Have we reached the limit?

Equity bulls couldn’t have scripted the FOMC any better yesterday. The pace of QE was higher than expected and this may have been the most-dovish phrase uttered in the history of central banking:

“We’re not thinking about raising rates, we’re not even thinking about thinking about raising rates.”

Couple that with a promise to act forcefully, aggressively and proactively and it’s never been more clear that the Fed put is in play.

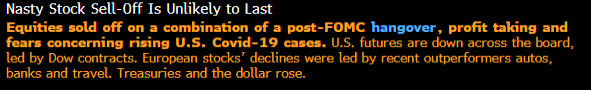

Yet as the dust settles, S&P 500 futures are 2.6% lower.

The message may be that we’ve hit the limit of what monetary policy can do for risk assets. In a sense, that’s a relief because the market can go back to focusing on reality instead of cheap money. A narrative about a second wave is starting to take hold.

There’s an argument that Powell didn’t do enough, or that he was too sombre but I don’t buy that. Yield curve control wasn’t on the table for this meeting and numerous Fed members made that extraordinarily clear. Anything more optimistic would have been misinterpreted as a hint about taking away the punch bowl.

So now we watch and see how it all shakes out. This is an emotion-driven market; the only thing that’s working is technical analysis and risk management. The market could fall 7% today and it wouldn’t surprise me, nor would an epic buy-the-dip.

I think the name of the game today is to try to read the sentiment of the market. For weeks all we heard was skepticism and the market ate it up. Is there a lot of negativity now? I don’t see it. he first headline I saw this morning was this:

I mean, wouldn’t it be poetic if the COVID-bounce died in rush by Robinhood traders to buy bankrupt companies?

Does anyone really believe in this economy? Starbucks yesterday was sobering. Even in China where 99% of stores are open and COVID cases are nil, sales were down 14% in the final week of May.

That kind of news has been steamrolled by the market for 10 weeks but between that an Trump’s epic victory lap after the Friday jobs report, maybe we’ve hit the limit.