Archives of “June 29, 2020” day

rssEUR/USD keeps higher to start the session, runs into test of key near-term levels

EUR/USD buyers look to seize near-term control as the dollar keeps weaker

The dollar is keeping lower to start the new week, despite the more tepid and slightly softer risk mood as we get things going in European morning trade today.

As the greenback gives back some of its gains from the latter half of last week, we’re seeing EUR/USD run back up to test key near-term resistance currently.

Buyers managed to push back above the 200-hour MA (blue line) @ 1.1241 and are now challenging the 100-hour MA (red line) @ 1.1256.

Keep below the 100-hour MA and the near-term bias stays more neutral, with price action to be more caught in between the two key hourly moving averages.

But break above the 100-hour MA and we will see buyers start to seize more near-term control and potentially look towards 1.1275-80 next before re-approaching 1.1300.

Considering the current risk mood, it is hard to see the pair push much higher as long as investors are looking to keep more cautious and defensive amid virus jitters.

The resurgence in US cases is starting to prompt renewed virus restrictions and new outbreaks being reported in the likes of Beijing, Tokyo, and Australia only adds to the concerns in the market over the past two weeks.

That said, month-end and quarter-end rebalancing flows are still something to consider – even if you would think most would have been settled by last week.

For now, the overall picture is that the dollar is weaker and the best we can do is to be guided by the technical levels highlighted above.

Eurostoxx futures -0.8% in early European trading

Softer tones observed in early trades

- German DAX futures -0.8%

- UK FTSE futures -1.1%

- Spanish IBEX futures -2.0%

This is mainly a continuation from the moves towards the closing stages of last week, with virus fears prompting jitters and led to a sharper fall in US indices on Friday. The softer mood in Asia also isn’t really helping to start the week.

Elsewhere, US futures are also keeping slightly softer for now. S&P 500 and Dow futures are both down 0.3%, having kept near flat levels in the past two hours.

The risk bias is slightly tilted towards the more defensive side but we’ll have to see what the virus headlines later today will offer.

As a reminder, the bears edged out a victory towards the end of last week if you were to view the S&P 500 as one of the key gauges of risk:

Let’s see if they can keep that momentum going later today. If so, the current patch of dollar weakness to start the session may not stay the course.

Nikkei 225 closes lower by 2.30% at 21,995.04

Asian equities slump to start the week

This follows the softer mood from US trading at the end of last week, where we saw the S&P 500 closing below its 200-day moving average. US futures are also looking more tepid to start the session, with E-minis keeping closer to flat levels now.

The Hang Seng is down by 1.4% while the Shanghai Composite is currently down by 0.7% after returning from a longer break since Thursday.

In the major currencies space, the dollar is the weakest performer so far as it is giving back some gains since trading late last week. EUR/USD is up from 1.1220 to 1.1250 with AUD/USD a little higher by 0.2% at 0.6880 at the moment.

That said, we may be in for a more choppy session considering the risk mood so just be wary of that as we navigate through European trading today.

Probe System

- Factor #1: Do not take your entire position all at once.

- It is wrong and dangerous to establish your full stock position at only one price.

- Factor #2: Wait for confirmation of your judgment — pay more for each lot you buy.

- The basic logic is simple and concise: each trade, as it is established toward the total 1000 share position, must always show the speculator a profit on his prior trades. The fact that each trade showed a profit is living proof, hard evidence, that your basic judgment is correct in the trade. The stock is going in the right direction — and that is all the proof you need, and conversely if you lose money… you know immediately that your judgment is wrong.

- Factor #3: Establish in your mind the total amount of shares you want to purchase, or specify the amount of dollars you are willing to commit, before you begin the trade.

- … you must first decide how many shares you want to trade. For example, if you want to purchase 1000 shares as the full final position do it like this: Start with a 200 share purchase on the pivot point — if the price goes up then buy an additional 200 shares, still within the pivot point range. If it keeps rising, buy another 200 shares. Then see how it reacts, if it keeps on rising or corrects and then rises you can go ahead and purchase the final 400 shares.

- [my note: using number of shares is better here because as the price rises, you spend more at each purchase meaning you put a bigger bet as you get more confirmation that your bet is correct. Whereas value investing should use the amount of dollars method because as the price drops, you buy more shares with the amount of dollars meaning you are increasing your bet size as the stock becomes more of a bargain. The key difference here is that the Livermore way buys on the way up, and value investing buys on the way down.]

- Pyramiding

- … I have tried to establish my main position at the beginning, at the initial Pivotal Point, and then increase it at what I call the Continuation Pivotal Point — providing the stock comes out of the consolidation with strength. By this I mean the trader must wait until the stock has proven it is going to break out on the strong side of the Continuation Pivotal Point…

- The final time a trader can pyramid is when a stock breaks out to a clear new high on heavy volume this is a very good sign because it most likely means that there is no more overhanging stock to stop the progress of the stock for a while.

