Archives of “June 2020” month

rssThis graphic is dedicated to the deflationary theorists saying deflation will cause gold to free-fall. Here you go.

U.S COMPANIES ARE MORE INDEBTED THAN AT ANY POINT SINCE 1950… HOW DOES THIS END WELL?

US dollar drops further after the fix

Heavy dollar selling

Almost everything is taking a bite out of the US dollar at the moment. There’s no news to pin this on but the positive sentiment in equities is generally USD-negative.

Aside from that, it’s month/quarter-end and this is the kind of thing that happens. Watch the technical levels and manage risk but be careful about drawing conclusions.

AUD/USD remains in the wedge pattern but it’s gone from a one-week low to a four-day high:

European shares end the session with mixed results

German Dax up 0.9%. UK’s FTSE -0.6%. France’s CAC unchanged

The European major indices are ending the session with mixed results. The German DAX is higher. The France’s CAC is unchanged. The UK’s FTSE is lower.

A look at the provisional closes are showing:

- German DAX, -0.9%

- France’s CAC, unchanged

- UK’s FTSE 100, -0.6%

- Spain’s Ibex, -0.8%

- Italy’s FTSE MIB, -0.3%

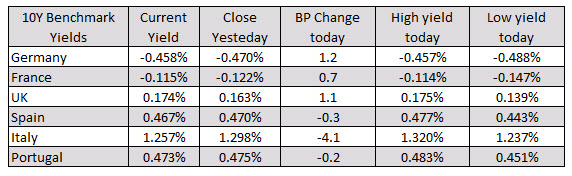

In the European debt market, the yields were lower across the board earlier in the day. However the German, France, and UK yields have since moved back into positive territory and are closing near the high yield for the day.

OPEC output falls 1.92 mbpd in June to lowest since at least 2000 – Reuters survey

Reuters’ secondary sources survey

- Output fell to 22.62 mbpd

- OPEC+ cuts comply with 107% of pledged reductions vs 77% in May

OPEC has done a surprising job on compliance.

This picture remains the equity bulls’ best bet

Talk of masks is picking up

The politicization of mask-wearing remains one of the all-time stupidest public health moves. The epidemic continues to rage in US and Arizona joined Florida and Texas yesterday in re-closing parts of its economy.

Quick recovery of the German economy likely “off the table” – DIHK

The German chambers of industry and commerce, DIHK, shares their latest outlook of the economy

- V-shaped recovery is likely “off the table”

- Half of German companies sees return to normalcy in 2021 at the earliest

- A third of German companies sees return to normalcy in 2020

- More than 40% of German companies are reporting liquidity shortages

The thing about moving on from the crisis is that the impact will continue to reverberate the longer it takes for the economy – not just Germany, but everywhere else too – to get back on track to pre-virus levels or conditions.

Many businesses and companies may survive for the time being on government stimulus and financial aid, but how long can this situation keep up if demand conditions and consumption activity take a much longer time to get back to “normal”?

China says will take retaliatory measures on US ending special treatment of Hong Kong

Comments by the Chinese foreign ministry

This comes on the back of the US announcing that it will pare back its special status treatment of Hong Kong, saying that they will take back some trade benefits it affords Hong Kong; adding that further measures are also being evaluated.

US secretary of state, Mike Pompeo, also tweeted out this:

“Today, the United States is ending exports of @StateDeptPM controlled U.S. origin defense equipment and sensitive @CommerceGov controlled dual-use technologies to Hong Kong. If Beijing now treats Hong Kong as “One Country, One System,” so must we.”

As for China’s “retaliatory measures”, this is still all part of the act with the two sides continuing to put up a show on the matter. I wouldn’t expect any major chaos to ensue.

If either side was serious about escalating things, it would’ve been done the minute China introduced the national security law at its parliament last month.

Hong Kong national security law passed by Beijing, expected to become effective on July 1

There was never any doubt China’s parliament would pas this

The Standing Committee of the National People’s Congress of the People’s Republic of China is the permanent body of the National People’s Congress of the People’s Republic of China (NPCSC) has unanimously passed the law