There’s a fine line between:

The economy is doing better (full stop)

and

The economy is doing a bit better but it’s early

The small different between those two statements could dictate the market’s reaction to the FOMC decision and press conference.

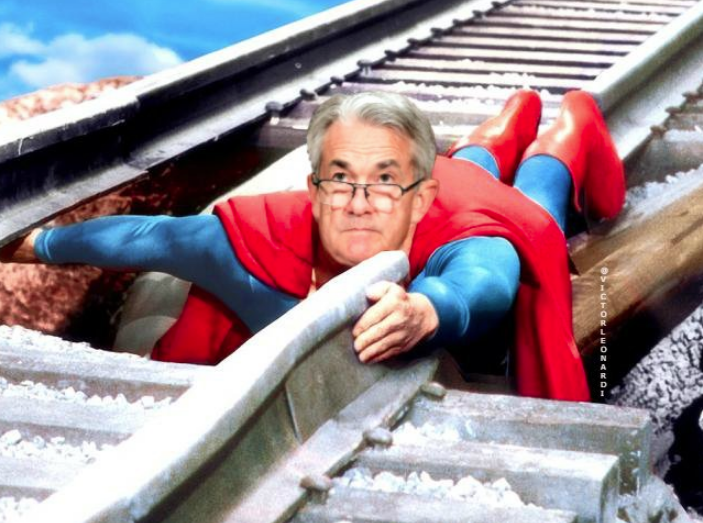

This market wants to be reassured that the Fed put is on, that they will do everything possible to keep the economy humming.

The market needs to feel like the Fed is a tailwind, not a potential headwind. There’s enough to worry about without worrying about some kind of Fed taper.

I don’t think you can quantify that with a code word or a point on the dot plot.

The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

That’s a line from the statement that hasn’t changed and shouldn’t change and I’m confident this part also won’t change.

The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

I could envision envision a statement that’s almost entirely unchanged save for the line about “significantly lower oil prices” and “significantly affected financial conditions.”

*financial conditions are a code word for the stock market, more or less.

Powell is likely to be asked about improving financial conditions and the stock market. The trap there is that he will express some kind of concern about the sharp rebound and indicate that the Fed is cautious about fueling it. That would give the market a bad feeling and spark some selling; maybe heavy selling.

As bad as some of the moves in stock markets are, I think the Fed can dismiss it. I mean, if some of the $1200 US stimulus checks went into the stock market, does that mean the whole program was a bad idea? The Fed sees its programs the same way.

Tread carefully but this is what Powell said 3 weeks ago and I doubt it changes:

“We expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.”