- Pyramiding is a dangerous activity… for the further a stock gets extended in its rise or decline the more dangerous the situation becomes. I tried to restrict any serious pyramiding to the beginning of the move. I found it not wise to enter a pyramiding action if the stock was far from the base — better to wait for the Continuation Pivotal Point of the breakout from a new high.

1930 Wyckoff’s “Wall Street Ventures…”” – Livermore quote from the chapter on him.

Mastering Speculation

i) Have a Plan

Not only for your trades, but for your progression up to bigger trade size – e.g. 10 day moving average Sum of net profits > 500 pips -> “up one level”. Don’t let yourself become complacent, keep pushing for bigger and better things.

ii) Don’t place too much emphasis on any single trade

Well, obviously you should pay it careful attention, but understand and accept that the result of the next trade isn’t important – it’s the aggregate of individual trades over days, weeks, months, and years that is important, where your “edge” will reward you.

iii) Have an understanding of what you think is more likely than the other and why

(Don’t know how revevant this is to mechanical or indicator based traders)

You should be able to exlain the “fundamentals” of your trade to a novice – for example, I aim to follow the footprint of “other timeframe” participants – Hedge Funds, Banks, Mulinational Corporations, etc…, in order that I can build a trade based on their next steps, and hop along for the ride. I can explain my interpretation of this, in words, to anyone that asks (XYZ Candle formation with a rising EMA doesn’t cut it IMO).

iv) Protect your Capital

You are f*cked without it. Implement “watermark” levels of losses that, if breached, cause you to take a break / move down trade size and so on.

v) Don’t create glass ceilings

Fixed profit targets cause you to stop trading when you are at your best. Set loss limits (see iv) above), but when everything is working and you are trading well, keep going!

vi) Know when you are wrong…

… and act fast. Losses are inevitable; be sure you identify the earliest signs of what you thought to be true breaking down.

vii) Don’t get married to a position, or a broker

THEY work for YOU, not vice versa.

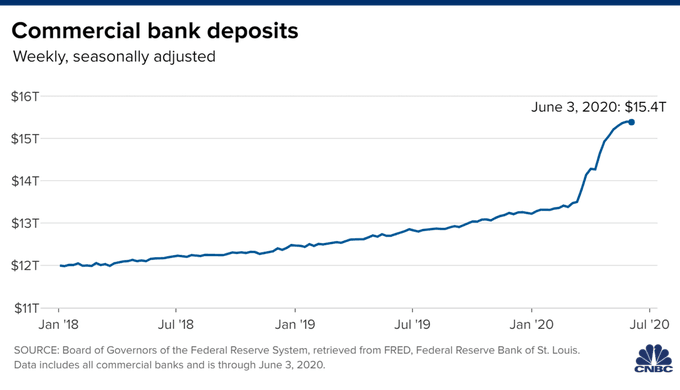

FED CORP BOND PURCHASES, $429M SO FAR

China is approving plans for new coal power plant capacity at the fastest rate since 2015

Financial Times weekend piece on further evidence of China stimulus plans

- plans for new coal power plant capacity at the fastest rate since 2015

- would add more than 40GW to the country’s power supply

This follows five years where China tried to reduce its dependence on coal. China is the world’s largest producer and consumer of coal, electricity from coal powered plants make up over half its energy mix.

—

Will be read as a positive input for AUD. Even if China does not buy more coal from Australia the news of further China stimulus is a plus for the currency.

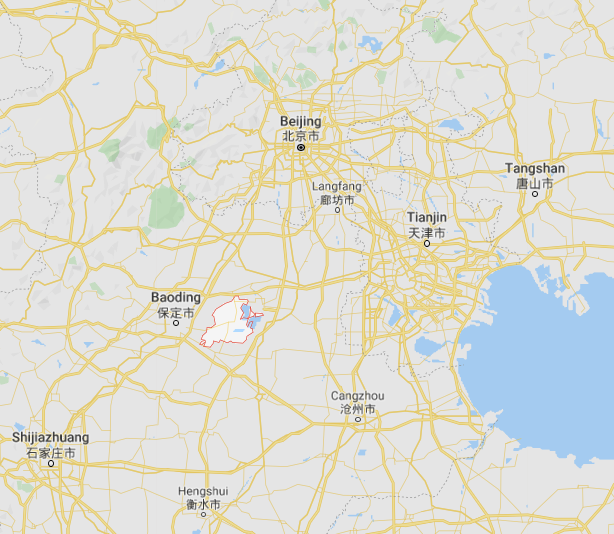

China – A new COVID-19 cluster near Beijing, half million in strict lockdown

Anxin county is about 150 kilometers (90 miles) from Beijing , it will go into the same strict lockdown as Wuhan did earlier in this year.

- 12 cases of coronavirus were found in the county

- 11 linked to the Xinfadi market where the latest Beijing outbreak began.