Archives of “June 2020” month

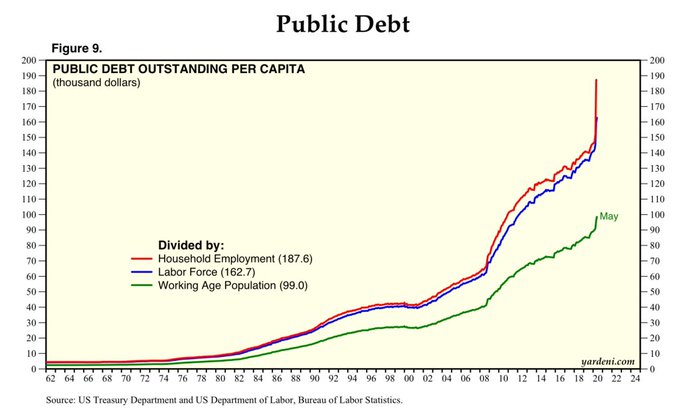

rssUS public debt per capita

About that king dollar…

Japan Industrial Production for May (preliminary) -8.4% m/m (expected -5.9%)

Japan Industrial Production, f;ash reading for May 2020

-8.4 % m/m

- expected -5.9% m/m, prior -9.8%

and -25.9% y/y

- expected -23.1% y/y, prior -15.0%

Some awful numbers there, maybe some light ahead with manufacturers seeing output in

- June at +5.7% m/m

- July +9.2%

Flu virus with ‘pandemic potential’ found in China (yes, another one)

BBC with the heads up on a new virus threat identified in China.

- new strain of flu

- has the potential to become pandemic

- emerged recently and is carried by pigs, but can infect humans

- researchers are concerned that it could mutate further so that it can spread easily from person to person, and trigger a global outbreak

- say it has “all the hallmarks” of being highly adapted to infect humans

- as it’s new, people could have little or no immunity to the virus

Posting this just in case you were considering climbing out from underneath the bed. Maybe not yet, K?

Gilead price for a treatment of COVID-19 drug remdesivir: US$2340 to $3120

Gilead Sciences is the maker of the treatment drug which is said to hasten recovery for severely ill coronavirus patients

- it will charge US$2340 for a typical treatment course for people covered by government health programs in the US

- price would be US$3120 for patients with private insurance

S&P 500 finishes at the highs of the day

Stocks ramp into the close

- S&P 500 up 44 points to 3053 (+1.4%)

- DJIA +2.3%

- Nasdaq +1.2%

Boeing was a big boost for the Dow.

Thought For A Day

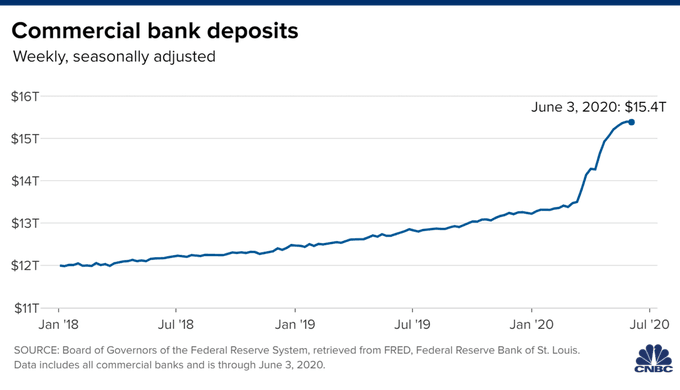

The savings of the Americans.

EUR/USD keeps higher to start the session, runs into test of key near-term levels

EUR/USD buyers look to seize near-term control as the dollar keeps weaker

The dollar is keeping lower to start the new week, despite the more tepid and slightly softer risk mood as we get things going in European morning trade today.

As the greenback gives back some of its gains from the latter half of last week, we’re seeing EUR/USD run back up to test key near-term resistance currently.

Buyers managed to push back above the 200-hour MA (blue line) @ 1.1241 and are now challenging the 100-hour MA (red line) @ 1.1256.

Keep below the 100-hour MA and the near-term bias stays more neutral, with price action to be more caught in between the two key hourly moving averages.

But break above the 100-hour MA and we will see buyers start to seize more near-term control and potentially look towards 1.1275-80 next before re-approaching 1.1300.

Considering the current risk mood, it is hard to see the pair push much higher as long as investors are looking to keep more cautious and defensive amid virus jitters.

The resurgence in US cases is starting to prompt renewed virus restrictions and new outbreaks being reported in the likes of Beijing, Tokyo, and Australia only adds to the concerns in the market over the past two weeks.

That said, month-end and quarter-end rebalancing flows are still something to consider – even if you would think most would have been settled by last week.

For now, the overall picture is that the dollar is weaker and the best we can do is to be guided by the technical levels highlighted above.