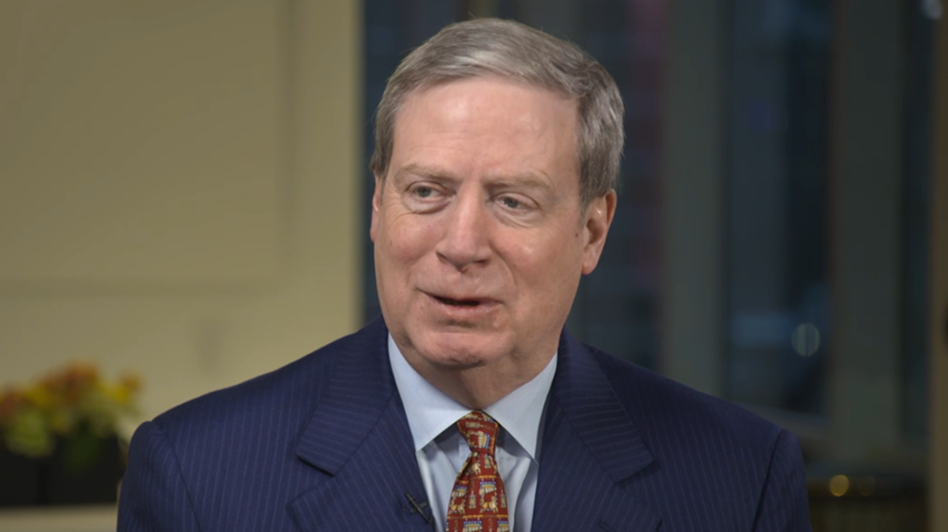

What the legendary investor sees next

Stanley Druckenmiller is arguably the greatest macro investor of all time. His record of 30 years straight of 30% returns is nothing short of legendary.

Yet Druckenmiller has never seen a market like this.

“I was up 2% the day of the bottom, and I’ve made all of 3% in the 40% rally,” he told CNBC today. “I missed a great opportunity here. It won’t be the last time.”

His humility and patience are a great lesson but his comments are a reminder of how difficult this rally is to believe in, and how much money might still be on the sidelines.

“I had long-term concerns for the last few years that because of easy money, too much debt was being built up in the corporate sector,” Druckenmiller said. “When Covid hit, I was pretty much of the view that there was a good chance that the credit bubble had finally burst and the unwinding of that leverage would take years.”

In May, Druckenmiller said the risk-reward in equities was the worst he had ever seen and he still says he has the least growth in his portfolio over the past 6-7 years.

One thing he says he underestimated is how far the Fed would go and said there could now be a ‘breadth thrust’ that carries equities higher.

With that, S&P 500 futures just crossed into positive territory year-to-date.