2 year note auction results

- high yield 0.193% vs. WI of 0.197%

- bid to cover 2.46x vs. six-month average of 2.6x

- dealers 31.2% vs. six-month average of 33.6%

- directs 16.7% vs. six-month average of 15.4%

- indirect 52% vs. six-month average of 50.9%

The good news is that the high yield at 0.193% Tas lower than the WI level of 0.197%. Dealers also took less than the six-month average at 31.2% vs. 33.6% over the last 6 months. The not so great news was the bid to cover came in less than the six-month average at 2.46x vs. 2.6x (six-month average).

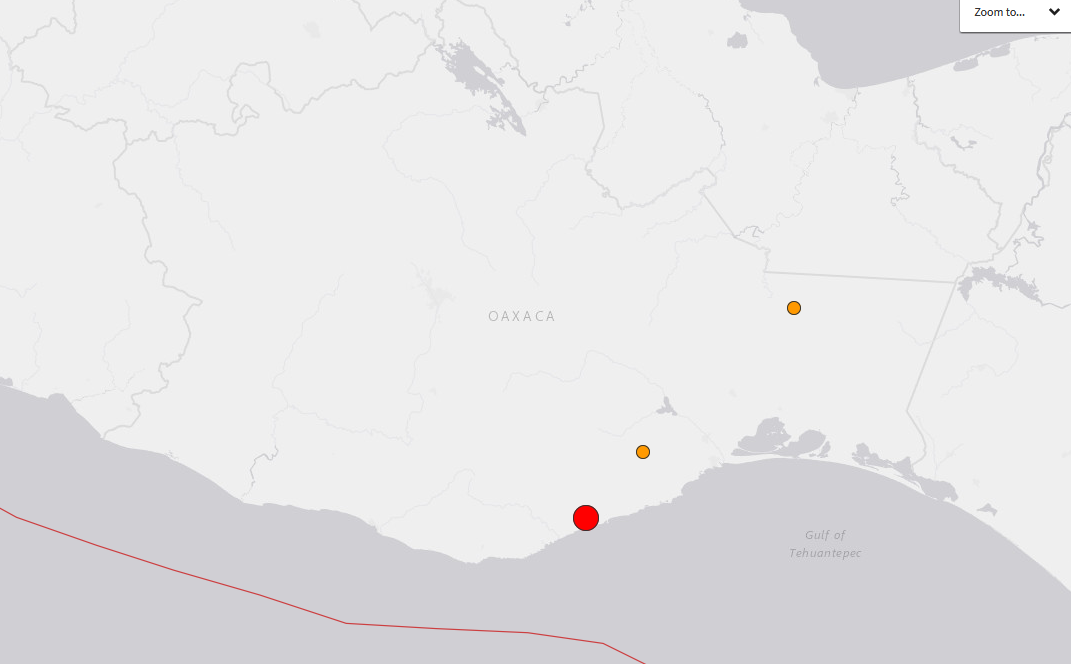

An earthquake of 8.0 in Mexico 1985 killed at least 5000 people, it was located 350 km away.

An earthquake of 8.0 in Mexico 1985 killed at least 5000 people, it was located 350 km away.