Archives of “June 2020” month

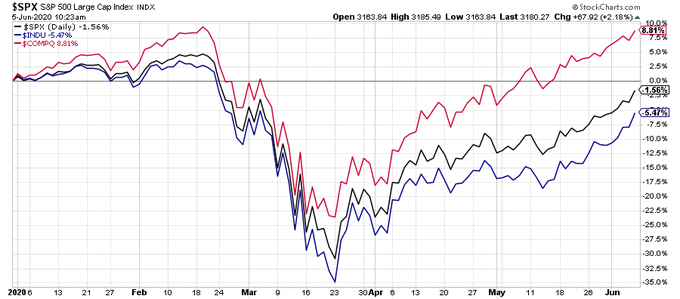

rssThe Dow, the NASDAQ and the S&P 500 year to date.

US Indices close sharply higher. NASDAQ prints a new all-time high

Dow, S&P best week in 2 months

The major US stock indices closed sharply higher after the much better-than-expected employment report.

- The gains propel the NASDAQ index to a new all time high.

- The Dow is now on its longest winning streak since January (5 day win streak).

- The S&P and Dow had their best week in 2 months.

- The S&P is within 1.14% of the closing level from 2019.

- The NASDAQ 100 index close at an all-time record high

A look at the final numbers are showing:

- S&P index rose 81.58 points or 2.62% at 3193.93

- NASDAQ index rose 198.26 points or 2.06% at 9814.08

- Dow industrial average rose 829.16 points or 3.15% at 27110.98.

For the week, rotation into to Dow stocks was the storyline.

- Dow rose by 6.81%

- S&P rose by 4.91%

- Nasdaq rose by 3.42%

For the year to date, the Nasdaq is up over 9%. The other indices are still down on the year but the S&P is getting close to the unchanged level:

- Nasdaq, +9.38%

- S&P, -1.14%

- Dow, -5.0%

Oversized winners today included:

- US steel, +13.73%

- Ford motor, +11.87%

- Boeing, +11.46%

- United Airlines +8.52%

- Exxon Mobil, 8.21%

- Daimler +7.28%

- Raytheon technologies, +6.75%

- Citigroup, +5.71%

- Delta Air Lines, +5.43%

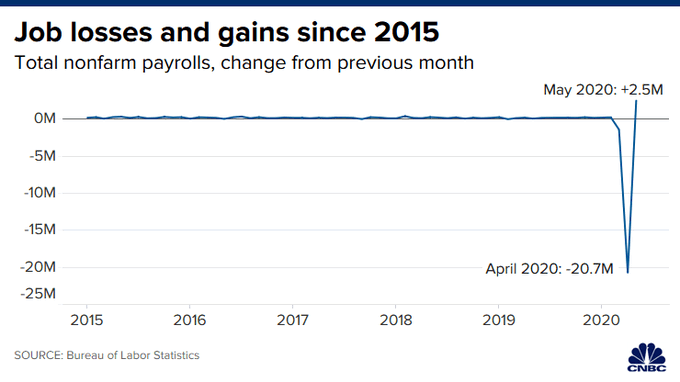

Everyone is shitting on this chart. Deservedly. It is pure shit. A toilet. Fox News should be deported

Suggested new currency after inflation hits

This proves you can make a charting pattern show whatever you want it to

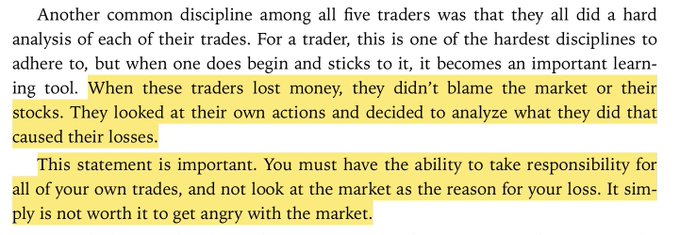

Thought For A Day

Mistakes are a huge part of this. From “Lessons From…” As ‘O’Neil once stated – when you make a mistake in the market the best thing to do is correct it, quickly.

Trump admin to issue revised China flight restrictions

The airline spat de-escalates

The US had planned to band Chinese passenger flight from the US because China had blocked US carriers on coronavirus fears. However China has now backed down and the US has revised its plan, according to multiple reports.

That’s more good news for risk sentiment (as if the market needed it).

European equity markets finish the week with gains greater than 10%

Massive week for European stock markets

Closing changes for the main bourses:

- German DAX +3.4%

- UK FTSE 100 +2.2%

- Italy MIB +2.7%

- French CAC +3.5%

- Spain IBEX +4.2%

On the week:

- German DAX +9.1%

- UK FTSE 100 +6.6%

- Italy MIB +10.9%

- French CAC +10.4%

- Spain IBEX +10.9%

When tack on a 2% rally in EUR/USD the gains look even better. With gains like this you can see why money is flowing into the euro.

The run in Italian stocks has been spectacular: