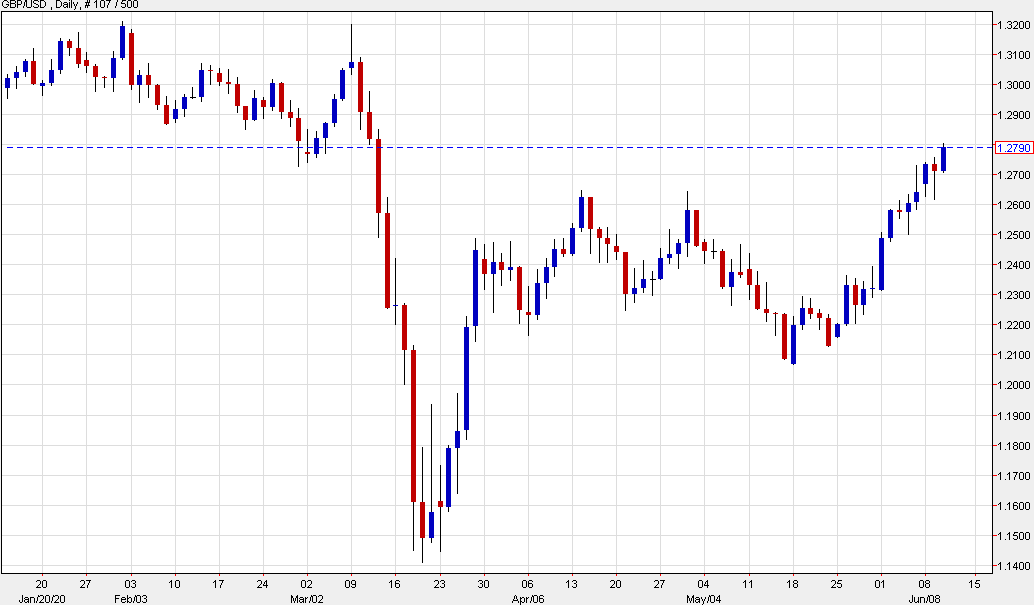

The dollar keeps weaker ahead of the Fed

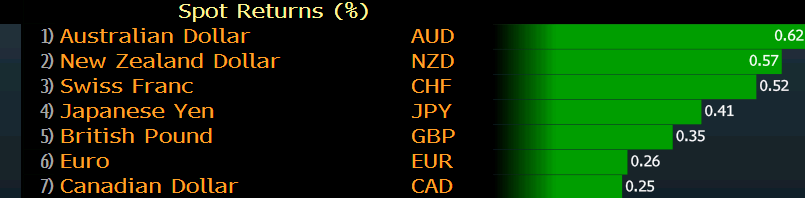

The greenback isn’t getting much of a reprieve despite a slight pullback in equities during European morning trade, with the dollar still seen weaker across the board.

The franc is a notable gainer, and is posting decent gains of around 1.7% against the greenback so far this week after SNB sight deposits declined for the first time since January – in a sign that the SNB is relaxing a little after months of heavy intervention.

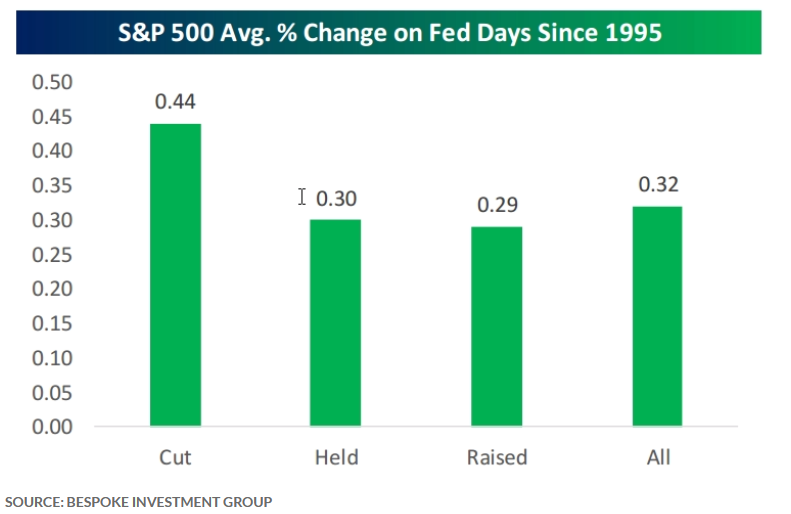

But in any case, all eyes are on the Fed later today with a couple of main points being any indication of yield curve control and how the Fed will assess the current economic situation and what will be their response to that i.e. will they keep the party going?

Barclays

- Expects the Fed to clarify its intentions on asset purchases

- Fed has scaled purchases back as overall functioning has improved

- Expects the Fed to shift its commitment from daily purchases ($4.5 billion in both Treasuries and agency MBS) to a monthly purchase rate of $80 billion in Treasuries and $60 billion in agency MBS instead

- Does not expect a change in forward guidance

- Expects median assessment of monetary policy to include keeping Fed funds rate at zero lower-bound through the end of 2022

Danske Bank

- Not expecting the Fed to make any significant changes to policy stance

- Looking for two things i.e. whether or not the Fed will change its forward guidance and changes to asset purchases to a monthly figure

- Thinks it is too early for Fed to change forward guidance at this stage

- Fed will make clearer what conditions for tightening policy moving forward

- Does not think the Fed will gain much by shifting to monthly asset purchase target

- Does not expect the Fed to implement yield curve control (YCC)

Citibank

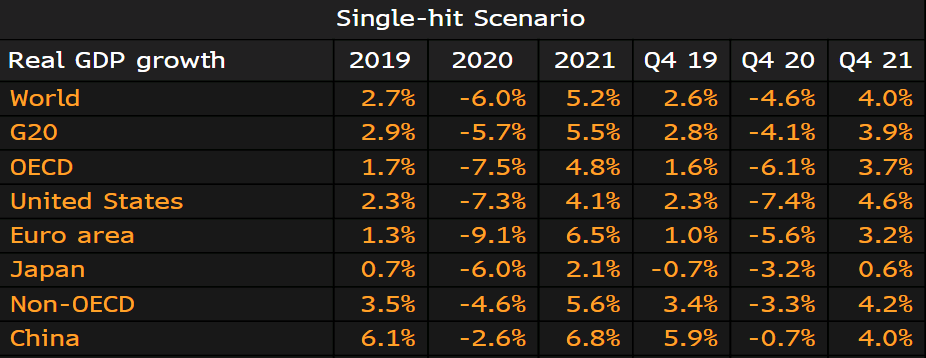

- US jobs report should keep policymakers more upbeat going into the meeting

- But it is unlikely to substantially change decisions/forecasts

- Says that the forward guidance is likely to be paired with a weak form of YCC

- Commitment mostly to front-end yields to reflect policy path implied by guidance

- Economic projections should show a median for no rate hikes through 2021

Deutsche Bank

- Expects the Fed to take its first step away from a crisis prevention back towards the goal of providing accommodative support for the recovery

- Expects the Fed to announce open-ended QE consistent with monthly purchases of Treasuries of between $65 billion and $85 billion

- Forward guidance should be enhanced to reaffirm commitment to keep rates low

From the expectations above, it shows that the market is expecting the Fed to dial back some of its earlier commitments i.e. daily asset purchases as they are no longer necessary, considering that market conditions are well maintained for now.