Archives of “June 2020” month

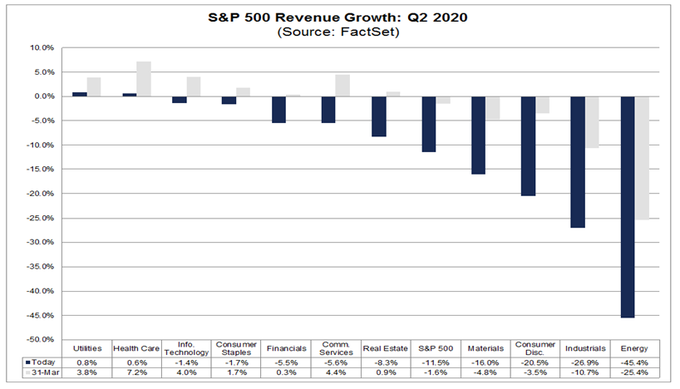

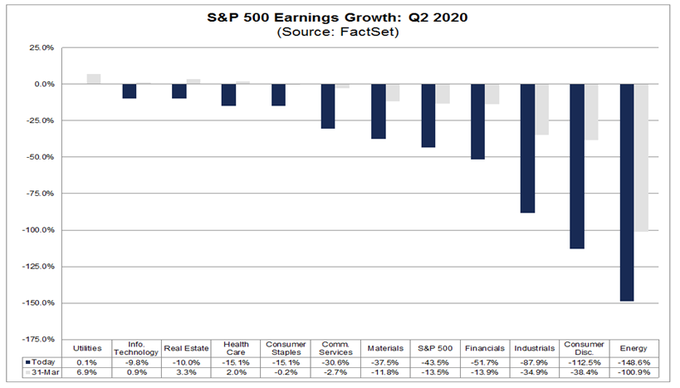

rssS&P 500 Revenue Growth: Q2 2020 / S&P 500 Earnings Growth: Q2 2020 (FactSet)

Tokyo reports the highest number of new COVID-19 cases since May 5

47 new cases reported by the Tokyo Metropolitan Government on Sunday

- 47 new coronavirus infections in the capital

- 18 of them in the Kabukicho entertainment district in Shinjuku Ward

- of the 29 other infections, 7 linked to a hospital, 4 to nightlife venues

Here we go, Tokyo Gov. Koike said the jump in cases resulted from very active testing. Yeah, sure.

If you are heading out to a nightclub, consider wearing a mask folks (and have a good time!)

Weekend news – record number of US coronavirus cases and hospitalisations continue

Fears of wave after wave (is the US even out of the first wave?) of COVID-19 in the US continue as cases, hospitalisation and deaths mount.

While case counts can be (and are) rationalised away citing increased testing, hospitalisation and the death toll cannot be swept under the carpet in the same way.

Via Reuters:

- Arkansas, North Carolina, Texas and Utah all had a record number of patients enter the hospital on Saturday

From the same report at Reuters:

- most states are not considering a second shutdown as they face budget shortfalls and double-digit unemployment. Many went ahead with reopenings before meeting government infection rate guidelines for doing so.

Health concerns are likely to keeping ‘risk’ in check.

Monday morning open levels – indicative forex prices – 15 June 2020

Good morning, afternoon or evening to all ForexLive traders and welcome to the start of the new FX week!

As is usual for a Monday morning, market liquidity is very thin until it improves as more Asian centres come on online … prices are liable to swing around on not too much at all, so take care out there.

Some change from late Friday levels:

- EUR/USD 1.1240

- USD/JPY 107.26

- GBP/USD 1.2525

- USD/CHF 0.9519

- USD/CAD 1.3605

- AUD/USD 0.6836

- NZD/USD 0.6425

This picture is the perfect metaphor for markets right now

Police officers protect a covered up, barricaded Wall Street bull statue

I can’t imagine a better metaphor for 2020 and 11 years of the most-coddled, protected market in history.

The memes write themselves:

Thought For A Day

Now we have unprecedented debt which will eventually need to be deleveraged, the question is how? Inflation? Restructuring? Default?

Big Week Ahead

Two G7 central banks meet and at least half a dozen emerging market central banks. There is a European Summit and perhaps a political effort to reinvigorate the UK-EU trade talks, which seem to be crashing on the shoals of stubbornness. The ECB offers its most generous long-term targeted loan that is bound to see earlier loans rolled into this new one. Further evidence that the world’s largest economy has taken a baby step toward recovery.

Let’s unpack next week’s events. But first, note that the events will take place as the recovery in risk assets appears to have come to an end with a flourish last week. That correction, which seemed overdue, appears to have more room to run. Also, the Covid virus continues to spread globally, and businesses, investors, and policymakers are sensitive to the so-called second-wave as countries and states re-open. Below are thumbnail sketches of the events and data that shape the macro picture.

- EU Summit: The European Council (heads of state) hold a virtual meeting on June 18 to ostensibly discuss the EU’s May 27 Recovery Fund proposal. Some have heralded the proposal as a key turning point in the evolution of Europe, and the possibility of a so-called Hamiltonian moment, a major set toward fiscal union, has been suggested. We have been less sanguine; recognizing the potential scaffolding for a greater union, but also that projecting emergency actions into the future is fraught with danger. Austria and Denmark, which have pushed back against grants instead of loans, could be won over by assurances that their rebates will remain intact. Others, including Eastern and Central European members, may be more difficult to persuade. Although expectations are running high, we suspect an agreement will remain elusive, in which case another try will be at the July summit, which, with a little luck, could be in person. Disappointment could weigh on the euro.

Crucial Technical Update : WTI & BRENT -Anirudh Sethi

To read more enter password and Unlock more engaging content