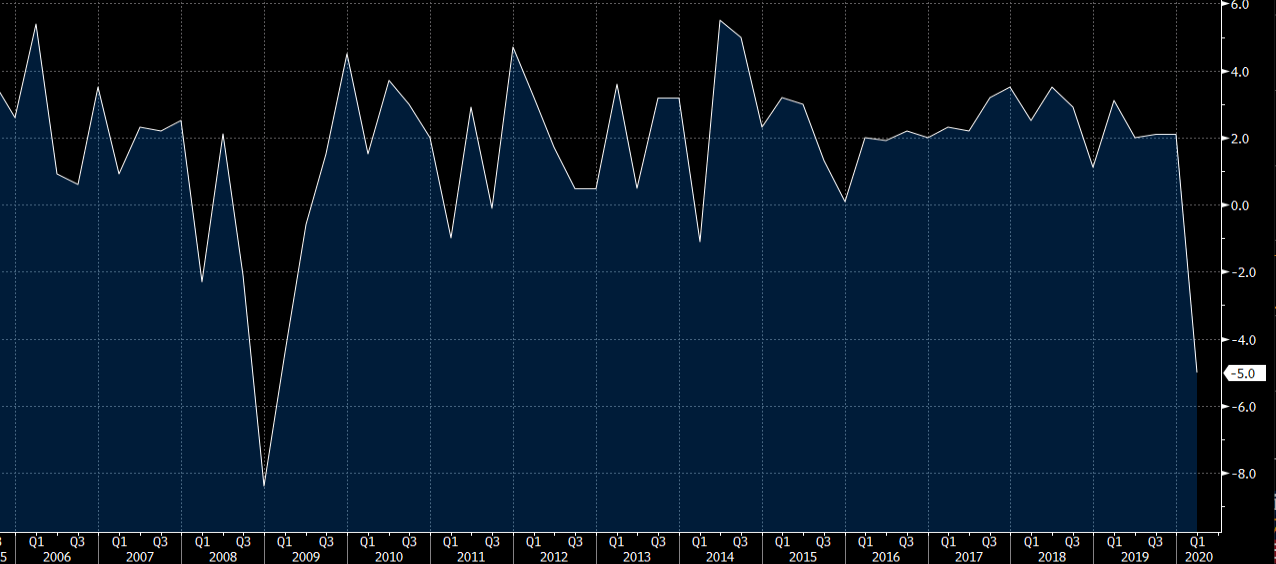

The director of energy, climate and resources at Eurasia Group sees the COVID-19 pandemic as paving the way for an ‘age of copper’ in the coming weeks and months. The primary reason for this is because governments are expected to accelerate the path towards an increase in government supported environmental investments. According to Eurasia’s group Henning Gloystein, ‘huge green and digital stimulus programs, especially in Asia and Europe, will create the conditions for a boom in copper demand – electric vehicles, 5G networks, and renewable power generation’.

Copper sitting under $6000

The big round number of $6000 has been containing copper prices. Falling demand for copper prices prompted by the COVID-19 outbreak has kept prices in check for now. Furthermore, the risks of at least isolated pockets of COVID-19 outbreaks remain in place and that could result in further slumps in copper in the near term. However, longer term commodities in general looks set to shine.Gold is in a great place as interest rates are low around the world and more and more investors are seeking the hedging value of gold

China’s top copper traders sees upside for Copper

The director of Maike Metals International Ltd, He Jinbi, said in a phone interview with Bloomberg that, ‘the pandemic will end and we have already seen the worst’. According to He, a long standing veteran after establishing Maike in Western China in 1993, copper could trade between $5800 and $6300 through 3Q. He cited the large levels of monetary support to likely deliver more gains for copper throughout the year. Furthermore, according to He, the recovery in prices have been driven by consumption rather than speculation. A good sign.

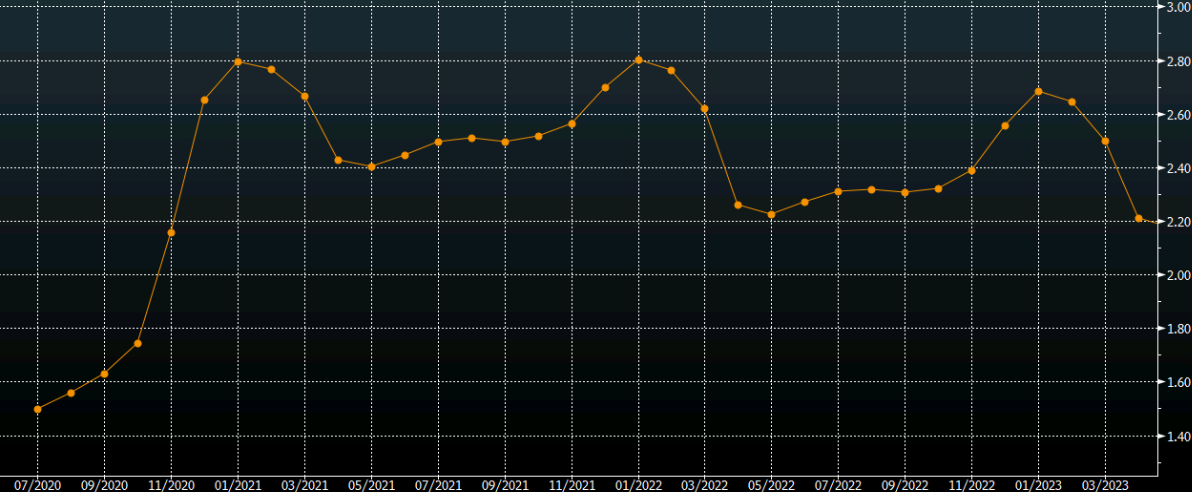

Copper is gaining traction with a number of Wall St banks like Goldman Sachs and Morgan Stanley. See price chart below with any pullbacks lower looking suitable for buying dips.