Archives of “June 2020” month

rssChina May CPI 2.4% (vs. 2.7% expected)

China inflation data from May 2020

CPI 2.4% y/y, first time under 3% since August last year

- expected 2.7% y/y, April’s was 3.3%

- -0.8% m/m

- Food prices +10.6% y/y

- non-food +0.4% y/y

PPI -3.7% y/y … deeper deflation

- expected -3.3% , April was -3.1%

- -0.4% m/m

This was written in 1907. How Money is Made in Security Investments – Hall.

From Commonsense Speculation – 1938

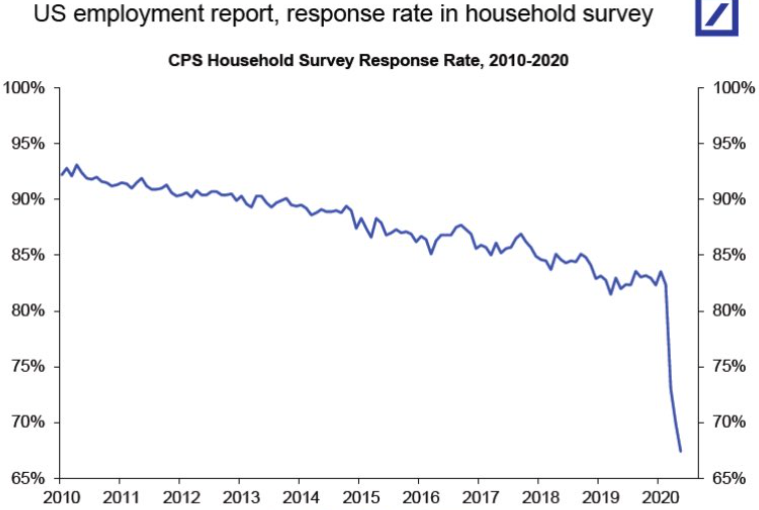

Deutsche Bank have cast further doubt on the strong US jobs figures

DB makes the point that the response rate in the survey was much lower than normal.

- “New households that have entered the household sample for the past 3 months did not get in-person introduction & explanations, which has increased uncertainty about the employment report data”

Just noting this, its probably best I am posting it now, any earlier and anyone paying attention might have been steamrollered by this market!

US Fauci says Covid-19 is his worst nightmare, “And it isn’t over yet.”

Dr. Anthony Fauci is a key member of the White House coronavirus task force, a top infectious disease expert.

Spoke with biotech executives at a conference held by the Biotechnology Innovation Organization, describing Covid-19 as his “worst nightmare”

- “In a period of four months, it has devastated the whole world”

- “And it isn’t over yet.”

- “An efficiently transmitted disease can spread worldwide in six months or a year, but “this took about a month”

Report via the New York Times (link for more)

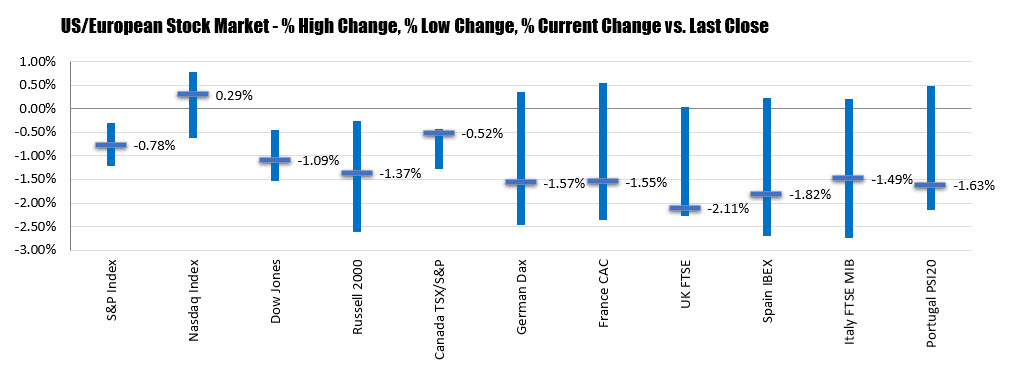

Mixed day for the US indices today. NASDAQ trades at 10000 for the 1st time

S&P and Dow stay negative all day. Nasdaq closes at new record and trades 10K

The US major indices close mixed today with the Nasdaq leading the way. The S&P index and the Dow ended lower and never generated enough upside momentum to get above the closes from yesterday. Recall the S&P closed in the black for the year for the 1st time since the tumble in February. That momentum could not be sustained today

The Dow closed down for the 1st time after 6 straight trading days higher (most and 9 months).

S&P closed down for the 2nd time in 8 days.

The NASDAQ index closed at a record level and surpassed the 10,000 level for the 1st time.

Amazon and Apple closed at record levels.

A look at the final numbers shows:

- S&P index fell by -25.21 points or -0.78% at 3207.18

- NASDAQ index rose by 29.009 points or 0.29% at 9953.75

- Dow industrial average fell by -300.14 points or -1.09% at 27272.38

Below are the percentage changes and percentage closing levels for not only the North American indices, but also European indices. The European indices all closed sharply lower with the UK FTSE falling by -2.11%.

Thought For A Day

New York Stock Exchange observers moment of silence for George Floyd

George Floyd funeral is starting

The the New York Stock Exchange and the NASDAQ exchange are observing a moment of silence for George Floyd. Floyd’s funeral is beginning. The moment of silence will last 8 minutes and 46 seconds. Him

Rest in peace…. Live in peace.

Spotting Bottoms

- Fake rallies

- At some point on the way down, the indices will attempt to rebound or rally. Bear markets normally come in 2 or 3 waves, interrupted by several attempted false rallies that usually fizzle out after 1, 2, or 3 weeks and occasionally 5 to 6 weeks or more [my note: created by both bargain hunters as well as big players going for the short squeeze].

- Counting rallies and follow-throughs

- 1st day of an attempted rally is when the index closes up from the prior day (doesn’t matter if the intraday low is lower than the prior day).

- If the intraday low of the 1st day of the attempted rally is undercut in the subsequent days, then the rally fails and the count is resetted back to zero.

- As long as the days after the 1st day of the attempted rally stay above the initial intraday low of the 1st rally day, you are still in the rally process.

- Look for a “follow-through day” in the 4th to 7th days (inclusive) of the attempted rally. A “follow-through day” is when the index closes up 1% or more with a jump in volume from the day before. Market is then in a new uptrend.

- “Follow-throughs” after the 10th day indicate the turn may be acceptable, but somewhat weaker.

- An initial “follow-through” can occur on any one of the indices and is usually followed a few days later on another index.

- False signals

- About 20% of the time they [the follow-through method] can give a false buy signal, which is fairly easy to recognize after a few days, because the market will usually promptly and noticeably fail on large volume.

- Most true “follow-throughs” will usually show strong positive action on good volume either the day after the “follow-through” or several days later. Convincing power and strength is what you want to observe.